Market Overview:

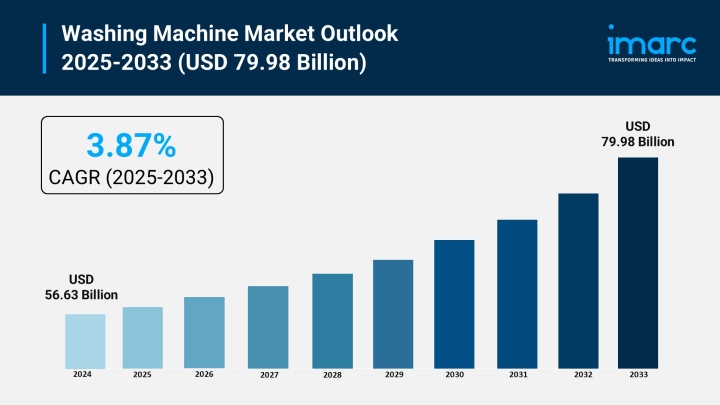

The washing machine market is experiencing rapid growth, driven by rapid urbanization and shifting lifestyles, focus on energy and water efficiency, and expansion of online retail and e-commerce. According to IMARC Group’s latest research publication, “Washing Machine Market Report by Product, Technology, Capacity, Application, End Use, and Region, 2025-2033”, the global washing machine market size was valued at USD 56.63 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 79.98 Billion by 2033, exhibiting a CAGR of 3.87% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/washing-machine-market/requestsample

Our report includes:

Growth Factors in the Washing Machine Market

The global shift of populations into urban centers, particularly in Asia-Pacific and Latin America, is a dominant factor driving growth. Urban living often involves smaller homes, dual-income households, and faster-paced routines, which amplify the demand for time-saving and space-efficient appliances. The residential segment, which still constitutes the largest revenue share in the market, benefits directly from this demographic change. Manufacturers are actively responding by promoting fully automatic machines, which commanded over 61% of the market revenue in a recent period, because they require minimal user effort compared to semi-automatic models. The rising disposable income of the expanding global middle-class further allows first-time buyers and those upgrading from manual methods to invest in these premium, convenient solutions.

Growing environmental consciousness, coupled with stringent government regulations, is spurring demand for high-efficiency washing machines globally. Regulatory bodies worldwide, such as those governing the ENERGY STAR program in the United States and the EU Energy Label, are constantly updating efficiency standards, compelling manufacturers to innovate. For instance, major brands are launching product lines that boast efficiency ratings of up to 40% better than a standard A-rated model, which significantly reduces the appliance's lifetime running costs. This move is supported by consumer preference, as high-efficiency models can save an estimated 25% on energy and 33% on water compared to conventional models, providing a strong economic incentive for consumers to replace older units.

The rapid growth of the e-commerce sector is fundamentally altering the distribution landscape for washing machines, driving increased market penetration and sales volume. Online platforms offer broader geographical reach, enabling manufacturers to efficiently target customers in Tier-II and Tier-III cities and rural areas where traditional retail may be scarce. The online segment, though smaller than offline sales, is experiencing the highest growth trajectory, with projections showing it expanding at a significantly faster rate than physical stores. This channel not only provides competitive pricing but also facilitates the sale of value-added services like extended warranties and easy financing options, making higher-end models more accessible to budget-conscious consumers.

Key Trends in the Washing Machine Market

The integration of Artificial Intelligence (AI) and Internet of Things (IoT) capabilities is transforming the washing experience into a fully automated, connected part of the smart home ecosystem. New generation washing machines are equipped with sensors and AI algorithms that automatically detect fabric type, load size, and water hardness to select the optimal wash cycle and dispense the precise amount of detergent. Leading companies have released models featuring AI-powered wash cycles and control via mobile applications, allowing users to remotely start or pause a cycle, receive completion alerts, and even perform cloud-based diagnostics. This smart-connected segment, though currently representing a small portion of total shipments, is forecast to achieve the highest growth rate across all technology segments, signaling a strong shift in consumer preference toward convenience.

There is a growing consumer emphasis on specialized cleaning features that go beyond basic washing, driven by increasing awareness of health and fabric longevity. Manufacturers are responding by incorporating technologies for enhanced fabric care and hygiene. For example, many front-load models now feature powerful steam cleaning cycles that sanitize clothes, eliminating common allergens and bacteria without the use of harsh chemicals. Furthermore, specialized drum designs and movements are being introduced, which provide gentler agitation and claim to offer up to 45% enhanced fabric care compared to conventional methods. The continued demand for health and well-being post-pandemic supports the growing popularity of these advanced, health-focused features in premium models.

A notable shift is occurring toward washing machines with capacities of 8 kg and above, a trend driven by the consolidation of laundry loads in busy households and the requirements of commercial users. As households manage larger volumes of laundry due to factors like less frequent washing or larger family sizes, the convenience of a high-capacity drum that handles bigger loads in a single cycle becomes a key selling point. The segment for machines above 8 kg capacity is projected to witness one of the fastest growth rates across all capacity segments in the near future. This trend is also evident in the commercial sector, such as the hospitality and accommodation industry, where there is an increasing demand for robust, large-capacity appliances to manage high-volume daily cleaning needs.

Leading Companies Operating in the Washing Machine Industry:

Washing Machine Market Report Segmentation:

By Product:

Fully automatic leads the market in 2024 with a 72.9% share, favored for ease of use and efficiency, driven by demand for convenience among urban consumers and advancements in technology.

By Technology:

Smart connected dominates due to IoT and AI integration, offering features like remote control and energy optimization, appealing to consumers seeking automation and efficiency in home appliances.

By Capacity:

6.1 to 8 kg commands a 41.8% market share in 2024, catering to small and medium households with a focus on energy efficiency and innovative features, driven by urbanization and convenience needs.

By Application:

The hospitality sector holds a 53.8% market share, requiring high-capacity, energy-efficient machines to meet extensive laundry demands while ensuring cleanliness and guest satisfaction.

By End Use:

Commercial accounts for 51.2% market share in 2024, driven by demand from laundromats, hotels, and hospitals, emphasizing high capacity and advanced cleaning technologies for operational efficiency.

Regional Insights:

Asia pacific dominates the washing machine market in 2024 with a 33.8% share, fueled by urbanization, rising incomes, and demand for energy-efficient appliances, supported by government initiatives and e-commerce growth.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302