Market Overview:

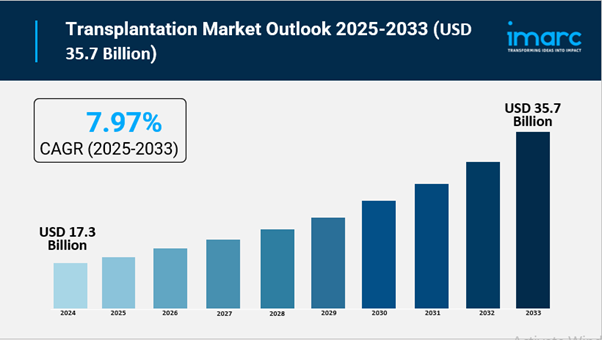

The transplantation market is experiencing rapid growth, driven by escalating prevalence of chronic end-stage diseases, strategic government initiatives and policy reforms, and advancements in organ preservation and logistics technology. According to IMARC Group's latest research publication, "Transplantation Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global transplantation market size reached USD 17.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 35.7 Billion by 2033, exhibiting a growth rate (CAGR) of 7.97% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/transplantation-market/requestsample

Our report includes:

Growth Factors in the Transplantation Market

The primary catalyst for market expansion is the rising global incidence of chronic conditions such as end-stage renal disease (ESRD), cirrhosis, and cardiovascular failure. These ailments frequently progress to a point where pharmaceutical intervention is no longer viable, making transplantation the sole life-saving option. In the United States alone, approximately 86% of the individuals currently on national waiting lists are seeking kidney transplants, a trend mirrored globally as diabetes and hypertension rates climb. The World Health Organization has noted that over 500 million people suffer from diabetes worldwide, many of whom face eventual organ failure. Consequently, the volume of procedures is rising to meet this demand; for instance, the U.S. recorded over 46,000 organ transplants in 2023. This sustained patient pool ensures a continuous requirement for surgical services, preservation solutions, and lifelong immunosuppressive drug regimens, anchoring the industry’s steady growth.

National governments are increasingly implementing robust legislative frameworks and financial support systems to bridge the gap between organ supply and demand. In India, the National Organ Transplant Program (NOTP) has streamlined the donation process, contributing to a record 18,900 transplants in 2024. Furthermore, the Indian government provides financial assistance of up to ₹15 lakh to underprivileged patients for major surgeries under the Rashtriya Arogya Nidhi. In the United States, the Centers for Medicare & Medicaid Services (CMS) introduced the Increasing Organ Transplant Access (IOTA) Model, set to begin in July 2025. This mandatory six-year program incentivizes 103 kidney transplant hospitals to optimize organ offer acceptance and improve long-term graft survival. These top-down interventions, combined with public awareness campaigns that have registered over 170 million donors in the U.S., are essential in formalizing and expanding the global transplantation infrastructure.

Technological innovation in how organs are maintained and tracked is significantly reducing wastage and expanding the geographical range of viable donations. Traditional static cold storage is being replaced by advanced machine perfusion systems, such as the SherpaPak and OrganOx platforms, which provide active thermal control and real-time monitoring. These systems keep organs in a physiological state, extending preservation windows and allowing clinicians to assess the viability of marginal donors. Corporate activity reflects this shift, with Terumo Corporation’s acquisition of OrganOx in late 2025 highlighting the move toward integrated preservation solutions. Additionally, the adoption of GPS-enabled tracking and cloud-based logistics software—currently utilized by over 65% of U.S. transplant centers—ensures time-critical coordination and chain-of-custody accuracy. By minimizing ischemic damage and logistical errors, these technologies increase the successful utilization of available organs, directly fueling market throughput.

Key Trends in the Transplantation Market

A transformative trend is the deployment of AI-driven platforms to optimize the complex process of donor-recipient matching. These intelligent systems analyze vast datasets, including histocompatibility markers and clinical urgency, to predict graft survival outcomes with high precision. For example, Stanford Medicine recently revealed a machine-learning model capable of predicting liver donor viability timeframes, which has demonstrated the potential to reduce futile organ procurement by 60%. Companies like Ataims Tech are launching secure, cloud-based platforms like LifeFuser to provide real-time analytics and workflow automation. This shift toward "precision transplantation" reduces the administrative burden on Organ Procurement Organizations (OPOs) and ensures that the highest-quality matches are made rapidly, significantly improving post-operative patient outcomes and reducing the risk of acute organ rejection in the early stages.

The industry is moving toward "off-the-shelf" biological solutions through the development of 3D bioprinting and tissue engineering. This trend aims to alleviate the chronic shortage of human donors by creating functional tissue constructs from a patient's own cells. Recent milestones include the introduction of μCollaFibR bio-ink additives by 3D BioFibR, which enhance the structural integrity of bioprinted scaffolds. Currently, tissue products dominate the market, accounting for nearly 60% of revenue in many regions due to their wide application in bone grafts, skin substitutes for burn victims, and corneal replacements. Scientists are now successfully producing multilayered skin and cartilage substitutes that integrate seamlessly with host biology. As these technologies move from laboratory research to clinical applications, they offer a scalable alternative to traditional allotransplantation, potentially eliminating long waitlists for specific tissue-based procedures.

Surgical innovation is increasingly centered on robotic assistance, which offers greater precision and faster recovery times compared to traditional open surgeries. In late 2025, VCU Health’s Hume-Lee Transplant Center reported the first fully robotic living-donor liver transplant in the United States, marking a major milestone for the field. Robotic platforms allow surgeons to perform complex vascular anastomoses through minimally invasive incisions, reducing the risk of infection and shortening hospital stays for both donors and recipients. This trend is particularly prevalent in kidney transplants, where robot-assisted techniques are becoming the standard in high-volume transplant centers. By reducing the physical toll on living donors, robotic surgery encourages higher participation rates in donation programs, while simultaneously improving the surgical accuracy necessary for the long-term success of the transplanted organ.

Leading Companies Operating in the Global Transplantation Industry:

Transplantation Market Report Segmentation:

By Product:

Tissue Products is the largest market segment due to high demand for tissues like corneas and bones, driven by applications in surgeries and advancements in tissue engineering, leading the market.

By Application:

Organ Transplantation is involves critical procedures for replacing vital organs, driven by end-stage organ failure, requiring effective immunosuppression and advanced surgical techniques.

By End User:

Hospitals are the leading segment, providing comprehensive services for transplant procedures, equipped with advanced facilities and capable of handling complex surgeries, leading the market.

Regional Insights:

North America leads the market share, with significant contributions from the United States and Canada, reflecting a strong transplantation infrastructure and demand.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302