Saudi Arabia Real Estate Market Overview

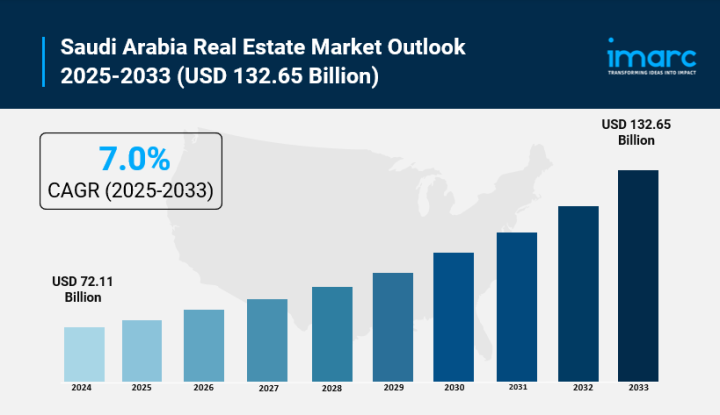

Market Size in 2024: USD 72.11 Billion

Market Size in 2033: USD 132.65 Billion

Market Growth Rate 2025-2033: 7.0%

According to IMARC Group's latest research publication, "Saudi Arabia Real Estate Market Size, Share, Trends and Forecast by Property Type, and Region, 2025-2033", The Saudi Arabia real estate market size reached USD 72.11 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 132.65 Billion by 2033, exhibiting a growth rate (CAGR) of 7.0% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-real-estate-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Real Estate Market

Saudi Arabia Real Estate Market Trends & Drivers:

Rapid urbanization combined with government-led mega infrastructure projects is a clear growth driver in the real estate market outlook in Saudi Arabia. Initiatives like the NEOM city, Red Sea development, and Riyadh Metro have sparked demand for commercial, residential, and mixed-use properties. The government’s Vision 2030 framework promotes diversification beyond oil, with an increasing focus on affordable housing and sustainable urban living options. Over 81 million domestic tourists and nearly 27 million international visitors further drive hospitality and retail real estate demand, fueling investment and development momentum across key cities.

Government-backed affordable housing programs have radically changed the market landscape by easing financing and expanding homeownership access. The Sakani Program, for example, has helped more than 1.2 million Saudi families secure homes by offering subsidized loans and slashing down payment requirements to as low as 5%. Coupled with mortgage refinancing efforts by institutions like the Saudi Real Estate Refinance Company, these initiatives raised homeownership rates to above 60%, unlocking new demand in the residential segment and pushing up real estate activity substantially.

Technology adoption and regulatory reforms are also reshaping sector growth by increasing transparency and foreign investment opportunities. The introduction of digital platforms for property transactions, combined with new leasing regulations under the Ejar system, ensures safer, more efficient market operations. Additionally, foreign ownership reforms in designated zones and investment vehicles such as REIFs have attracted global capital, as shown by over 130 foreign real estate licenses issued recently. These reforms contribute to growing market confidence and expansion across residential, commercial, and industrial real estate.

Saudi Arabia Real Estate Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Property Type:

Regional Insights:

Competitive Landscape:

Recent News and Developments in Saudi Arabia Real Estate Market

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302