Saudi Arabia Venture Capital Investment Market Overview

Market Size in 2024 : USD 3.1 Billion

Market Size in 2033: USD 13.4 Billion

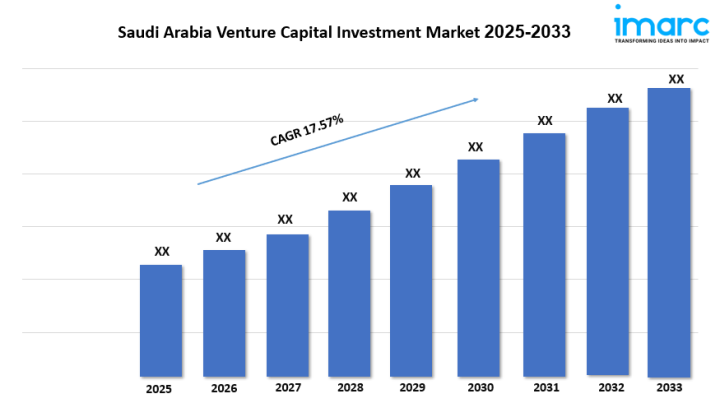

Market Growth Rate 2025-2033: 17.57%

According to IMARC Group's latest research publication,"Saudi Arabia Venture Capital Investment Market Size, Share, Trends and Forecast by Sector, Fund Size, Funding Type, and Region, 2025-2033", The Saudi Arabia venture capital investment market size reached USD 3.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.4 Billion by 2033, exhibiting a growth rate (CAGR) of 17.57% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Venture Capital Investment Market

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-venture-capital-investment-market/requestsample

Saudi Arabia Venture Capital Investment Market Trends & Drivers:

Saudi Arabia’s venture capital boom is the government’s aggressive push through initiatives like Vision 2030 and the Saudi Venture Capital Company (SVC). These programs are injecting billions into startups, with SVC alone committing over $1 billion to fuel early-stage investments. The focus is on diversifying the economy beyond oil, and it’s working—Saudi startups raised a record $1.4 billion in 2023, nearly doubling the previous year’s figures. This isn’t just about funding; it’s about creating an ecosystem where tech, fintech, and e-commerce startups can thrive, backed by strong policy support and financial incentives.

Another key factor is the rapid rise of Saudi-based unicorns and mega-deals, proving the market’s maturity. Companies like Tamara and Foodics have hit billion-dollar valuations, drawing global investor attention. These success stories are pulling in more capital, with international VCs like SoftBank and Sequoia increasing their presence in the Kingdom. The numbers speak for themselves—Saudi Arabia now accounts for over 60% of all VC funding in the MENA region, a clear sign that local startups are scaling faster and attracting bigger checks than ever before.

A third trend is the explosive growth of sectors like fintech and clean energy, driven by both consumer demand and regulatory easing. The Saudi Central Bank’s sandbox program has fast-tracked over 30 fintech startups, while green energy ventures are booming thanks to NEOM’s $500 billion commitment to sustainability. Investors are piling into these high-potential areas, with fintech deals alone making up nearly 30% of all VC transactions last year. It’s a gold rush mentality, but with real substance—Saudi Arabia isn’t just chasing trends, it’s building the infrastructure to dominate them.

Our comprehensive Saudi Arabia Venture Capital Investment Market outlook reflects both short-term tactical and long-term strategic planning. This analysis is essential for stakeholders aiming to navigate the complexities of the market and capitalize on emerging opportunities.

Saudi Arabia Venture Capital Investment Industry Segmentation:

The report has segmented the market into the following categories:

Sector Insights:

Fund Size Insights:

Funding Type Insights:

Regional Insights:

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Recent News and Developments in Saudi Arabia Venture Capital Investment Market

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302