Market Overview:

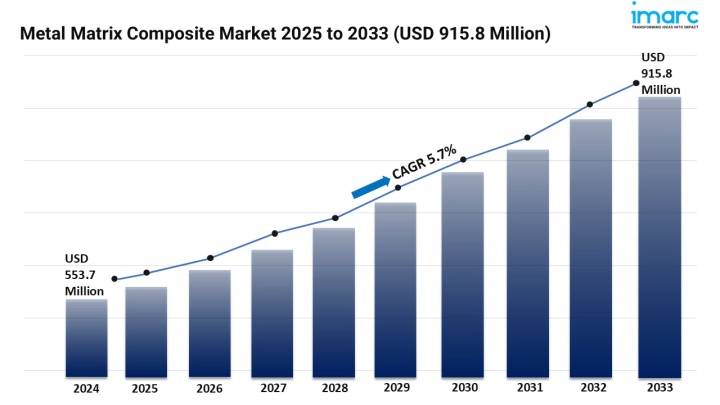

The metal matrix composite market is experiencing rapid growth, driven by Rising Demand from the Automotive Sector, Advancements in Aerospace Materials, and Increased Focus on Lightweight and High-Performance Components. According to IMARC Group's latest research publication, "Metal Matrix Composite Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025–2033", The global metal matrix composite market size reached USD 553.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 915.8 Million by 2033, exhibiting a growth rate (CAGR) of 5.7% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/metal-matrix-composite-market/requestsample

Our report includes:

Growth Factors in the Metal Matrix Composite Market:

As demand increases for automobiles that are lighter and more fuel efficient, the automobile industry is increasingly using metallic matrix composites (MMCs). MMCs have a high strength-to-weight ratio, good corrosion resistance and very good thermal stability. These properties are desirable in applications such as automotive engines, brakes, and structures. BMW, Ford and other car manufacturers have explored aluminum based MMCs to replace steel in their vehicles in order to save weight and improve performance. Such vehicles are sometimes presented at trade fairs and on social media. With stricter emissions regulations requiring manufacturers to reduce vehicle weight and fuel consumption, MMCs are becoming more important on next-generation electric and hybrid vehicle platforms.

The first common application of MMCs was in aerospace parts because of their ability to withstand high physical and thermal stress. Titanium and silicon carbide reinforced MMCs are used in jet engines, satellite frames, and thermal shields. Organisations such as NASA and Airbus are investing in material development, and LinkedIn and scientific publications regularly cite collaborations on the development of aerospace grade MMCs. With increased activities in space research and military expenditure, MMCs have become important as structural components that are lightweight, strong, stiff and stable, thus improving fuel efficiency and operational reliability, for commercial and military aircraft.

With pressure to make products lighter, more efficient, and longer-lasting, industrial and electronics applications have increased. Aluminum MMCs have been used to increase electrical conductivity and reduce thermal load. Powder metallurgy techniques have been developed that can produce custom-designed MMC components in volume with low material waste, and research in MMC processing technology is currently being funded by governments and organizations, particularly in the Asia-Pacific region. Web-based materials conferences on LinkedIn raise awareness of this collaborative community and, as innovation increasingly concentrates on material science, MMCs will be the default materials choice used for applications where improved performance and weight reduction are paramount.

Key Trends in the Metal Matrix Composite Market:

Aluminum-based MMCs are most commonly used due to their wide-ranging availability, low cost, low density, good corrosion resistance, and easy machinability. Large scale production of aluminum MMCs is being handled by companies like DWA Aluminum Composites and startups are looking to develop recyclable composites. Aluminum-based MMCs are entering Asia and North America's EV manufacturers and aerospace industries due to increased attention on sustainability and lightweight materials. Industry expositions and online discussion forums regard aluminum MMCs as fast-emerging materials in lightweight design.

Powder metallurgy is becoming the preferred fabrication route for MMCs because of the efficiency of the process, the flexibility of the shapes that can be made, the absence of material loss and the ease of controlling the additions to the metal matrix. The German and Japanese companies have made large investments in powder-based production facilities. Additive manufacturing companies indicate progress is being made with MMC production at scale via LinkedIn posts. This trend supports a popular call for sustainable manufacturing and mass adoption of MMCs in commercial and defense applications.

Using their thermal conductivity alongside electrical insulation, MMCs are used structurally for heat sinks, thermal spreaders, and housings in electronics. Silicon carbide and aluminum oxide-based MMCs are used in semiconductor devices and in EV battery enclosures. Social media marketing for MMCs is based on their ability to prevent overheating while improving circuit reliability. Thermal management creates an opportunity for MMCs to be deployed throughout the electronics supply chain, as 5G, artificial intelligence computing and electric vehicles become commonplace.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging metal matrix composite market trends.

Leading Companies Operating in the Global Metal Matrix Composite Industry:

Metal Matrix Composite Market Report Segmentation:

Type Insights:

Refractory (largest segment) dominates due to high-temperature resistance and mechanical strength, widely used in aerospace/defense.

Reinforcement Material Insights:

Silicon carbide leads for its hardness/thermal conductivity, prevalent in automotive/electronics.

Reinforcement Type Insights:

Discontinuous reinforcement (most common) offers easier processing, used in automotive/industrial machinery.

Production Technology Insights:

Powder metallurgy prevails for cost-effectiveness and uniform particle distribution.

End Use Industry Insights:

Automotive/locomotive leads by adopting lightweight materials for fuel efficiency/emissions reduction.

Regional Insights:

North America (largest market) driven by advanced manufacturing and aerospace/defense demand.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302