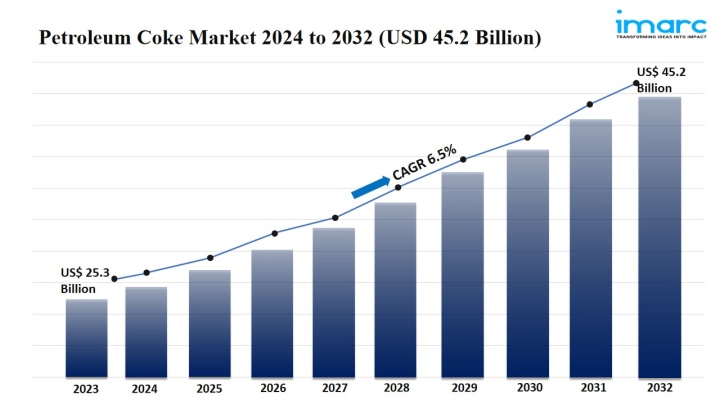

Global Petroleum Coke Market Statistics: US$ 45.2 Billion Value by 2032

Summary:

Request PDF Sample for more detailed market insights: https://www.imarcgroup.com/petroleum-coke-market/requestsample

Industry Trends and Drivers:

Petroleum coke is an essential component in the aluminum industry, particularly in the production of carbon anodes used for aluminum smelting. Aluminum smelters rely on calcined petroleum coke for its high carbon content and efficiency in the electrolysis process. The growing demand for aluminum, driven by expanding uses in industries like automotive, aerospace, and construction, is driving the need for petroleum coke. The increasing production of electric vehicles (EVs), renewable energy infrastructure, and lightweight transportation materials are contributing to this growth. In addition, the shift toward sustainable energy solutions is catalyzing the demand for aluminum in solar panels and wind turbines, further driving the need for petroleum coke in aluminum production.

The cement and power generation industries are significant consumers of petroleum coke, owing to its high energy content and lower cost compared to traditional fuels like coal. Cement manufacturers in regions with rising infrastructure demands are turning to petroleum coke as a cost-efficient alternative. Its higher calorific value allows for more energy output, leading to greater efficiency in cement kilns. In addition, power generation plants are adopting petroleum coke as a primary fuel source, especially in areas with abundant petroleum refining activities. The use of petroleum coke in power generation offers a cost-effective solution for meeting energy demands while reducing dependence on more expensive or less efficient fuel options.

Power generation plants worldwide are diversifying their fuel sources to reduce dependency on traditional fossil fuels like coal and natural gas. Petroleum coke is being adopted as a viable alternative due to its high energy output and lower cost. In particular, countries with heavy oil refining industries are turning to petroleum coke to meet the rising electricity demands. Power plants in these regions find petroleum coke to be an efficient way to balance energy production costs while maintaining the high output needed to support growing populations and industries. Many countries are seeking to diversify their energy portfolios and manage fuel costs, which is driving the demand for petroleum coke in power generation.

We explore the factors propelling the petroleum coke market growth, including technological advancements, consumer behaviors, and regulatory changes.

Petroleum Coke Market Report Segmentation:

Breakup By Type:

Fuel grade coke exhibits a clear dominance in the market due to its extensive use in energy generation and cement manufacturing, where high energy output is crucial.

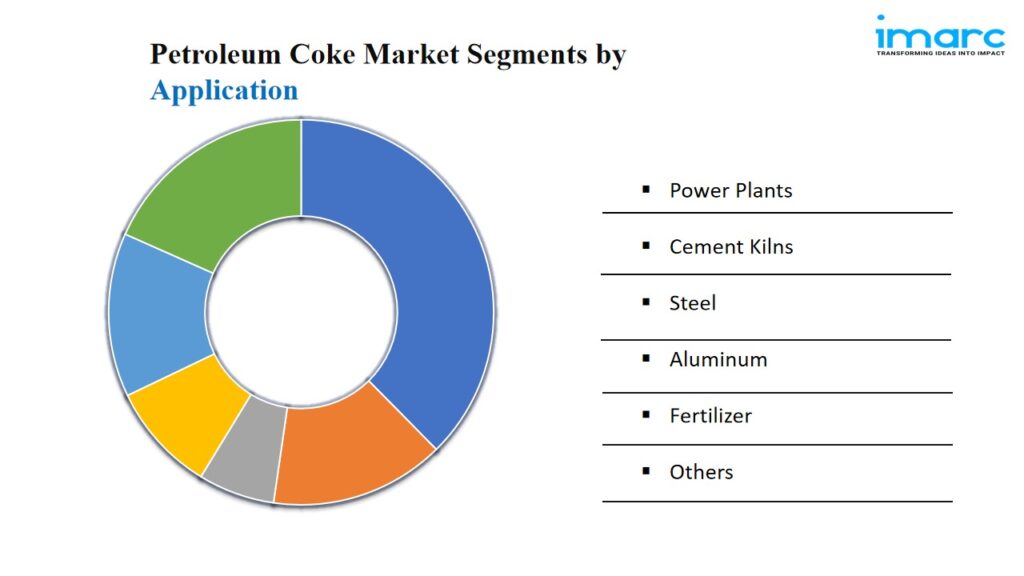

Breakup By Application:

Aluminum represents the largest segment, as petroleum coke is widely utilized as a cost-effective source of energy and as a carbon source in aluminum manufacturing.

Breakup By Region:

Asia-Pacific dominates the market, driven by the presence of major aluminum and cement manufacturers and increasing energy demands in the region.

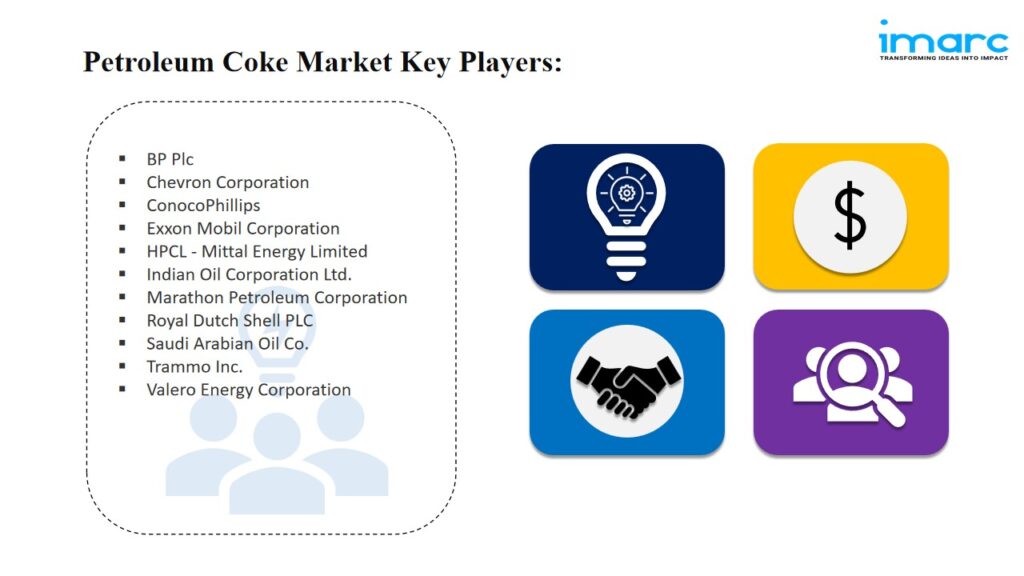

Top Petroleum Coke Market Leaders:

The petroleum coke market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145