“In the first week of December, it looked like gold was set for a bit of a reality check after the rally above $2,100 fizzled rather quickly,” said Justin Low, currency analyst at ForexLive. “That saw price dip back below $2,000 but gold bugs have definitely salvaged the situation in a push to a record high close this week.”

Looking at gold’s current climb from $1,982 on Dec. 13 to yesterday’s high above $2,088, Low said that “[t]hinner liquidity conditions may still cast some doubts over the latest move higher” but he said there are still good arguments for gold to move even higher as 2024 approaches.

“And the seasonal tailwind in January is arguably one of the strongest points there could be in advocating for an extension higher,” he said.

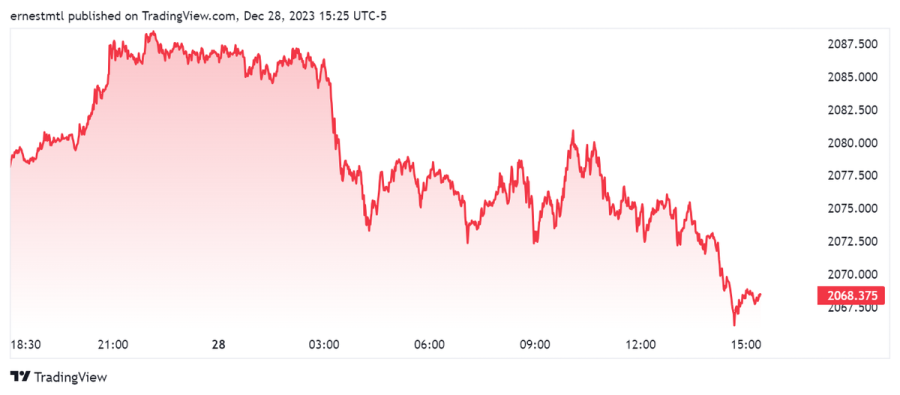

Spot gold is currently trading at $2,068.37 per ounce at the time of writing, down 0.41% on the session but up 1.8% over the last five days, and up nearly 2.7% during the month.

“The way I see it, gold is poised for one of two things now,” Low said. “It is either we go off to the races to start the new year i.e. fresh record highs, or we get a notable squeeze lower before buyers reload on long positions. It would really surprise me if we got a quiet and slow January, all things considered.”

He added that his reticence to predict which outcome is more likely “is to do with the fact that I heavily detest reading too much into year-end and thin liquidity moves such as what we're seeing this week. As such, I still do hold some reservations about the high points for gold on the week currently.”

Other analysts are looking through the liquidity concerns at the geopolitical and macroeconomic environments, both of which suggest continued strength for gold prices, with the potential for new all-time highs in January.

“The most likely scenario in the current context points towards a continued upward trajectory, with the initial target in the vicinity of $2100 per ounce,” said analyst Damian Nowiszewski at Investing.com.

“The recent strong demand shot established a new historical high in the $2150 per ounce price area, but these were quickly negated,” he wrote. “Buyers are not short of fuel, however, and all indications are that they will be able to permanently overcome the key resistance area tested several times over the past few years located near the round barrier of $2100.”

“The natural target for demand is the area around $2150 and the next round barrier of $2200,” Nowiszewski said. “Possible corrective movements should be limited by the local upward trend line and demand zones near $2000 and $1950 per ounce.”

Kitco Media

Ernest Hoffman