Japan Cryptocurrency Market Overview

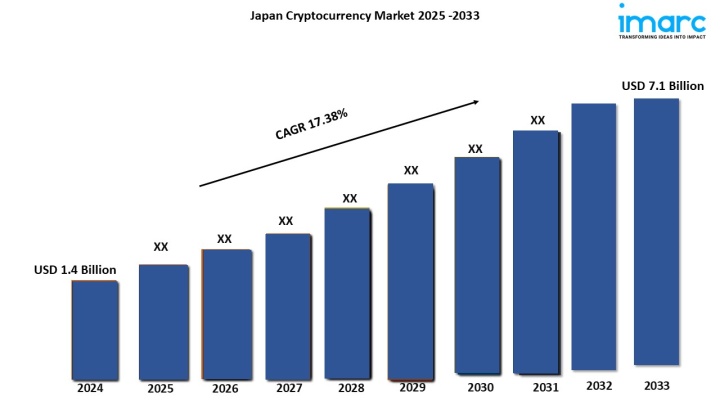

Market Size in 2024: USD 1.4 Billion

Market Size in 2033: USD 7.1 Billion

Market Growth Rate 2025-2033: 17.38%

According to IMARC Group's latest research publication, "Japan Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033," the Japan cryptocurrency market size reached USD 1.4 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.1 billion by 2033, exhibiting a growth rate (CAGR) of 17.38% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/japan-cryptocurrency-market/requestsample

Progressive Regulatory Framework and Legal Recognition

Japan stands out as a global leader in cryptocurrency regulation, becoming the first country to establish a comprehensive legal framework for digital assets. The government's recognition of Bitcoin as legal tender in 2017 marked a pivotal moment for mainstream adoption. Currently, 29 licensed crypto-asset exchange service providers operate in the country, offering a total of 94 different virtual currencies to Japanese residents. This regulatory clarity has created a stable foundation for market growth, with companies like GMO and bitFlyer leading the charge in providing secure trading platforms. The government's tax reform in April 2024, which exempted companies from taxes on unrealized gains from third-party cryptocurrencies, has further encouraged corporate participation in the digital asset sector.

Tech-Savvy Population and Digital Transformation

Japan's technologically advanced society has embraced cryptocurrency trading with remarkable enthusiasm. The country's tech-savvy population, known for being early adopters of innovative technologies, has driven significant trading volumes. In August 2024, Bitcoin dominated the market with over 1.1 trillion Japanese yen in spot trading value, while XRP led in volume with 837.1 million units traded. This widespread adoption reflects the population's comfort with digital financial instruments and their willingness to explore alternative investment options. The integration of cryptocurrency services by major Japanese banks has further legitimized the industry, making it accessible to both individual and institutional investors.

Government Initiatives and Blockchain Investment

The Japanese government has allocated substantial resources to support blockchain technology development, with 15 billion yen dedicated to various blockchain initiatives in 2024. These investments span multiple sectors, including supply chain management, medical data sharing, and green energy trading. The government's push for cashless transactions aligns perfectly with cryptocurrency adoption, creating synergies that benefit the entire digital payments ecosystem. Additionally, the Bank of Japan's ongoing research into Central Bank Digital Currency (CBDC) demonstrates the country's commitment to staying at the forefront of digital financial innovation.

Integration of AI and Automated Trading Systems

Artificial intelligence is revolutionizing cryptocurrency trading in Japan, with advanced algorithms enabling more sophisticated investment strategies and risk management. Japanese fintech companies are developing AI-powered trading bots that can analyze market patterns, execute trades automatically, and optimize portfolio performance. This technological advancement has made cryptocurrency trading more accessible to retail investors while providing institutional traders with powerful tools for market analysis. The integration of machine learning algorithms has also improved security measures, helping exchanges detect and prevent fraudulent activities more effectively.

Expansion of Corporate Cryptocurrency Adoption

Japanese corporations are increasingly integrating cryptocurrency into their business operations, moving beyond speculative investment to practical applications. Major companies are exploring Bitcoin and other cryptocurrencies as treasury assets, while others are implementing blockchain-based solutions for supply chain transparency and cross-border payments. The favorable tax environment introduced in April 2024 has accelerated this trend, with corporations no longer facing tax burdens on unrealized gains from cryptocurrency holdings. This corporate adoption is creating a more mature and stable cryptocurrency market in Japan.

Growth in Stablecoin Development and Regulation

Japan is developing a robust framework for stablecoins, with proposed legislation requiring these digital currencies to be linked to the yen or other legal tender. The regulation mandates that stablecoins can only be issued by licensed banks, registered money transfer agents, and trust companies, ensuring stability and consumer protection. This regulatory approach is expected to drive innovation in the payments sector, with stablecoins potentially becoming a preferred method for both domestic and international transactions. The focus on yen-backed stablecoins could position Japan as a leader in regional digital currency adoption.

Artificial intelligence is transforming Japan's cryptocurrency landscape through sophisticated trading algorithms, enhanced security protocols, and automated market-making systems. Japanese exchanges are implementing AI-driven fraud detection systems that analyze transaction patterns in real time, significantly reducing security risks. Machine learning models are being used to predict market volatility and optimize trading strategies, making cryptocurrency investments more attractive to risk-averse Japanese investors. Additionally, AI-powered chatbots and customer service systems are improving user experience on trading platforms, making cryptocurrency more accessible to newcomers.

The integration of AI with blockchain technology is also enabling the development of smart contracts and decentralized applications (DApps) tailored to the Japanese market. These innovations are creating new opportunities for financial services, supply chain management, and digital identity verification, further expanding the utility and adoption of cryptocurrency in Japan.

The Japan cryptocurrency market has witnessed significant developments throughout 2024, with several major milestones shaping the industry's trajectory. The government's tax reform in April 2024 eliminated corporate taxes on unrealized cryptocurrency gains, leading to increased institutional adoption. The Bank of Japan has made substantial progress in its CBDC research, with plans to resolve legal frameworks for digital yen issuance continuing into 2025.

Japan Cryptocurrency Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

Component Insights:

Process Insights:

Application Insights:

Regional Insights:

Request a Customized Report for Deeper Insights: https://www.imarcgroup.com/request?type=report&id=9081&flag=E

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

The future of Japan's cryptocurrency market looks incredibly promising, driven by continued regulatory support, technological innovation, and growing mainstream acceptance. The government's commitment to digital transformation and blockchain development, combined with the upcoming CBDC initiatives, will likely create new opportunities for market expansion.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact:

Street: 563-13 Kamien

Area: Iwata

Country: Tokyo, Japan

Postal Code: 4380111

Email: sales@imarcgroup.com