Market Overview:

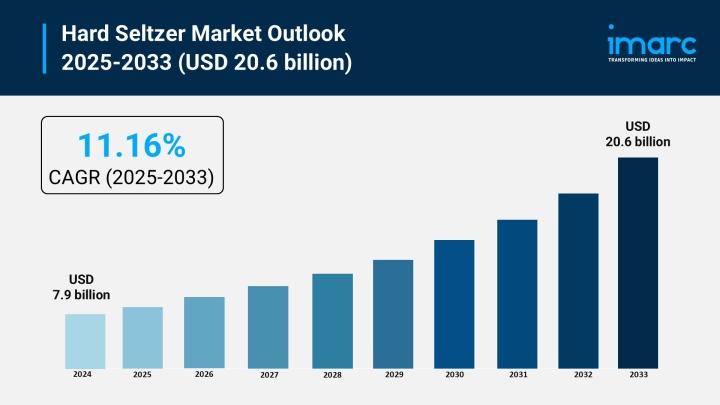

The hard seltzer market is experiencing rapid growth, driven by the health and wellness movement, the ready-to-drink (RTD) convenience, and flavor innovation and product diversification. According to IMARC Group's latest research publication, "Hard Seltzer Market Size, Share, Trends, and Forecast by ABV Content, Packaging Material, Distribution Channel, Flavor, and Region, 2025-2033", The global hard seltzer market size was valued at USD 7.9 billion in 2024. Looking forward, the market is projected to reach USD 20.6 billion by 2033, growing at a CAGR of 11.16% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/hard-seltzer-market/requestsample

Our report includes:

Growth Factors in the Hard Seltzer Market

The foremost factor propelling the hard seltzer market is the growing global emphasis on health and wellness, which directly translates into a demand for "better-for-you" alcoholic alternatives. Consumers, particularly younger demographics, are actively seeking low-calorie, low-sugar, and low-carbohydrate options to align with their active lifestyles and dietary trends like keto and gluten-free diets. Major brands, such as Truly Hard Seltzer, actively market their products with transparent labels promoting approximately 100 calories and minimal carbohydrates per serving, giving them a distinct advantage over traditional high-calorie beers and sugary cocktails. This positioning as a guilt-free indulgence has led to significant market share gains, with the segment of hard seltzers containing low alcohol-by-volume content (less than $5%$) being favored by consumers prioritizing moderation and health.

The market's expansion is fundamentally driven by the rising popularity of the ready-to-drink (RTD) format, which hard seltzer epitomizes with its convenience and portability. Hard seltzers are predominantly packaged in slim metal cans, a format that currently accounts for a substantial majority of the market's packaging revenue, with a share exceeding $75%$. This packaging type is favored for its convenience for on-the-go consumption, outdoor activities, and ease of transport for social gatherings, making it an ideal choice for modern, busy consumers. Moreover, the ease of availability across both off-trade channels, such as supermarkets and convenience stores, which dominate the distribution landscape with a revenue share over $70%$, and rapidly expanding e-commerce platforms, ensures high accessibility, further boosting adoption across diverse consumer bases.

Continuous and rapid flavor innovation by major industry players is a critical driver for maintaining consumer interest and attracting a broader palate. Hard seltzer brands are consistently introducing a wide variety of fruit flavors, from traditional citrus and berries to more exotic and unique combinations like yuzu and prickly pear. For instance, companies continually launch seasonal and limited-edition flavors, which creates excitement and encourages repeat purchases, exemplified by new launches that combine real fruit juice and botanical extracts. This strategy of flavor diversification is particularly effective in appealing to younger consumers who value experimentation. Furthermore, product evolution is extending into spirits-based seltzers, such as tequila or vodka sodas, effectively blurring category lines and opening new market segments for continued expansion.

Key Trends in the Hard Seltzer Market

An emerging trend is the movement toward premium and craft hard seltzers, which is elevating the category beyond its initial mass-market positioning. This segment is characterized by brands using higher-quality ingredients, emphasizing natural or organic flavorings, and adopting more sophisticated packaging, such as glass bottles, which are often associated with a premium image. For example, some brands are focusing on a clear, clean-label approach, highlighting ingredients like purified water and natural fruit infusions, rather than simply low calories. This strategic move aligns with a broader consumer trend where individuals with increased disposable income are willing to pay more for products that convey high quality and a more refined drinking experience.

A notable evolution within the market is the rise of spirits-based hard seltzers, which are expanding the category's reach by appealing to consumers who prefer a vodka, tequila, or rum base over the traditional fermented sugar or malt base. This diversification offers a new, lighter alternative to classic spirit-and-mixer drinks, maintaining the low-calorie and convenience benefits of hard seltzer. A key industry example is the launch of vodka-based hard seltzers by major beverage companies, which have quickly become top-selling spirits-based RTD brands in certain regions. This trend leverages the familiarity and appeal of established spirit categories to capture a new wave of adult drinkers seeking flavor variety and a perceived step-up in quality.

The integration of functional ingredients into hard seltzers represents a compelling new trend that taps into the demand for beverages offering added wellness benefits. Beyond the core attributes of low calories and low sugar, some new hard seltzer products are now incorporating ingredients like adaptogens, electrolytes, or even vitamins to cater to health-conscious consumers. This innovation positions the drink not just as an alcoholic refreshment but as a "better-for-you" lifestyle product. This strategic shift is being pursued by emerging brands to differentiate themselves in a crowded market, providing a functional twist that resonates with consumers who prioritize holistic well-being and are constantly seeking products that can support their active lives.

Leading Companies Operating in the Global Hard Seltzer Industry:

Hard Seltzer Market Report Segmentation:

By ABV content:

The 5% to 6.9% ABV segment leads the market in 2024 with 49.5% share, driven by the popularity of hard seltzers like Vizzy, which offer a balanced taste and moderate alcohol content.

By Packaging Material:

Cans dominate the market with a 51.8% share in 2024 due to their convenience, portability, and eco-friendliness, with manufacturers like Passion Tree Hard Seltzer introducing mini cans to meet consumer demand.

By Distribution Channel:

Supermarkets and hypermarkets hold a 27.5% market share in 2024, benefiting from their wide shelf space, promotional campaigns, and convenience for consumers looking to explore various hard seltzer flavors.

By Flavor:

Cherry flavor leads the market with a 26.5% share in 2024, appealing to consumers with its sweet-tart profile and associations with freshness, as seen in products like Anheuser-Busch's cherry cola hard soda.

Regional Insights:

North America accounts for 81.5% of the market share in 2024, fueled by a vibrant social culture, strong economy, and increased acceptance of alcohol consumption, exemplified by new product launches like SunnyD Vodka Seltzer.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302