Market Overview:

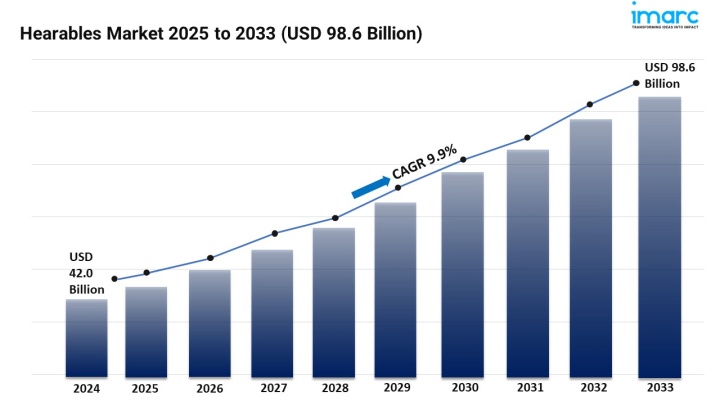

The Hearables Market is experiencing rapid expansion, driven by Growing Demand for Wireless Audio Devices with Enhanced Sound Quality, Health and Wellness Integration in Consumer Electronics, and Advancements in Noise Cancellation Technology. According to IMARC Group's latest research publication, "Hearables Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025--2033", The global hearables market size reached USD 46.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 104.0 Billion by 2034, exhibiting a growth rate (CAGR) of 9.40% during 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/hearables-market/requestsample

Our Report Includes:

Growth Factors in the Hearables Industry:

The trend of wireless audio is strong. Wireless earphones are replacing wired headphones and earphones to provide users with a wireless high definition audio experience. Common features include easy pairing, touch controls, and long battery life among others. Differentiating features can include spatial audio, low-latency gaming mode, and multi-device pairing within. Apple released its second-generation AirPods Pro in 2022. The release included improvements in audio drivers and a new adaptive transparency mode. Because the audio sounds better and the sound delights, many consumers now use the Bose QuietComfort Ultra Earbuds regularly. This allows for easy streaming and high-quality audio on the go, and wireless audio devices with features like 360-degree sound options as well as user-customizable EQ settings are expected to see a rise in popularity.

Consumers have subsequently begun expecting characteristics beyond audio on hearables, such as heart rate trackers, reminders to drink water during the day, and calorie trackers. Earbuds and earphones today frequently include these capabilities. Jabra and Sennheiser are among manufacturers that have released sports headsets with biometric and activity-tracking features. Some headphones, like Jabra's Elite 8 Active, even track metrics of exercise and levels of stress, making audio contribute to health as a key part of integration with wellness. Preventive health becomes increasingly important. Hearables become a good vehicle for consumer adoption. Some brands are differentiated in a meaningful means.

Noise cancellation is one of the most wanted features for hearables with numerous solutions available, such as adaptive ANC that uses machine learning to estimate the habits of the user or the environment to optimize the sound isolation. Other ANC features in Sony and Bose include multiple microphones and artificial intelligence (AI) to improve hybrid ANC with low-latency noise suppression and wind noise reductions. Most of these newer ANC features are mainly intended for outdoor use and commuting. Noise control includes user-adjustable controls via the mobile app and other modes for transparency and isolation. As people work from anywhere and work hybrid, noise cancels and remains a key area where hearables innovate, even as people work from various environments and noise distractions are present.

Key Trends in the Hearables Market:

Artificial intelligence and machine learning (ML) can help turn hearables into smart personal assistants that adapt the sound quality, battery usage, speech recognition, and other settings to the user's surroundings. Features could also include recommending settings that automatically equalize or cancel noise based on the usage and the surrounding environment of the device. Devices are being introduced with Amazon's Alexa virtual assistant and Google Assistant clever personal assistants that can be controlled by voice. For instance, Samsung's Galaxy Buds product line uses artificial intelligence and adaptively sounds to improve call quality. This is part of a broader consumer-driven shift in hearables shifting from music listening to multifunction connected accessories that improve users' daily productivity and experience.

All of these features and more have led to a demand for TWS sales from customers who would like not to be wired to a device and would like a device that could be easily moved. High quality low latency Bluetooth codecs and high-resolution audio are available. With the advent of wireless charging cases and improvements in battery life, TWS have become functionally comparable to customary earphones, and vendors such as Apple, Sony and OnePlus have attempted to distinguish their offerings by adding features such as multipoint connectivity or waterproofing. Due to decreasing prices and continued adoption of TWS in developing markets, it is expected that TWS will continue to proliferate in consumer products with a greater focus on ergonomics, ruggedness and automatic connectivity.

Hearables can be used in consumer electronics, entertainment, healthcare, industrial safety and enterprise collaboration. Smart hearing aids, for example, use artificial intelligence algorithms to improve speech sounds for people with hearing loss as well as filter background noise. Hearables are also used in fitness through blood oxygen saturation monitoring or exercise feedback. Ruggedized hearables are also used for industrial applications such as protecting workers from noise hazards in manufacture or construction activities, or for hands-free communications. For example, Honeywell produces smart earplugs which allow the user to hear alarms or voices when they work in noisy environments. As a way to gain additional revenue and build technology, manufacturers may begin expanding into the professional and medical market.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging hearables market trends.

Leading Companies Operating in the Global Hearables Industry:

Hearables Market Report Segmentation:

Breakup by Product:

The report offers a comprehensive breakdown and examination of the market, categorizing it by product such as headsets, earbuds, and hearing aids, with headsets emerging as the largest segment.

Breakup by Type:

The report also includes a thorough breakdown and analysis of the market segmented by type, covering variations such as on ear, in ear, and over ear, with on ear holding the majority of the market share.

Breakup by Connectivity Technology:

Breakup by End User:

The report extensively analyzes the market's segmentation by end user, encompassing consumer, industrial, and healthcare sectors, with consumer emerging as the largest segment.

Market Breakup by Region:

Asia Pacific demonstrates clear dominance, holding the largest market share in the hearables market.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302