Market Overview:

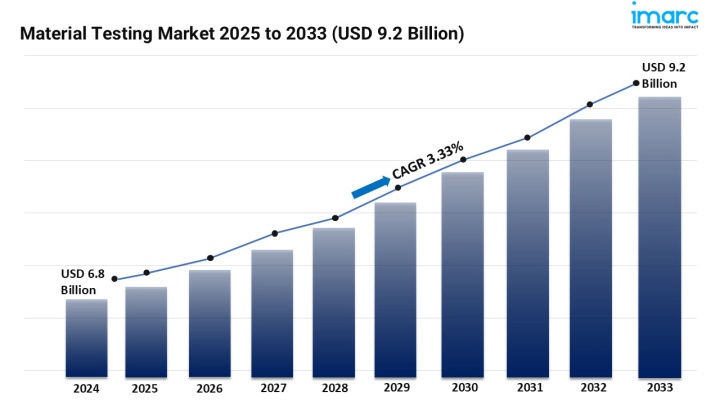

The material testing market is expanding steadily, driven by increased demand for quality assurance, technological advancements in testing equipment, and expansion across diverse end-use industries. According to IMARC Group's latest research publication, "Material Testing Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global material testing market size reached USD 6.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.33% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/material-testing-market/requestsample

Our report includes:

Growth Factors in the Material Testing Market:

Quality assurance has become a core focus for industries where safety and reliability are critical. Material testing ensures that products—from automotive components to aerospace structures—can withstand stress, wear, and harsh conditions. Governments are tightening compliance standards, and consumers expect defect-free products. For example, global recalls in the automotive industry have highlighted the cost of poor quality, pushing manufacturers to invest in advanced testing solutions. Material testing prevents failures, reduces warranty claims, and strengthens brand trust. In sectors such as construction, verified durability of concrete and steel not only improves safety but also boosts market competitiveness.

Material testing equipment is undergoing rapid transformation with the integration of AI, robotics, and Industry 4.0. Modern machines provide automated testing, real-time analytics, and predictive insights that minimize human error and accelerate decision-making. Non-destructive testing (NDT) techniques like ultrasonic and X-ray inspections are expanding into aerospace, semiconductors, and renewable energy. Servohydraulic systems now deliver greater control in simulating stress and fatigue conditions. Moreover, the shift toward digital twins allows manufacturers to model material behavior virtually before physical testing. These innovations are not only improving testing precision but also cutting costs, enabling companies to accelerate product development without compromising safety standards.

The adoption of material testing is expanding beyond heavy industries to include education, renewable energy, healthcare, and electronics. Universities and research labs increasingly use testing equipment for training and innovation projects. In renewable energy, testing verifies solar panels’ resistance to UV degradation and wind turbines’ ability to withstand extreme winds. Consumer electronics companies rely on testing to ensure product durability, such as smartphone screens that resist scratches and drops. Even medical device manufacturers are investing in advanced testing methods to validate biocompatibility and reliability. This expansion into new end-use sectors is broadening market opportunities for solution providers and equipment manufacturers.

Key Trends in the Material Testing Market

Non-destructive testing (NDT) has become increasingly vital as companies prioritize asset longevity and worker safety. Techniques like ultrasonic, magnetic particle, and radiographic testing allow engineers to detect flaws without damaging critical components. This is especially important in sectors like aviation, oil & gas, and nuclear power, where even small defects can cause catastrophic failures. NDT supports predictive maintenance, enabling companies to identify risks before they escalate into costly downtime. As infrastructure ages, governments and private companies are investing heavily in advanced NDT tools and skilled technicians. The approach ensures compliance, reduces accidents, and extends equipment life cycles significantly.

The digital shift in material testing is creating smarter and more connected labs. Cloud-based platforms now store, analyze, and share testing data in real time, improving collaboration across global teams. Smart testing machines integrated with IoT sensors capture thousands of data points per second, helping engineers identify hidden material behaviors. Predictive analytics allows manufacturers to forecast failures before they happen, improving efficiency and reducing waste. For instance, automotive suppliers use AI-powered testing to validate lightweight materials for electric vehicles. This digitalization not only enhances accuracy and transparency but also supports faster decision-making, reducing time-to-market for high-performance products.

As industries prioritize eco-friendly manufacturing, material testing is evolving to assess recycled and bio-based alternatives. Green concrete, biodegradable plastics, and composite materials require rigorous validation to ensure durability matches traditional counterparts. Testing now includes evaluating carbon footprints, recyclability, and long-term performance under real-world conditions. Renewable energy projects, such as offshore wind farms, rely on sustainability testing to guarantee resilience in extreme environments. Governments are also encouraging eco-certifications, creating demand for specialized testing services. By enabling confidence in sustainable materials, testing supports circular economy goals while driving innovation. This shift positions testing labs as critical enablers of greener manufacturing worldwide.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging Material Testing Market trends.

Leading Companies Operating in the Global Material Testing Industry:

Material Testing Market Report Segmentation:

By Type:

Non-destructive testing machines represent the largest segment as they offer numerous benefits across various industries, contributing to enhanced safety, efficiency, and cost-effectiveness.

By Material:

Metals and alloys exhibit a clear dominance in the market due to their durability and easy availability.

By End Use Industry:

Construction accounts for the majority of the market share owing to the increasing utilization of material testing procedures to gain insights into the quality, durability, and performance of construction materials.

Regional Insights:

Asia Pacific's dominance in the material testing market is attributed to investment in research and development (R&D) to bring improvements in material testing procedures.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302