Market Overview:

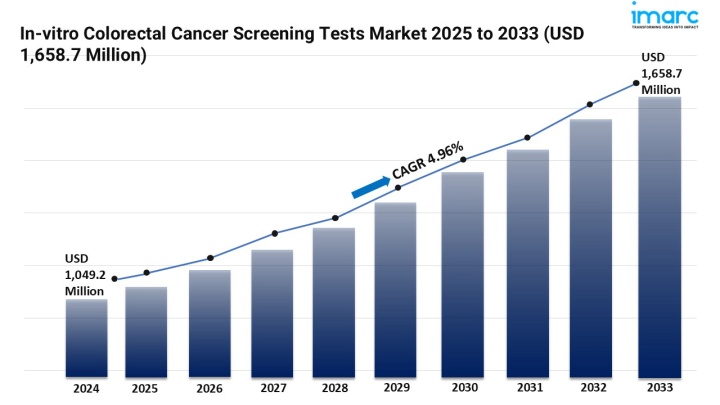

The in-vitro colorectal cancer screening tests market is experiencing rapid growth, driven by Early Detection & Non-Invasive Techniques, Technology Advancements and Sensitivity, and accessibility & decentralized testing. According to IMARC Group's latest research publication, "In-vitro Colorectal Cancer Screening Tests Market Size, Share, Trends and Forecast by Product, Imaging Type, End User, and Region, 2025-2033", The global in-vitro colorectal cancer screening tests market size was valued at USD 1,049.22 Million in 2024. The market is projected to reach USD 1,658.67 Million by 2033, exhibiting a CAGR of 4.96% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/in-vitro-colorectal-cancer-screening-tests-market/requestsample

Our report includes:

Growth Factors in the In-vitro Colorectal Cancer Screening Tests Industry:

The global focus on early colorectal cancer detection is driving innovations in non-invasive testing methods. Stool-based DNA and fecal immunochemical tests (FIT) are becoming the preferred first-line tools for population screening due to their comfort, accuracy, and home-use convenience. These tests help identify microscopic traces of blood and genetic mutations long before symptoms appear. Healthcare providers are increasingly promoting such alternatives to improve compliance rates among patients hesitant about colonoscopy. Furthermore, ongoing R&D is exploring RNA markers and microRNA profiling for even earlier detection. The shift toward simple, non-invasive, and scalable tests supports national screening programs aimed at reducing cancer mortality.

Technological progress is revolutionizing the sensitivity and reliability of in-vitro colorectal cancer screening. Innovations in molecular assays, such as digital PCR, next-generation sequencing (NGS), and microarray platforms, allow detection of rare genetic mutations with exceptional precision. AI-driven image and data analysis tools are minimizing diagnostic errors by interpreting complex biomarker patterns in real time. Companies are also integrating automated sample processing and multiplex testing to reduce turnaround times and human error. The use of liquid biopsy techniques—detecting tumor DNA fragments in blood—is gaining ground as a complementary approach. Collectively, these advancements enhance accuracy, speed, and clinical confidence in early-stage cancer diagnostics.

Expanding equitable access to colorectal cancer screening remains a core healthcare objective. Self-sampling kits, telehealth consultations, and pharmacy-based test distribution are improving screening participation, particularly in rural and underserved areas. Governments and NGOs are launching national awareness campaigns and subsidy programs to increase adoption rates. Mobile diagnostic vans equipped with stool collection and analysis tools are also bridging healthcare gaps in remote communities. Furthermore, partnerships between diagnostic firms and public hospitals are enabling affordable distribution channels. This decentralized testing approach enhances outreach, empowering individuals to take proactive health measures while easing the burden on centralized healthcare infrastructure.

Key Trends in the In-vitro Colorectal Cancer Screening Tests Market:

Patient-friendly, at-home colorectal cancer screening kits are gaining traction as the preferred alternative to traditional invasive methods. Modern test kits use DNA or hemoglobin detection from stool samples, allowing users to collect specimens privately and conveniently. Insurance coverage and reimbursement policies are further driving adoption. Healthcare providers are recommending periodic home testing as a preventive step between colonoscopies. Subscription-based services and direct-to-consumer models are making testing kits more affordable and frequent. These solutions not only increase participation but also generate valuable population-level data, advancing proactive cancer surveillance and enabling large-scale early detection across different risk demographics.

The merging of digital technology with diagnostic testing is transforming patient engagement and screening efficiency. Mobile applications now guide users through test preparation, sample collection, and result tracking. Cloud-based dashboards enable healthcare providers to monitor patient adherence and intervene when needed. AI-powered systems assess risk profiles based on health records and genetic markers, offering personalized screening schedules. Telemedicine consultations following positive results ensure timely medical guidance. Digital connectivity also allows healthcare systems to conduct nationwide cancer screening initiatives with improved coordination. This integration of in-vitro diagnostics and digital health is streamlining workflows and enhancing preventive healthcare delivery.

Biomarker discovery is emerging as the cornerstone of next-generation colorectal cancer diagnostics. New assays are targeting DNA methylation, circulating tumor cells (CTCs), and microRNA alterations that signify early tumor development. Multi-analyte panels that combine genomic, proteomic, and metabolomic markers provide a more comprehensive cancer profile. Companies are investing in AI-driven biomarker validation to enhance specificity and reduce false positives. This molecular precision supports personalized screening approaches based on genetic predisposition and lifestyle factors. As biomarker-based tests become clinically validated and cost-effective, they are expected to redefine colorectal cancer screening, shifting the focus from detection to true early prevention.

We explore the factors propelling the in-vitro colorectal cancer screening tests market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Global In-vitro Colorectal Cancer Screening Tests Industry:

In-vitro Colorectal Cancer Screening Tests Market Report Segmentation:

Breakup by Product:

The in-vitro colorectal cancer screening tests market is segmented by product type into various categories based on diagnostic approaches. Fecal occult blood tests represent a primary segment, which is further divided into guaiac-based FOB stool tests, immuno-FOB agglutination tests, lateral flow immuno-FOB tests, and immuno-FOB ELISA tests.

Breakup by Imaging Type:

By imaging type, the market is categorized into several diagnostic imaging modalities used for colorectal cancer detection. These include colonoscopy and proctoscopy, which are traditional endoscopic procedures used to visually inspect the colon and rectum. Advanced imaging technologies such as CT scans and MRI provide cross-sectional views and detailed anatomical imaging. Ultrasound is employed for non-invasive abdominal evaluations, while PET scans are utilized for detecting cancer spread and monitoring treatment response through metabolic imaging.

Breakup by End User:

In terms of end users, the market serves various healthcare settings. Hospitals represent a major segment where comprehensive diagnostic and treatment services are offered. Clinics, especially specialized gastroenterology centers, play a crucial role in routine screening and follow-up care. Diagnostic laboratories support both public and private sector testing with a wide range of in-vitro diagnostic solutions. The "others" category includes research institutes, academic centers, and home-based test users who increasingly rely on at-home testing kits for preliminary screening.

Breakup By Region:

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302