Market Overview:

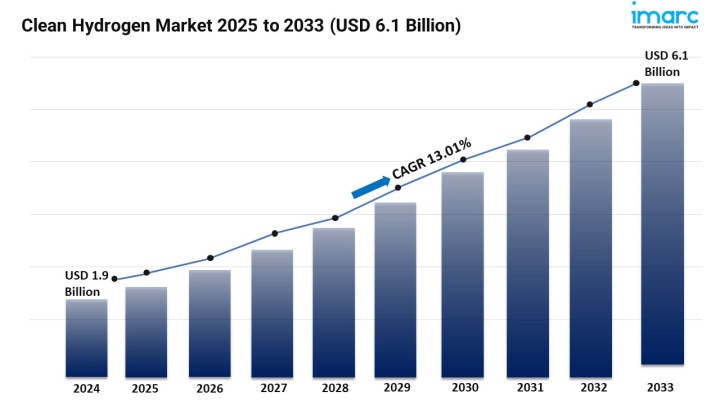

The Clean Hydrogen Market is experiencing rapid expansion, driven by Government Policies and Regulations, Technological Advancements in Electrolysis, and Increasing Investment from Private Sector. According to IMARC Group's latest research publication, "Clean Hydrogen Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global clean hydrogen market size was valued at USD 1.92 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.10 Billion by 2033, exhibiting a CAGR of 13.01% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/clean-hydrogen-market/requestsample

Our Report Includes:

Growth Factors in the Clean Hydrogen Industry:

As governments across the world promote carbon neutrality policies, hydrogen is considered a calculated pillar of the worldwide energy transition. Countries are implementing long-term funding, tax credits, and procurement policies for establishing hydrogen as a low-emission fuel for heavy mobility, industry, and electricity generation. For example, the U.S. Inflation Reduction Act provides USD 3/kg production tax credits for clean hydrogen. Japan and South Korea have both published hydrogen roadmaps in support of hydrogen fuel cell vehicles and the import of hydrogen as an energy carrier. These regulatory activities have eased a rapid commercialization with increased private sector engagement and reinforced hydrogen as a mainstay of energy independence and climate objectives.

Rapid innovation increases the efficiency and scale for PEM, Solid Oxide, and AEM electrolysis. Manufacturers invest in catalyst materials that are new, membranes that are durable, and electrolyzers that are modular for production that is decentralized. Floating offshore wind, other renewable energies reduce lifecycle emissions, costs. New digital monitoring systems can increase electrolyzer uptime while reducing maintenance costs. Nel ASA, Plug Power, Siemens Energy, and others have begun building gigafactories for mass production of hydrogen electrolysis technologies, with a goal of reducing the cost per kilowatt of green hydrogen electrolysis to the point that it can compete with fossil-fuel based hydrogen for industrial applications.

Private capital is a major driver behind clean hydrogen infrastructure. Automotive, steel, aviation and utility companies have formed joint ventures to secure early access to hydrogen supply. Venture capital is flowing into storage, fuel cells and hydrogen mobility. Companies such as Toyota, Adani New Industries, and Air Liquide are undertaking multi-billion dollar projects for the establishment of hydrogen export terminals and refueling infrastructure. Shell and BP, energy majors, are bringing green hydrogen projects into renewable energy portfolios. Commercial offtake agreements and long-term supply contracts increase. This reduces market uncertainty. This lowers investment risks. This accelerates market-scale up.

Key Trends in the Clean Hydrogen Market

Artificial intelligence and machine learning (AI/ML) are used to improve hydrogen production, distribution, and storage by optimizing these processes and predicting their operations. Smart algorithms can be used to optimize electrolyzer operations according to electricity cost, weather and load balancing in real time. Digital twins are used to model and simulate large-scale hydrogen hubs toward safety optimization. Analytics driven by AI predict equipment faults, which minimizes downtime. Machine learning on hydrogen facility data also optimizes carbon footprint calculations and regulatory compliance for low-emission certification. These clever automation applications are expected to further decrease the costs of producing hydrogen over the next decade.

A global hydrogen infrastructure build-out is underway, transitioning projects from pilot stage to commercial. Several countries are developing hydrogen backbone pipeline networks. These networks connect industrial clusters, ports, and mobility hubs. New liquefaction, compression, and ammonia conversion technologies are enabling more efficient hydrogen transport toward better economics. Big logistics companies are starting trials of fuel-cell trucks and ships on hydrogen corridors among refueling hubs. International partnerships, such as Europe's high-demand Hydrogen Backbone and Australia/Japan export partnerships, are developing scalable networks of infrastructure to provide a reliable supply chain, although this is not yet the case for all end-user sectors.

Hydrogen is needed for decarbonizing industrial sectors that cannot be electrified such as the use of hydrogen instead of coal in DRI steelmaking or instead of natural gas in producing ammonia and methanol. Power utilities plan to co-fire hydrogen together with natural gas in gas turbines to increase the flexibility of the power grid, especially as variable renewable energy grows. Hydrogen trains, mining machinery, and heavy trucks are being piloted at present. More companies adopt net-zero targets. Regulatory requirements for corporate sustainability reporting evolve. Customers demand more sustainable industrial production processes. Green hydrogen demand is expected to rise.

The clean hydrogen market forecast offers insights into future opportunities and challenges, drawing on historical data and predictive modeling.

Leading Companies Operating in the Global Clean Hydrogen Industry:

Clean Hydrogen Market Report Segmentation:

Breakup by Technology:

Alkaline electrolyzer represents the largest segment as this conventional technology for hydrogen production uses water electrolysis with an alkaline solution as an electrolyte, offering reliability, durability, scalability, simple design, and lower material costs, making it particularly ideal for large-scale industrial applications.

Breakup by End User:

Transport accounts for the majority of the market share driven by the growing application of hydrogen gas-powered vehicles, government actions to reduce carbon emissions, development of hydrogen refueling infrastructure, advantages of fast refueling time and longer ranges for heavy-duty and long-haul applications, and investments from automobile producers in hydrogen vehicles including buses, trucks, passenger cars, trains, and maritime vessels.

Breakup By Region:

Europe's dominance in the clean hydrogen market is attributed to the European Union's extensive and ambitious energy and climate policies including the European Hydrogen Strategy as part of the European Green Deal, financially significant instruments like the Clean Hydrogen Partnership allocating billions for hydrogen projects, partnerships among European countries for cross-border hydrogen infrastructure, and the presence of high-technology providers in the region.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302