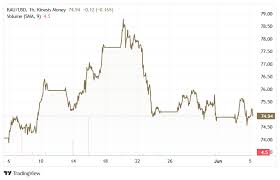

Gold heads into Friday a little stronger but also little changed from the week’s open.

It appears to have consolidated around the critical $2,312/oz level following the previous week’s decline. However, we note that some technicals have deteriorated, with the 50-day simple moving average now becoming a constraint and a head and shoulders pattern now apparent.

.jpeg)

Nevertheless, from a fundamental perspective, gold has remained relatively resilient, facing mixed US inflation data and, crucially, the Federal Reserve cutting its ‘dot plot’ projection of interest rates from an implied three-quarter-point cut to just one such cut this year. In mitigation, the Cleveland Fed inflation nowcast has moderated a little over the last week, but with the core PCE (the Federal Reserve’s preferred inflation measure) still at 2.6%, this currently gives US rate-setters little scope for comfort.

Against this backdrop, one might expect that positive (downside) surprises for gold are now priced out of US rates markets. However, both 2-year and 10-year US Treasury yields have moved some 20bp lower this week, leaving a rebounding dollar as the only rate hawkish signal. CME FedWatch suggests futures are still pricing a significant (c. 30%) probability of more than one quarter-point cut in US rates by the end of 2024, little changed from a week ago.

The market calendar for today is quite light, with only May US import prices and June Michigan Consumer Sentiment prints likely to be of some interest to gold investors.

Mike Ingram