Middle East Data Center Market Overview

Market Size in 2024: USD 5,355.6 Million

Market Size in 2033: USD 17,861.1 Million

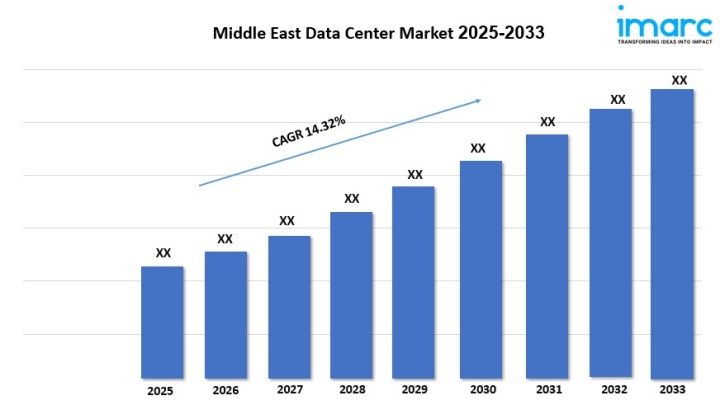

Market Growth Rate 2025-2033: 14.32%

According to IMARC Group's latest research publication, "Middle East Data Center Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Middle East data center market size reached USD 5,355.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 17,861.1 Million by 2033, exhibiting a CAGR of 14.32% during 2025-2033.

How AI is Reshaping the Future of Middle East Data Center Market

Grab a sample PDF of this report: https://www.imarcgroup.com/middle-east-data-center-market/requestsample

Middle East Data Center Market Trends & Drivers:

The Middle East data center market is experiencing unprecedented growth driven by comprehensive digital transformation initiatives across multiple sectors including government, finance, healthcare, and telecommunications. The region's ambitious smart city projects, particularly in the United Arab Emirates and Saudi Arabia, are creating substantial demand for robust data infrastructure to support advanced urban services including smart transportation systems, e-governance platforms, and IoT-enabled municipal management. Saudi Arabia's NEOM project, representing a USD 500 billion investment and expected to become operational in 2025, exemplifies the scale of technological ambition reshaping the region's data center landscape. The rapid deployment of 5G networks across major Middle Eastern markets is accelerating data center adoption as the technology requires dense networks with low-latency processing capabilities that modern facilities can provide. Additionally, sovereign AI programs such as Saudi Arabia's HUMAIN initiative and the UAE-France AI partnership are creating guaranteed anchor demand for GPU-dense data center halls, with AI expected to contribute 12.4% to Saudi Arabia's GDP and 14% to the UAE's economy by 2030, fundamentally transforming regional data processing requirements.

The explosive growth of cloud computing adoption among Middle Eastern businesses and government entities is driving massive expansion in data center capacity, with organizations seeking greater scalability, flexibility, and operational efficiency through cloud-based solutions. This shift is attracting major global hyperscalers including Amazon Web Services, Microsoft Azure, Google Cloud, and Oracle to establish regional presence, with Google's announcement of a new cloud region in Saudi Arabia expected to contribute USD 109 billion to the Kingdom's economy. The region's strategic geographic location, positioned between Europe, Asia, and Africa, combined with extensive submarine cable infrastructure including the 2Africa cable system and Saudi Vision Cable, is enhancing connectivity and reducing latency to sub-80 milliseconds for European connections, positioning Middle Eastern data centers as critical nodes in global digital infrastructure. The booming e-commerce sector and proliferation of online services across the region are generating exponential growth in digital traffic and data storage requirements, while solid sovereign funding, hyperscale capacity mandates, and supportive cloud-first regulations are combining to attract unprecedented capital investment, with approximately USD 12 billion in new investments expected to flow into upcoming Middle East data centers by 2027.

Government support and regulatory frameworks are playing a pivotal role in accelerating data center development across the Middle East through strategic national digitalization initiatives, substantial financial incentives, and data localization regulations. Countries are implementing progressive policies including tax incentives, special economic zones for technology infrastructure, and regulatory reforms to attract both domestic and international investment in data center facilities. The increasing emphasis on data sovereignty and security is driving demand for local data storage solutions, with governments mandating that sensitive information remain within national borders, creating opportunities for domestic data center operators while compelling international cloud providers to establish regional facilities. The growing focus on sustainability and environmental responsibility is reshaping data center design and operations, with operators increasingly adopting renewable energy sources, innovative cooling technologies including seawater-based systems, and energy-efficient infrastructure to reduce carbon footprints and operational costs, aligning with global environmental goals while addressing regional challenges of water scarcity and high ambient temperatures. The emergence of edge computing as a complementary technology to centralized hyperscale facilities is creating new opportunities for distributed data infrastructure that brings processing power closer to end users, supporting real-time applications, IoT deployments, and AI-driven workloads while enhancing data security and reducing latency across the diverse and rapidly evolving Middle Eastern digital ecosystem.

Middle East Data Center Industry Segmentation:

The report has segmented the market into the following categories:

Component Insights:

Type Insights:

Enterprise Size Insights:

End User Insights:

Breakup by Country:

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Middle East Data Center Market

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302