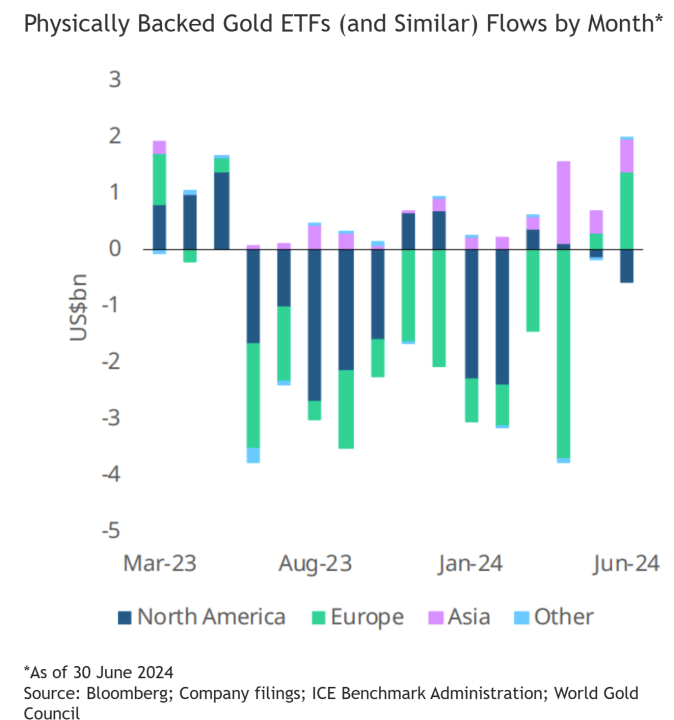

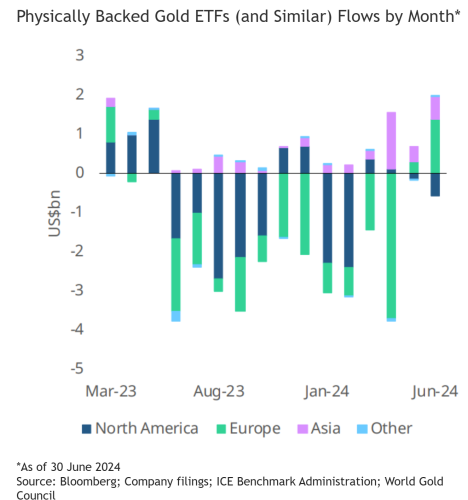

The gold market is starting to see a turn of fortunes as investment demand picked up in June, according to the latest report from the World Gold Council.

On Tuesday, analysts from the World Gold Council reported that global gold-backed exchange-traded funds saw their second consecutive month of inflows in June. According to the report, global holdings increased by 17.5 tonnes, valued at $1.4 billion last month.

“Inflows were widespread, with all regions seeing positive gains except for North America, which experienced mild losses for a second month. In general, lower yields in key regions and non-dollar currency weaknesses increased gold’s allure to local investors,” the analysts said.

However, even after two months of inflows, the market still has a deep hole to dig out of. The WGC said that year-to-date, global gold ETFs have lost $6.7 billion, their worst H1 since 2013.

European investors continued to lead the way in the gold market. Analysts note that it is not surprising that demand has picked up in the region as central banks, including the Swiss National Bank and the European Central Bank, have started easing interest rates. Even the Bank of England has struck a dovish tone, with economists looking for a rate cut in August.

“Lowering yields were a key contributor to the region’s inflows. Additionally, falling equities and political uncertainties related to elections in the UK and France, which sparked notable inflows there, also pushed up investor interest in gold,” the analysts said.

European-listed funds saw inflows of 17.9 tonnes, valued at $1.42 billion.

However, North American demand continues to drag down the market. The report said that North American ETFs saw outflows of 8.2 tonnes, valued at $573 million.

“The dollar strength and continued equity rally may have drawn investor attention away from gold despite falling Treasury yields,” the analysts said. “Nonetheless, flare-ups in geopolitical risk prompted sporadic inflows, partially offsetting larger outflows during the month.”

Although North American gold demand remains lackluster, analysts note that it can easily turn around if the Federal Reserve starts to ease interest rates. Markets see a roughly 70% chance of a rate cut in September.

Looking at other regions, Asian demand remains a solid pillar within the gold market. Asian-listed funds have seen inflows for the last 16 consecutive months. The region saw inflows of 7.2 tonnes, valued at $560 million.

“Similar to previous months, Asian inflows were mainly driven by China, which added $429 million in the month. Among factors that kept Chinese investor interest in gold elevated, we believe persistent weaknesses in stocks and the property sector, as well as continued depreciation in the RMB, were highly relevant. Japan also witnessed its 16th consecutive monthly inflow in June, primarily supported by a weakening yen,” the analysts said.

Other regions saw inflows of 0.7 tonnes, valued at $37.4 million.

Kitco Media

Neils Christensen