Market Overview:

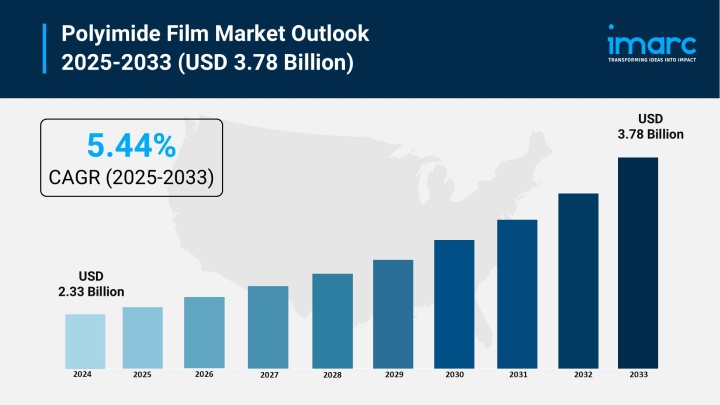

The Polyimide Film Market is experiencing robust growth, driven by Rising Demand in Electronics and Flexible Circuits, Expanding Usage in Automotive and Aerospace Components, and Increased Adoption in High-Temperature Industrial Applications. According to IMARC Group’s latest research publication, "Polyimide Film Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global polyimide film market size was valued at USD 2.33 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.78 Billion by 2033, exhibiting a CAGR of 5.44% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/polyimide-film-market/requestsample

Our Report Includes:

Growth Drivers in the Polyimide Film Industry:

Polyimide films are gaining strong traction in advanced electronics where performance, miniaturization, and flexibility are critical. These films provide excellent dielectric strength and thermal resistance, making them indispensable in foldable smartphones, wearable sensors, and flexible printed circuits. Manufacturers are now leveraging polyimide films in 3D semiconductor packaging and next-generation microchips, where ultra-thin insulation is essential. As consumer devices shrink in size yet increase in computing power, demand for lightweight, heat-resistant materials is accelerating. With smartwatches, medical wearables, and flexible displays entering mass adoption, polyimide films are becoming a core enabler of durability, reliability, and innovation in electronic applications.

Automotive and aerospace players are expanding the use of polyimide films in mission-critical components that demand safety, reliability, and lightweight performance. EV manufacturers deploy these films in battery insulation, high-temperature wiring, and power electronics, improving efficiency while extending vehicle range. Aerospace firms integrate them in thermal shielding, advanced cable coatings, and avionics insulation to enhance aircraft durability under extreme conditions. With the global transition toward electric mobility and the push for fuel-efficient aircraft, demand for flame-retardant and high-strength films is accelerating. These properties also align with stricter safety regulations, positioning polyimide films as a material of choice for next-generation transportation.

Polyimide films are increasingly used in industrial environments that involve extreme heat, mechanical stress, and chemical exposure. Semiconductor fabs apply them in wafer processing and photolithography due to their stability under repeated thermal cycling. In power generation, they are integrated into insulation systems for transformers, motors, and high-voltage reactors. Oil & gas operators use them in cable linings, sensors, and pipelines exposed to corrosive agents. Their resistance to solvents and radiation also makes them vital in nuclear facilities and chemical processing plants. As industries push for greater automation and reliability, polyimide films provide the resilience required for continuous, safe operations.

Key Trends in the Polyimide Film Market:

Transparent and colorless polyimide films are driving innovation in display and energy sectors. Unlike traditional amber-colored films, these materials allow light transmission, making them ideal for OLEDs, AR/VR headsets, and foldable smartphones. Companies are refining properties such as scratch resistance, flexibility, and optical clarity to meet premium consumer expectations. Asian electronics giants, particularly in South Korea and Japan, are pioneering their integration into ultra-thin display panels. Beyond electronics, these films are being tested in next-gen solar panels and smart windows, where lightweight, transparent coatings can improve efficiency. This versatility makes colorless polyimides a game-changer in high-performance design applications.

The expansion of 5G and IoT networks is reshaping demand for high-frequency, heat-stable materials like polyimide films. Telecom companies deploy these films in antennas, flexible connectors, and micro-sensors, ensuring minimal signal loss and high dielectric performance. With billions of IoT devices requiring durable connectivity solutions, polyimide films are now integrated into routers, base stations, and industrial IoT sensors. Their ability to withstand heat generated by high-speed data transmission is a major advantage for data centers and connected vehicles. As smart cities and Industry 4.0 expand globally, polyimide films will play a vital role in enabling reliable digital infrastructure.

Sustainability initiatives are driving innovation in eco-friendly and recyclable polyimide films. Manufacturers are experimenting with bio-based feedstocks and solvent-free processes to cut carbon emissions. Some are piloting closed-loop recycling, where films from temporary electronics or packaging are collected and reprocessed into new materials. These green alternatives are particularly attractive for electronics companies under pressure to reduce e-waste. European regulations on carbon neutrality and North American green standards are accelerating adoption. With customers increasingly preferring low-impact materials, eco-friendly polyimides offer companies a competitive edge while supporting global ESG commitments. This trend is creating a new growth frontier in the market.

Leading Companies Operating in the Global Polyimide Film Industry:

Polyimide Film Market Report Segmentation:

Breakup By Application:

Flexible printed circuit account for the majority of shares as it offers enhanced flexibility, high heat resistance, and dielectric features.

Breakup By Distribution Channel:

On the basis of distribution channel, the market has been divided into specialty stores, online stores, and others.

Breakup By End Use:

Electronics represent the majority of shares due to the rising adoption of smartphones, laptops, and wearables.

Breakup By Region:

Asia Pacific enjoys the leading position owing to a large market for polyimide film driven by rapid urbanization.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302