$2,500 gold is in play this week – Forex.com’s James Stanley

Gold prices have broken out of a near-term bearish technical pattern and the yellow metal is poised once again to surpass its all-time highs, according to James Stanley, Senior Strategist at Forex.com.

“Gold prices broke out of a falling wedge pattern in a very big way last week,” Stanley wrote. “Coming into April Gold prices were flying higher, eventually pushing weekly RSI into deeply overbought territory.”

He said that when gold prices failed to hold above the $2,400 per ounce level, it triggered a strong pullback that drove gold down $100 in relatively short order.

“But, just like Gold bulls failed to gain acceptance above the $2400 level, Gold bears struggled to gain acceptance below $2300,” Stanley said. “There was a single daily close below that price but in the days after, buyers returned to hold support above the level while also building in a backdrop of higher-lows.”

Stanley said this price action is what created the falling wedge pattern on the daily chart “as sellers were showing more aggression at highs or near resistance but suddenly showed passiveness near lows or at support.”

Turning to the price action seen this week, Stanley noted another technical pattern that he gleaned from the pullback: “a Fibonacci retracement that has continued to show inflections.”

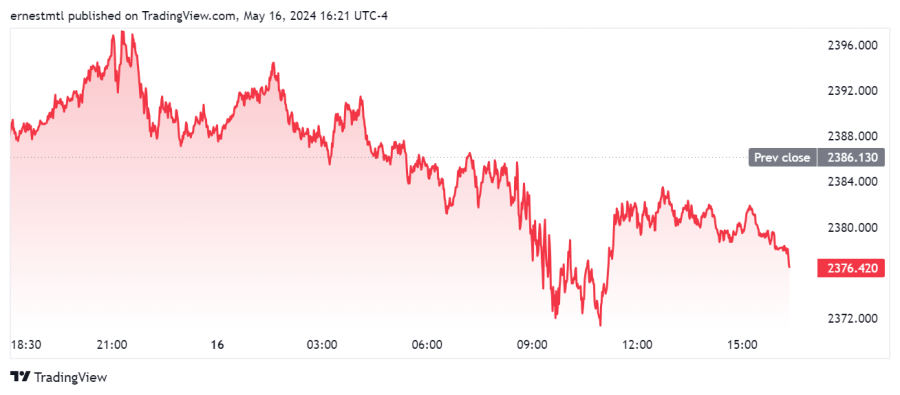

“Taking the April high down to the May low produces a 61.8% Fibonacci retracement at $2372.68,” he said. “That’s what helped to hold the highs on Friday before a pullback appeared.”

Stanley said the pullback ran all the way down to the 38.2% retracement level. “That plots at $2336.31, and that price helped to hold the lows on Monday and into Tuesday, at which point bulls came back,” he said. “That then led to a run and a pause at the 61.8% level, followed by extension up to the 76.4% retracement at $2395.18, and that’s so far held the highs for this week.”

He added that the pullback from this level “has so far held support on a re-test of support at prior resistance, at the same 61.8% retracement of 2372.68.”

Moving forward, Stanley said “the big question is whether bulls have the drive to push a weekly close above the $2400 level,” something that XAU/USD has yet to achieve.

“The two instances that we did have of price testing over that level were met with fast pullbacks, with the second test also showing a lower-high,” he noted. “This provides some context should continuation show, and gold bulls holding the bid above the big figure would illustrate a strong response to the pullback that started a month ago.”

Above the 2400 level, Stanley pointed out the prior inflection points at the $2,417 and the $2,431 levels, after which there would be no prior barrier standing in the way of gold’s march to $2,500 per ounce.

“Given that price would be at fresh all-time highs beyond 2431, a degree of projection would be required to set shorter-term resistance levels,” he said. “[T]his could put focus on spots such as 2450 or 2475 before a test of 2500 could come into the picture.”

After forming a triple top pattern just below the $2,400 level shortly after 9 pm EDT Wednesday evening, gold prices have trended lower on Thursday. Spot gold last traded at $2,376.42, down 0.41% on the session at the time of writing.

Kitco Media

Ernest Hoffman