Market Overview:

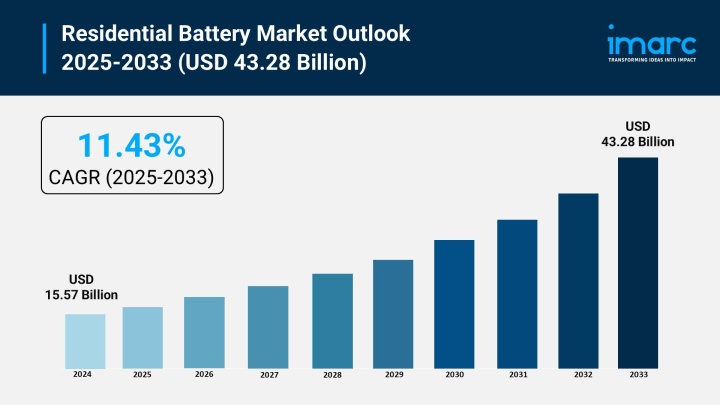

The residential battery market is experiencing rapid growth, driven by surging adoption of solar and renewable energy, government incentives and supportive policies, and declining battery costs and technological advancements. According to IMARC Group’s latest research publication, “Residential Battery Market Size, Share, Trends and Forecast by Type, Power Rating, Operation, and Region, 2025-2033”, the global residential battery market size was valued at USD 15.57 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 43.28 Billion by 2033, exhibiting a CAGR of 11.43% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/residential-battery-market/requestsample

Our report includes:

Growth Factors in the Residential Battery Market

The explosive adoption of solar energy in homes worldwide is giving a massive boost to the residential battery market. More people are installing rooftop solar panels to cut energy bills and reduce their ecological footprint. But solar is only useful when the sun is shining, so storing surplus energy for later has become a must. In fact, it’s reported that over 28% of new residential solar installations now include storage, up from less than 12% just the previous year. This pairing lets homeowners use solar energy even when the grid is down or at night, making their power supply more resilient. As renewable energy continues its rapid uptake—especially in countries like Germany, the United States, and Australia—residential batteries have evolved from a niche product to an essential component of modern home energy systems. This shift is fundamentally changing the dynamics of household power use.

Bold government schemes and policy incentives are supercharging the residential battery market. Across major economies, from tax credits in the United States to subsidy-driven programs in India and Japan, governments are actively encouraging homeowners to invest in battery storage. For example, India’s PM Surya Ghar Muft Bijli Yojana offers subsidies of up to 60% for rooftop solar systems, while the United States provides tax credits under the Inflation Reduction Act, sharply lowering the up-front cost of owning a residential battery. Even policy moves like Germany’s rooftop-PV pairing mandates and California’s rules that improve self-consumption economics are making batteries an attractive investment for more consumers. These measures are not just about grid stability or greener energy—they’re part of a global push to achieve ambitious renewable energy targets and make decentralized, resilient power systems a reality.

There’s a technology revolution underway that’s making home batteries more affordable and efficient with every passing year. The price of lithium-ion batteries has dropped dramatically, with batteries for typical home systems priced well under $250 per kWh. This sharp cost reduction means more families can afford to install batteries, and the technology is improving just as rapidly. Modern batteries offer higher energy density, longer lifespans, and safer operation, with new innovations like solid-state and sodium-ion batteries entering the mainstream. Manufacturers are also rolling out smarter, AI-driven solutions that maximize self-consumption and grid interaction, making the whole system easier for users. As batteries get cheaper and smarter, they’re no longer just for tech enthusiasts—they’re a mainstream solution for everyone wanting to save on energy bills and cut reliance on the grid.

Key Trends in the Residential Battery Market

A top trend reshaping residential batteries is the seamless integration of storage systems with smart home technology. New generations of batteries are designed to work hand-in-hand with AI-enabled software, smart meters, and connected devices throughout the house. For instance, advanced systems can automatically shift power usage to off-peak hours or store energy when rates are lowest, all while learning from a family’s unique consumption patterns. Companies like EcoFlow are rolling out AI-based solutions that coordinate solar, grid, and battery power to maximize savings and comfort. Not only does this mean more efficient energy use, but it’s also making the whole experience “plug and play”—much simpler for homeowners. This kind of intelligence is transforming batteries from passive backup systems into active, intuitive energy managers for modern households.

With wild weather events and grid outages making headlines, backup power is now a major driver for residential battery adoption. Homeowners aren’t just interested in cutting energy bills—they want reliable, round-the-clock electricity, even during blackouts or storms. For example, after a series of major natural disasters in places like California and Texas, the demand for resilient backup power soared, with power shutoff events highlighting grid vulnerabilities. Modern batteries enable families to run essential appliances and stay connected when the grid fails, giving peace of mind in uncertain times. Beyond basic emergency backup, people are increasingly seeking energy independence: the ability to rely less (or not at all) on the utility company, especially in regions prone to disruptions.

A big emerging trend is the move toward holistic, solar-first home design where solar panels, batteries, and sometimes even electric vehicles are planned as an integrated energy ecosystem. No longer are batteries an afterthought—builders and homeowners now design new homes to maximize self-generated and self-consumed clean energy. In leading markets like Germany, Italy, and Australia, over 70% of new solar homes already include battery storage right from the start. Companies are also partnering to offer bundled solutions, making installation and management seamless for the consumer. As these ecosystems evolve, homeowners benefit from full control over their power—selling excess to the grid, optimizing consumption, and tracking everything with a smartphone app. This ecosystem approach is set to become the industry standard, empowering households to be both energy producers and smart consumers.

Leading Companies Operating in the Global Residential Battery Industry:

Residential Battery Market Report Segmentation:

By Type:

Lithium-ion battery dominates the residential market in 2024 due to superior performance, longer lifespan, high energy density, and reduced costs.

By Power Rating:

3-6 kW ideal for smaller households or moderate energy needs, providing cost-effective energy storage for basic appliances.

By Operation:

Standalone operates independently from solar, storing grid electricity during low rates for use during high rates and outages.

Regional Insights:

Asia Pacific enjoys a leading position in the residential battery market due to the rising focus on reliable power solutions.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302