Market Overview:

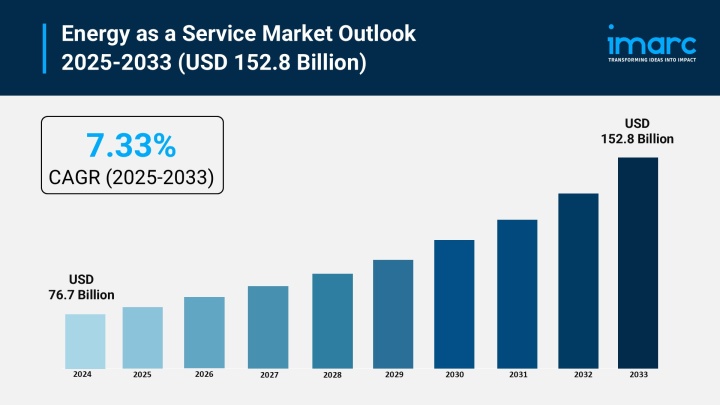

The energy as a service market is experiencing rapid growth, driven by shift from capital expenditure to operational expenditure (CapEx to OpEx), growing demand for decentralized energy and resiliency, and corporate decarbonization and net-zero mandates. According to IMARC Group’s latest research publication, “Energy as a Service Market Report by Service Type (Energy Supply Services, Maintenance and Operation Services, Energy Efficiency and Optimization Services), End User (Commercial, Industrial), and Region 2025-2033, the global energy as a service market size reached USD 76.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 152.8 Billion by 2033, exhibiting a growth rate (CAGR) of 7.33% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/energy-as-a-service-market/requestsample

Our report includes:

Growth Factors in the Energy as a Service Market

The transition of energy infrastructure costs from a large upfront capital expenditure (CapEx) to a predictable operational expenditure (OpEx) model is a primary driver for the Energy as a Service (EaaS) market. This financial model is particularly attractive to commercial and industrial customers who seek to conserve their capital for core business activities while immediately benefiting from energy system upgrades. For instance, an industrial conglomerate was recently able to bypass an initial upfront spend exceeding $text{USD }100$ million for retrofitting 1,200 sites by utilizing an EaaS agreement. These pay-for-service contracts transform volatile utility bills into a single, predictable monthly line item, with performance guarantees often bundled in. In 2024, pay-for-service agreements alone accounted for over $40%$ of the EaaS industry's total revenue, underscoring the strong market preference for this risk-mitigating, asset-light financing approach.

The increasing need for reliable and resilient power supply, driven by grid vulnerabilities and a higher incidence of extreme weather events, is significantly propelling the EaaS market. This demand translates into the accelerating adoption of Distributed Energy Resources (DERs) such as on-site solar, battery storage, and microgrids. The market segment for Microgrid-as-a-Service is particularly strong, with a notable growth rate projected for the coming years, as essential facilities like hospitals, airports, and manufacturing parks prioritize "island-mode" resiliency during grid disturbances. Recent data indicates that the shift to decentralized energy is empowering facility owners, and a major driver is the increasing preference for green power. Energy-intensive data centers and multinational industrial firms are increasingly opting for OpEx-based supply from third-party solar installations to enhance power security and hedge against supply price risk.

The rising corporate pressure to achieve aggressive decarbonization and net-zero emission targets is a fundamental accelerator for EaaS adoption globally. Enterprises across commercial and industrial sectors are prioritizing securing competitively priced, low-carbon electricity supply without having to manage complex procurement and asset ownership processes. In 2024, energy supply services—which often bundle renewable sourcing—generated almost $40%$ of the total EaaS turnover, demonstrating the urgency for clean energy solutions. This trend is amplified by supportive government regulations and incentives for renewable energy deployment. Companies are leveraging EaaS agreements to power operations, with major tech companies, for example, using these solutions to power data centers with renewable energy and significantly reduce their environmental impact, setting a high sustainability benchmark for the industry.

Key Trends in the Energy as a Service Market

A key emerging trend is the pervasive integration of Artificial Intelligence and Internet of Things (IoT) sensors for advanced energy management. Sophisticated AI platforms are now capable of predicting load, detecting equipment faults, and optimizing energy dispatch across entire portfolios in near real-time, moving beyond simple automation. Field deployments are demonstrating the concrete benefits of this trend, with reports showing cuts in commercial-building energy use by as much as $19%$ and a lengthening of equipment life by one-fifth due to predictive maintenance. Leading vendors are embedding machine-learning engines directly into edge controllers, making advanced, data-driven analytics accessible and affordable for mid-tier facilities. This capability transforms raw energy data into measurable financial and operational advantages, reinforcing the value proposition of the EaaS model.

The market is rapidly shifting toward highly flexible, subscription-based, and outcome-linked pricing models that align provider compensation directly with realized customer savings or performance targets. This trend moves away from traditional asset-based financing by guaranteeing specific energy performance metrics, reducing the financial risk for the end-user. For instance, new EaaS models for the residential sector have emerged, such as a 20-year subscription option in North West England that allows homeowners to install heat pumps, solar panels, or battery storage with zero upfront cost, paying an approximate fixed monthly fee instead. This model, which emphasizes lowering both energy costs and carbon emissions, aims to improve the accessibility of clean energy technologies by removing the significant barrier of initial capital expenditure.

EaaS providers are increasingly specializing in the development and management of complex, aggregated energy systems, namely microgrids and Virtual Power Plants (VPPs). This trend enables greater grid stability, especially in the face of aging infrastructure and geopolitical energy supply risks. VPPs, for example, aggregate distributed energy resources like commercial rooftop solar and battery storage from multiple sites into a single operational entity that can provide grid services, effectively acting as a single power plant. Furthermore, government initiatives like the UK's multi-billion-pound Great Grid Partnership, designed to support massive offshore wind capacity, are strengthening the EaaS model's role by creating demand for flexible, technology-driven solutions to integrate these large-scale renewable resources into a modernized grid infrastructure.

Leading Companies Operating in the Global Energy as a Service Industry:

Energy as a Service Market Report Segmentation:

By Service Type:

Energy supply services represent the largest segment due to the increasing energy demand around the world.

By End User:

Commercial exhibits a clear dominance in the market as companies often require assistance in renewable energy integration and energy storage solutions.

Regional Insights:

North America’s dominance in the energy as a service market is attributed to increasing focus on diversifying energy sources and rising focus on renewable energy sources.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302