Market Overview:

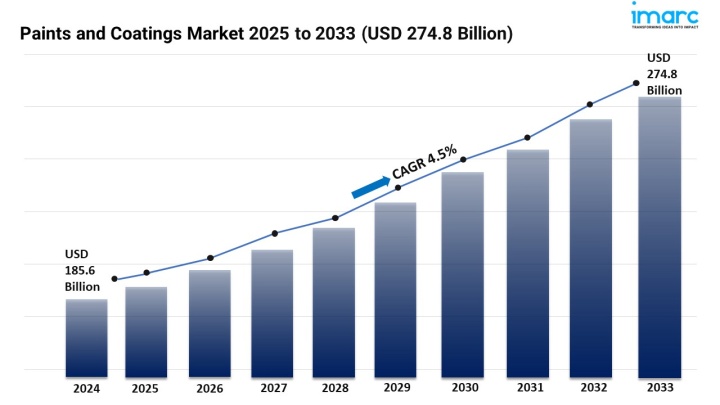

The paints and coatings market is experiencing rapid growth, driven by Construction and infrastructure boom, Expanding automotive and industrial sectors and Shifting toward eco-friendly and smart coatings. According to IMARC Group’s latest research publication, “Paints and Coatings Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033“, The global paints and coatings market size was valued at USD 185.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 274.8 Billion by 2033, exhibiting a CAGR of 4.5% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/paints-coatings-market/requestsample

Our report includes:

Factors Affecting the Growth of the Paints and Coatings Industry:

The global paints and coatings industry is experiencing strong growth, driven by an unprecedented surge in infrastructure and construction activity. Urbanization across emerging economies and renovation demand in mature markets is increasing the use of architectural coatings for residential, commercial, and industrial buildings. Countries like India, Indonesia, and Vietnam are investing billions in housing, metro projects, and smart cities, directly increasing the demand for protective and decorative coatings. In the U.S. and Europe, retrofitting of aging infrastructure and sustainable building mandates are encouraging the use of low-VOC, eco-friendly paints. According to World Bank estimates, over 55% of the global population now lives in urban areas, which has pushed the construction sector to invest in durable and visually appealing coating solutions.

The rise in automotive production and the resurgence of manufacturing are major contributors to the increasing demand for performance coatings. These sectors require a wide range of functional coatings for corrosion resistance, thermal insulation, and aesthetic appeal. Global automakers like Toyota and BMW have ramped up vehicle production to meet post-pandemic demand, leading to higher consumption of OEM and refinish paints. Similarly, industrial machinery and heavy equipment manufacturers are applying advanced coatings to extend product life and meet regulatory standards. In China, industrial output rose significantly, and regions like Eastern Europe are emerging as new automotive hubs, driving local coating demand. Additionally, with the global focus on electrification, coatings used in battery casings, motors, and electronic components are witnessing a spike.

Environmental regulations and growing consumer awareness are fueling the shift toward sustainable, low-VOC, and water-based paints. Governments across the EU, U.S., and Asia-Pacific are enforcing stricter emissions limits for indoor air pollutants and hazardous chemicals used in coatings. As a result, manufacturers like AkzoNobel and PPG Industries are investing heavily in waterborne and bio-based formulations. This green transition has become a competitive differentiator, particularly in segments like home improvement and commercial building design. Additionally, demand is rising for smart coatings—products that respond to heat, moisture, or light. These include anti-microbial coatings for hospitals, anti-graffiti solutions for public spaces, and thermal-sensitive paints for electronics.

Key Trends in the Paints and Coatings Market:

One of the most exciting trends in the paints and coatings industry is the integration of nanotechnology. Nanoparticle-infused coatings are enabling enhanced properties like self-cleaning surfaces, UV resistance, corrosion protection, and antimicrobial behavior. These advancements are being adopted across sectors—from construction and marine to automotive and healthcare. For example, nano-ceramic coatings are now widely used on luxury cars for their high scratch resistance and hydrophobic effects. In medical settings, antimicrobial nanocoatings on walls and furniture help reduce infection transmission. Even the oil and gas sector is exploring nanocoatings for pipeline corrosion protection in harsh environments. Startups and research labs are collaborating with chemical giants to develop next-gen coatings that offer not just protection but also functionality.

Digitalization is transforming the way consumers and professionals select and apply paints. With AI-powered color matching tools, 3D visualizers, and mobile apps, end-users can now preview how a specific shade or texture will look on walls or products before purchasing. Paint companies are investing in digital retail platforms and AR-driven in-store tools to streamline customer experiences. Brands like Sherwin-Williams and Asian Paints offer color recommendation engines that consider lighting, décor, and mood preferences. Furthermore, there's a growing preference for on-demand customization—such as exact shade replication for heritage buildings or brand-specific colors for commercial projects. Industrial clients, too, use digital systems to align coatings with production lines and product designs.

As the world accelerates its shift toward renewable energy, specialized coatings are playing a crucial role in supporting the durability and efficiency of clean energy infrastructure. Wind turbines, solar panels, and hydropower plants all require high-performance coatings to protect against corrosion, UV degradation, and extreme weather conditions. For instance, wind turbine blades use hydrophobic and erosion-resistant coatings to extend operational life and maintain performance. Solar panel frames often rely on anti-reflective or self-cleaning coatings to maximize energy capture. Global companies such as Jotun and Hempel are actively developing tailored solutions for the energy transition market. Moreover, governments offering incentives for renewable energy projects are indirectly boosting demand for coatings in these applications.

The Paints and Coatings Market report provides a comprehensive overview of the industry. This analysis is essential for stakeholders aiming to navigate the complexities of the Paints and Coatings Market and capitalize on emerging opportunities.

Leading Companies Operating in the Global Paint and Coatings Industry:

Paints and Coatings Market Report Segmentation:

By Product:

Waterborne coatings represented the largest segment due to their environmentally friendly nature, low VOC content, and increasing regulatory pressure to reduce emissions, driving their adoption across various industries and applications.

By Material:

Acrylic represented the largest segment due to its versatility, durability, and wide-ranging applications in architectural coatings, automotive coatings, industrial coatings, and decorative paints, among others, making it a preferred choice for manufacturers and end-users alike.

By Application:

Architectural and decorative represented the largest segment primarily because of the booming construction industry worldwide, coupled with growing urbanization and increasing consumer demand for aesthetically pleasing and long-lasting coatings for residential, commercial, and institutional buildings.

Regional Insights:

Asia Pacific enjoys the leading position in the paints and coatings market, driven by rapid urbanization, infrastructure development, and thriving construction industry.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States:+1–201971–6302