Market Overview:

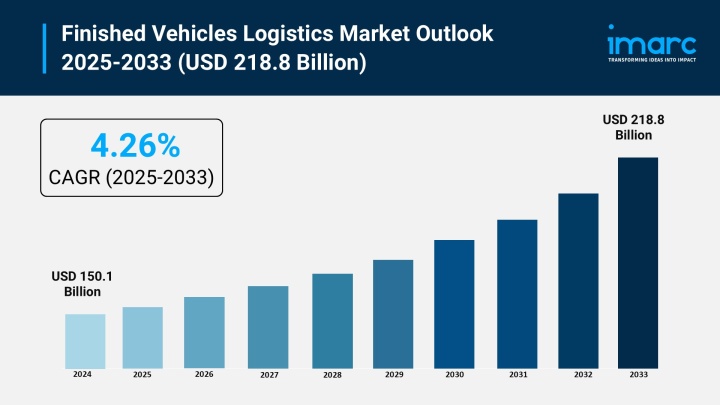

According to IMARC Group's latest research publication, "Finished Vehicles Logistics Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global finished vehicles logistics market size reached USD 150.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 218.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.26% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Finished Vehicles Logistics Market

- AI optimizes route planning for vehicle transport fleets, reducing delivery times by 15% and cutting fuel costs through predictive analytics and real-time traffic monitoring.

- Logistics companies are investing €2 billion+ in digital transformation, utilizing AI-powered tracking systems that provide 99% accuracy in vehicle location and condition monitoring.

- Machine learning algorithms enhance warehouse operations, with AI-driven inventory management reducing vehicle storage time by 20% and improving turnover efficiency.

- Companies like DHL and CEVA Logistics deploy AI chatbots for customer service, handling 60% of routine shipment inquiries, freeing up staff for complex logistics coordination.

- AI-powered damage detection systems identify vehicle defects during transit with 95% accuracy, minimizing insurance claims and enhancing quality control across the supply chain.

Download a sample PDF of this report: https://www.imarcgroup.com/finished-vehicles-logistics-market/requestsample

Key Trends in the Finished Vehicles Logistics Market

- Rise of Electric Vehicle Logistics Solutions: The transition to EVs is reshaping logistics requirements, with specialized handling needed for battery-sensitive vehicles. EV sales reached 1.6 million units in the US in 2024, with over 10% market share, driving demand for EV-ready transport lanes and charging infrastructure integration during transit.

- Digital Transformation and Real-Time Tracking: Logistics providers are investing heavily in GPS tracking, IoT sensors, and blockchain technology to enhance transparency. These innovations enable precise route optimization, real-time vehicle condition monitoring, and data accuracy that reduces delivery delays by 18% while improving customer experience.

- Expansion of Flexible Ownership Models: Vehicle leasing, rental, and subscription services are creating new logistics demands. These models require rapid vehicle turnover, frequent inspections, and fleet relocation across geographic regions, shifting logistics from one-time delivery to continuous fleet management services.

- Modular and Agile Logistics Networks: Major automakers like Volkswagen, GM, and Nissan are revolutionizing their logistics by adopting flexible, resilient networks. The May 2025 conference highlighted the integration of modular systems and data-driven quality control to adapt to supply chain disruptions and market volatility.

- Sustainability and Green Logistics Initiatives: Stricter EPA regulations for 2027+ model vehicles are pushing logistics providers toward low-emission transport. Companies are increasing rail and maritime use, adopting alternative fuel vehicles, and optimizing routes to reduce carbon footprints by up to 25%, meeting both regulatory requirements and OEM sustainability goals.

Growth Factors in the Finished Vehicles Logistics Market

- Surging Global Vehicle Production: Emerging markets are driving automotive growth, with India producing 2.84 crore vehicles in FY 2023-24, up from 2.59 crore in FY 2022-23. This manufacturing surge demands sophisticated logistics to transport finished vehicles from factories to dealerships efficiently.

- E-Commerce and Direct-to-Consumer Sales Growth: Online vehicle sales platforms are expanding rapidly, requiring logistics providers to offer flexible, faster delivery options. This shift necessitates last-mile delivery capabilities and enhanced customer tracking systems to meet consumer expectations.

- Infrastructure Development in Emerging Markets: Asia-Pacific, Latin America, and Africa are investing in improved ports, road networks, and logistics hubs. These infrastructure upgrades facilitate smoother vehicle distribution and reduce transportation bottlenecks, supporting market expansion.

- Technological Advancements in Fleet Management: Advanced telematics, automated yard management systems, and AI-driven scheduling tools are enabling logistics companies to handle larger volumes with greater precision. Road freight transport in the EU showed 78.6% carried by heavy goods vehicles over 30 tonnes in 2022.

- Government Incentives for Sustainable Transport: India's FAME II scheme provided subsidies of 5,228 INR crore for 11.53 lakh electric vehicles as of December 2023. Such initiatives boost EV adoption, creating specialized logistics demand and encouraging providers to develop eco-friendly transport solutions.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging finished vehicles logistics market trends.

Leading Companies Operating in the Global Finished Vehicles Logistics Industry:

- CargoTel Inc.

- CEVA Logistics (CMA CGM)

- DHL (Deutsche Post AG)

- DSV A/S

- Hellmann Worldwide Logistics SE & Co. KG

- Kuehne + Nagel International AG

- Omsan Logistics

- Pound Gates

Finished Vehicles Logistics Market Report Segmentation:

Breakup By Activity:

- Transport

- Warehouse

- Value-added Services

Transport (rail, road, air, sea) accounts for the majority of shares due to its critical role in delivering vehicles from manufacturing sites to dealerships and end consumers across global networks.

Breakup By Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

- Hybrid Electric Vehicle

- Battery Electric Vehicle

Commercial Vehicle dominates the market driven by rising demand for transportation and delivery services from e-commerce growth, construction activities, and expanding logistics networks worldwide.

Breakup By Distribution Channel:

- OEMs (Original Equipment Manufacturers)

- Aftermarket

OEMs (Original Equipment Manufacturers) represent the leading segment as they are the primary source of new vehicle production requiring efficient logistics from manufacturing facilities to global distribution networks.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific enjoys the leading position owing to rapid automotive manufacturing expansion, large population bases, growing middle-class incomes, and government initiatives promoting the automotive sector and infrastructure development.

Recent News and Developments in Finished Vehicles Logistics Market

- December 2024: CEVA Logistics (CMA CGM) announced the expansion of its specialized vehicle transport offerings across Europe, promising efficient handling of scheduled vehicle deliveries and strengthening its continental logistics network.

- May 2025: The Finished Vehicle Logistics North America conference brought together industry leaders including Volkswagen, GM, and Nissan to showcase revolutionary approaches in modular networks, EV-ready lanes, and data-informed quality control systems.

- 2024: The EPA implemented tougher multi-pollutant emissions regulations for light- and medium-duty vehicles starting with model year 2027, driving logistics providers to invest in sustainable transportation solutions through 2032.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302