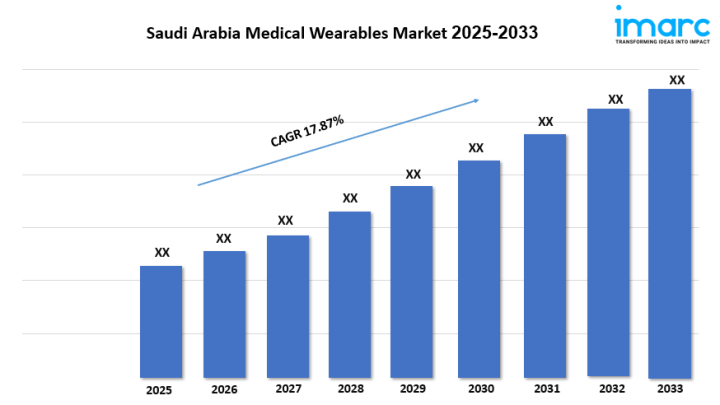

Saudi Arabia Medical Wearables Market Overview

Market Size in 2024: USD 311.66 Million

Market Size in 2033: USD 1,368.68 Million

Market Growth Rate 2025-2033: 17.87%

According to IMARC Group's latest research publication, "Saudi Arabia Medical Wearables Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia medical wearables market size reached USD 311.66 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,368.68 Million by 2033, exhibiting a CAGR of 17.87% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Medical Wearables Market

- AI-Powered Health Monitoring and Predictive Analytics: AI-integrated wearable devices are revolutionizing healthcare delivery by enabling continuous, real-time monitoring of vital health parameters including heart rate, glucose levels, blood pressure, and sleep patterns. These smart devices leverage machine learning algorithms to analyze extensive datasets, delivering actionable insights and personalized healthcare recommendations that facilitate early disease detection and proactive health management.

- Enhanced Chronic Disease Management: AI-driven wearables are transforming chronic disease care in Saudi Arabia, where lifestyle-related conditions are prevalent. With diabetes affecting approximately 5.3 million adults and cardiovascular diseases remaining a leading health concern, AI-enabled devices provide continuous monitoring capabilities, predictive health risk assessments, and personalized treatment recommendations, significantly improving patient outcomes while reducing hospital visits.

- Integration with National Digital Health Infrastructure: AI-powered wearables are being seamlessly integrated with Saudi Arabia's National Digital Health Strategy and Vision 2030 initiatives. Platforms like SEHA Virtual Hospital, connecting over 150 hospitals and 30+ specialties, are leveraging wearable device data to enable remote patient monitoring, virtual consultations, and AI-assisted diagnostics, fundamentally transforming healthcare accessibility across the Kingdom.

- Advanced Biosensor Technology and Non-Invasive Monitoring: Recent advancements in AI-enhanced biosensor technology have enabled sophisticated non-invasive monitoring of diverse biochemical and physiological signals. Innovations such as continuous glucose monitoring devices, wearable ECG monitors, and smart health patches are providing real-time health tracking with sensitivity and specificity rates between 82% and 97%, supporting preventive healthcare and early intervention strategies.

- Personalized Healthcare and Wellness Optimization: AI algorithms integrated within wearable devices are enabling highly personalized healthcare experiences by analyzing individual health patterns, activity levels, and biometric data. These intelligent systems provide customized health recommendations, fitness guidance, and wellness insights, empowering Saudi Arabia's tech-savvy population to take proactive control of their health and well-being aligned with the growing preventive healthcare movement.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-medical-wearables-market/requestsample

Saudi Arabia Medical Wearables Market Trends & Drivers:

Saudi Arabia's medical wearables market is experiencing exceptional growth, driven by the government's ambitious Vision 2030 initiative and National Digital Health Strategy, which prioritize healthcare digitalization and technology-enabled service delivery. The market is fueled by increasing health awareness and a significant shift toward preventive healthcare, with 65% of the population actively seeking health and wellness information. The Kingdom's digital health market, valued at USD 2.5 billion in 2024 and projected to reach USD 13.3 billion by 2031, is creating a robust ecosystem for wearable device adoption across healthcare, fitness, and wellness sectors.

The rising prevalence of chronic diseases is significantly driving market demand. With diabetes affecting approximately 5.3 million adults out of a total adult population of 25 million, and cardiovascular diseases remaining a leading cause of death, there is urgent need for continuous health monitoring solutions. The Kingdom's obesity rate, recorded at 35% in 2020-2021—among the highest globally—further emphasizes the critical requirement for wearable devices that enable real-time tracking of vital health parameters. These devices are becoming essential tools for managing lifestyle-related health conditions through continuous monitoring of heart rate, glucose levels, blood pressure, and physical activity.

Technological advancements and increased accessibility are accelerating market expansion. The booming e-commerce market in Saudi Arabia, estimated at USD 222.9 billion in 2024 and projected to reach USD 708.7 billion by 2033 (CAGR of 12.8%), is significantly improving distribution channels for health-tracking technologies. With 93% smartphone penetration and high internet usage (30 million users representing 83% of the population), the Kingdom presents ideal conditions for wearable device adoption. Manufacturers are introducing innovative products like Huawei's WATCH GT 5 Series with TruSense system, Samsung Galaxy Ring, and SFDA-approved devices such as sugarBEAT® non-invasive glucose monitoring system, catering to diverse health needs while leveraging AI, IoT connectivity, and advanced biosensor technologies to deliver enhanced functionality and user experiences.

Saudi Arabia Medical Wearables Industry Segmentation:

The report has segmented the market into the following categories:

Product Insights:

- Patches

- Wristband and Activity Monitors

- Smartwatches

- Others

Device Type Insights:

- Diagnostic and Monitoring Medical Devices

- Vital Signs Monitoring Devices (ECG/Holter Heart Rate Monitors, Pulse Oximeters, Blood Pressure Monitors, and Multiparameter Trackers)

- Glucose Monitoring Devices

- Sleep Apnea Monitors

- Fetal Monitoring Devices

- Neurological Monitoring Devices

End User Insights:

- Hospitals and Clinics

- Long-Term Care Centers/Assisted Living Facilities/Nursing Homes

- Home Healthcare/Patients

- Ambulatory Care Centers

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Recent News and Developments in Saudi Arabia Medical Wearables Market

- February 2025: LEAP 2025 conference in Riyadh showcased cutting-edge medical wearables including XPANCEO's revolutionary smart contact lens capable of monitoring stress levels, blood sugar, and body temperature. Dutch designer Anouk Wipprecht also unveiled innovative wearable technology featuring health monitoring functions, including a robotic dress equipped with heartbeat monitoring capabilities, demonstrating the Kingdom's growing role as a regional hub for healthcare innovation.

- January 2025: Samsung Electronics announced the global expansion of its Galaxy Ring to sizes 14 and 15, extending availability to 15 additional markets starting February, building upon its existing presence in 38 markets including Saudi Arabia. The Samsung Health app introduced advanced features including Sleep Environment Report, Sleep Time Guidance, and a comprehensive Mindfulness Tracker, enhancing sleep quality monitoring and overall wellness management for Saudi consumers.

- August 2025: The Saudi Food and Drug Authority (SFDA) granted marketing authorization for a locally developed hand-worn medical device created by King Saud University, protected by patents in both Saudi Arabia and the United States. This milestone reflects the Kingdom's increasing regulatory support for domestic medical technology innovation and underscores the growing role of local R&D and government partnerships in accelerating medical wearable adoption.

- August 2023: Nemaura Medical received SFDA approval for sugarBEAT®, a groundbreaking non-invasive continuous glucose monitoring wearable device launched via TPMENA in Saudi Arabia. This approval highlights the expanding role of medical wearables in preventive healthcare and chronic disease management, offering safer and more convenient solutions for real-time health tracking in a country facing rising diabetes prevalence.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302