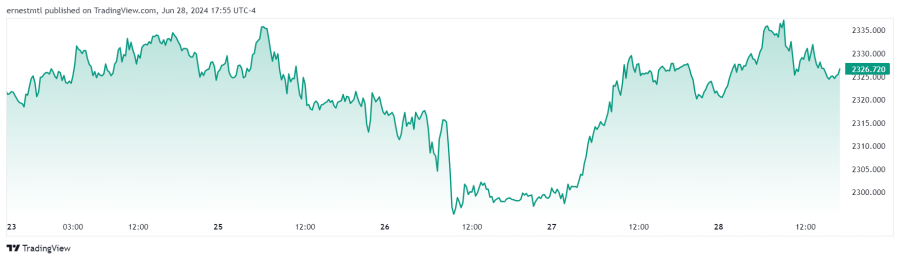

Slow and steady continued to be the name of the game in the gold market this week, as the yellow metal once again traded in a narrow channel between $2,300 and $2,340 per ounce.

After opening the week at $2321.87, spot gold spent Sunday night through early Tuesday morning flirting with the high 2,330s, but the bulls’ advances were rebuffed, and after holding in the $2,320 area for the rest of the day, the bears finally took control during the overnight session. North American markets then woke up to slap spot gold down to its weekly low of $2,295.23 by 9:30 am EDT on Wednesday morning.

The spot price then saw multiple tests of the psychologically important $2,300 level before finally breaking back to the upside during Thursday's overnight trading, when it once again tested $2,330.

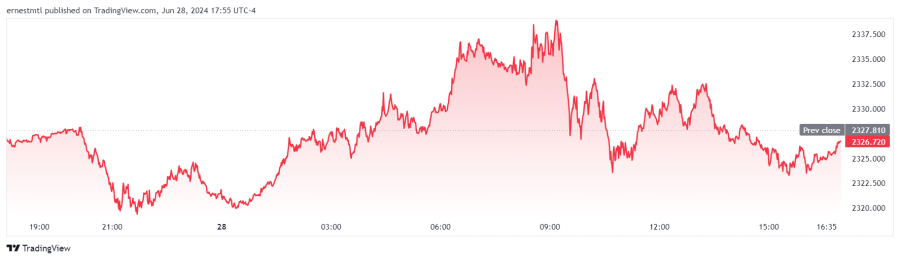

Friday morning brought a spike to the weekly high of $2,339.78 per ounce just before the U.S. market open, after which it pulled back and chopped sideways in the mid-2320s for the remainder of the North American session.

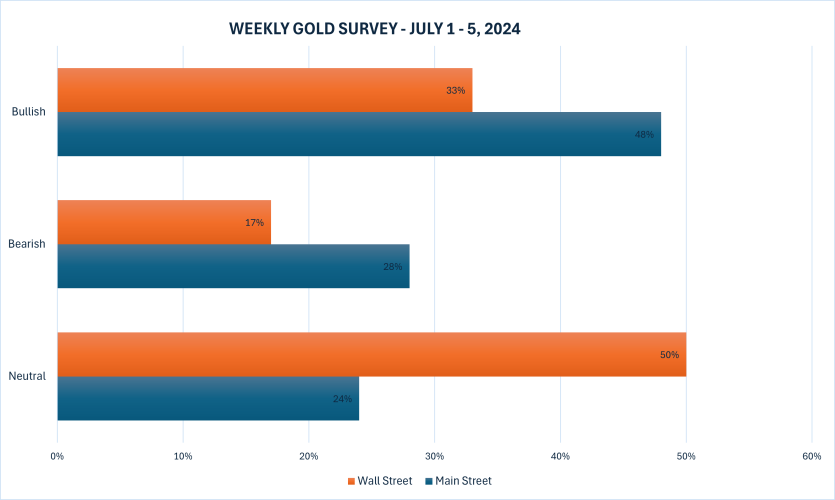

The latest Kitco News Weekly Gold Survey shows most industry experts planning to sit on the sidelines next week, while retail sentiment is divided on gold’s near-term prospects.

Alex Kuptsikevich, senior market analyst at FxPro, is bearish on the yellow metal as the price has moved below its 50-day moving average.

“Gold, and the markets along with it, may be at the intersection of weak economic data (slowing growth and weak inflation) and a less dovish Fed,” Kuptsikevich said. “This is the worst combination for risk demand and could trigger a broad sell-off, including in gold.”

Marc Chandler, Managing Director at Bannockburn Global Forex, thinks after this week’s solid performance, gold is in a position to make gains next week.

“Gold recovered from the dip below $2300 Wed-Thurs last week to recover back toward $2340 at the end of the week,” he wrote. “It recouped the previous week’s losses in full.”

Chandler said the move was sufficient to extend gold’s rally for a fifth consecutive month. “It has fallen only in one month since the end of Q3 23 (and that was in January).”

Now, he believes gold is poised to recover further in the coming days. “A move above $2350-60 lifts the tone and could signal a return toward $2400,” he said. “Two macro developments that could help gold are the results of the first round of the French election that make a hung parliament more likely and a disappointingly weak US jobs report at the end of next week.”

“Up,” said James Stanley, senior market strategist at Forex.com. “I think that it’s still bulls to lose, at this point. The monthly candles are looking more and more like they want a pullback and prior resistance at $2,075 for spot Gold seems a logical place to look for that to run towards. But, with that said, bulls have continued to defend $2,300 and until that changes, I’m going to favor with a topside bias.”

Kevin Grady, president of Phoenix Futures and Options, said the coming week will likely see thin markets, but that also means the risk of greater volatility.

“A lot of people right now are taking off, it’s started already, and they're going to be down for the week, big vacation week,” he said. “I think you're going to see a lot of people that are flat.”

“The issue with that is I think that's going to cause volatility because what's going to happen is the things that are going to be trading and moving the market are the algorithms reading the headlines,” he said. “I do think there's some volatility depending on how the numbers shape out. Having a holiday week with a lot of data coming out, it's going to be interesting. You're going to have a lot of junior traders on the desks, a lot of guys that are not the main guys. No one's going to really be taking risks. I think it's going to be a pretty quiet week.”

Grady acknowledged that in this kind of environment, geopolitical developments like an escalation in Ukraine or the Middle East can disrupt the market very quickly.

“I think that's why you're going to see a lot of people, I think, flattening out,” he said. “If you're going to be off the desk, you're going to lighten up that position. You don't want to be sitting on a beach and reading news about it and your position is blowing up. It's not the place you want to be. I think a lot of people are not going to be trading as much next week, but again, the algos are going to move that market.”

Grady said he doesn’t even expect many traders to be focused even on Friday’s nonfarm payrolls report. “And even the people that are around on Friday, when London shuts down, say 11:30 [am EDT] or so, I think the market's going to just die. Everyone's going to be getting out of there early.”

This week, 12 Wall Street analysts participated in the Kitco News Gold Survey, and the consensus for next week was that discretion is the better part of valor. Four experts, representing 33%, expect to see gold prices climb higher next week, while two analysts, or 17%, predict a price decline. The remaining six experts, exactly 50% of the total, didn’t want to trust gold’s direction during the coming week.

Meanwhile, 178 votes were cast in Kitco’s online poll, with Main Street investors as divided on gold’s near-term prospects this week as their Wall Street counterparts were last week. 86 retail traders, or 48%, look for gold prices to rise next week. Another 50, or 28%, expected the yellow metal to slide lower, while 42 respondents, representing the remaining 24%, saw prices continuing to chop sideways during the week ahead.

U.S. Independence Day will make next week an unusual one for economic data, with the important releases compressed on either side of the holiday. On Monday, markets will receive the ISM Manufacturing PMI, followed by the Tuesday release of Eurozone CPI flash estimates and JOLTS Job Openings. ECB President Christine Lagarde and Federal Reserve Chair Jerome Powell will also be speaking at a central bank conference in Portugal.

Then on Wednesday, markets will be watching for ADP Employment, Weekly Jobless Claims, and the ISM Services PMI, along with the minutes from the June FOMC meeting.

After the July 4th holiday on Thursday, U.S. traders will wake up to the June Nonfarm Payrolls Report on Friday morning.

Darin Newsom, Senior Market Analyst at Barchart.com, is still optimistic about gold prices for the coming week.

“I’ll stick with up again this week as the August issue still looks to have room to extend its short-term uptrend,” he said. “Early Friday morning saw August take out its previous 4-day high of $2,349.70, with the next short-term upside target at $2,370.40. We need to keep in mind the contract’s intermediate-term trend remains down, with what looks to be a triple bottom made up of $2,304.20 (week of June 3), $2,304.50 (week of June 10), and $2,304.70 (this week).”

“The old adage, or maybe just because I’m old and remember it, is ‘Triples are taken out,’ Newsom warned.

Everett Millman, Chief Market Analyst at Gainesville Coins, said he expects gold to remain trapped in its recent holding pattern until something rocks the broader market.

“A lot of people right now are looking at gold as an inverse to risk assets in the stock market, even though that is not a perfect direct one-to-one line,” he said. “I think right now that's the biggest driver, especially when people conflate the performance of the stock market, and particularly what we're seeing now, just the very top of it, very bad breadth in the start stock market right now, as far as gainers to decliners. It's not a perfect foundation right now, but we still remain pretty close to all-time highs and until we get a really big breakdown in stocks, which I think is inevitable at some point, I think gold is going to hang out.”

Millman said gold would be It would be much lower if there weren't underlying concerns about the broader markets are shaky, “but so long as those magnificent seven hold up, we can point to the headline, we can point to the indices and say ‘oh, U.S. stocks are still in a bull market. Increasingly, I think that's one of the main things that has kept gold in place is that we haven't seen a big decline or correction in the stock market, at least not a sustained one.”

“But at the same time, it's not all roses out there, right?” he added. “I think even people who are still bulls who see stocks moving higher throughout the rest of the year, at least until the election, a lot of them will at least acknowledge that beneath the surface or beneath the hood, there are some challenges and concerns for equity markets right now.”

“Given those two factors, I think it makes sense that gold is ebbing back and forth,” Millman said. It doesn't want to completely sell off because it's not as if we're seeing fresh all-time highs [in equities] day after day, but we're not far from them. Until the stock market moves really wildly one way or the other, I would not at all be surprised if gold just continues to consolidate and hang out in the range it's been stuck in.”

Millman also sees next week’s odd shape, with most significant data coming out on Wednesday, followed by the July 4th holiday, then markets reopening for the release of the employment report early Friday morning, as a risky scenario for traders and investors.

“It's definitely worth taking note of,” he said. “Given that trading volumes might be lower, it wouldn't take as much to push gold. But of course, that would very likely be a temporary move, something that we could see evaporate or correct back in the other direction quickly, given that it's not based on as much of the economic fundamentals.”

Millman said that in the medium term, the market will continue to digest the implications of contradictory inflation data from around the world.

“We got this fairly inline PCE report, and the, CPI numbers in Canada and maybe the UK where inflation is actually rising and moving the wrong direction when they're already moving to start cutting rates,” he said. “I think that dynamic, that differential between improving U. S. inflation and perhaps worsening inflation or backsliding inflation in the rest of the Western world, that divergence is something that's going to have to be considered. I don't think that's baked in completely yet. I think they're still waiting to see if maybe there's just a lag where the US data catches up.”

“That's what I think is being digested right now,” he said. “We're just going to need more data. We're going to have to be like the Fed and be data-dependent.”

Phillip Streible, Head of Market Strategy at Blue Line Futures, is bullish on gold, but he said that now is not the time to enter. “If you don't have a position, don't chase the market at these levels,” Streible said.

And Christopher Vecchio, head of futures strategies and forex at Tastylive.com, is neutral on gold for the coming week. “If you are long gold, there is no reason to sell as prices remain above $2,200 per ounce,” he said.

Spot gold last traded at $2326.72 at the time of writing for a loss of 0.05% on the day, but a gain of 0.21% on the week.

Kitco Media

Ernest Hoffman