The reasons health insurance is expensive include rising prescription drug costs, hospital consolidations, increased hospital labor costs, overall inflation, and a lack of transparency in healthcare pricing.

Why Is Health Insurance Expensive?

7 Things You Can Do to Lower Costs

The reasons health insurance is expensive include rising prescription drug costs, hospital consolidations, increased hospital labor costs, overall inflation, and a lack of transparency in healthcare pricing.

Employers can lower medical expenses by negotiating lower rates and incentivizing preventive care, telemedicine services, and generic prescriptions.

Incorporating health literacy and wellness programs into your benefits plan can help you meet your company’s needs and stay within budget.

Switching to a self-funded group captive plan lets you design your own health insurance plan and save money.

Skyrocketing employee health insurance premiums make it challenging for companies and their employees to afford healthcare. What can we do about it? Understanding why health insurance is expensive is a great place to start. Having the right information can help you make better decisions when designing a plan that meets your company’s needs and budget.

Who Has the Most Expensive Healthcare in the World?

With costs in 2021 estimated to be $12,318 per person, the U.S. has the most expensive healthcare in the world by far, according to the World Economic Forum. Germany comes in a distant second at $7,383 – 40% lower. Costs for France,

Canada, the United Kingdom, Australia, and Japan average about $5,000 per person.

Sadly, we’re not getting much for our money. Despite our enormous healthcare spend, the U.S. lags behind most developed nations when it comes to life expectancy. It ranks in the bottom half of countries in the Organization for

Economic Cooperation and Development (OECD), a collection of high income nations, according to the Council on

Foreign Relations.

Why Are You Seeing Annual Health Insurance Premium Increases?

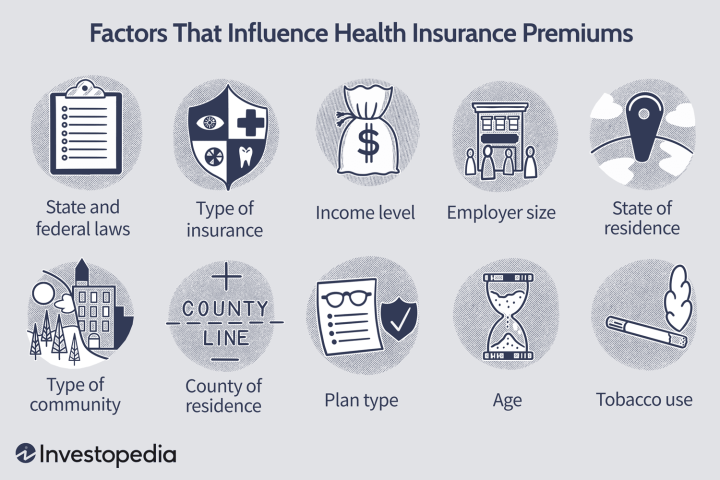

Health insurance premiums are a top concern for over one-third of insured Americans, with 44% worrying about paying the deductibles before insurance coverage kicks in for their medical care. Many factors contribute to increased health insurance premiums, including high prescription drug costs, hospital system consolidations, and a lack of transparency in claims data from traditional insurers.

Increase in Prescription Costs

A 2022 study revealed that the launch prices for new drugs increased by 20% each year from 2008 to 2021. Inflation trends increased prescription costs in 2022. The Department of Health and Human Services reported 1,216 drugs had an inflation rate of over 8.5%, with an average increase of 31.6%. Some drugs even increased by over $20,000 — 500% — in 2022.

Traditional insurance companies often restrict patient access, increase premiums, or impose unaffordable out-of-pocket costs due to the increase in brand-name drug prices. Many people struggle to afford necessary healthcare and prescriptions due to high costs. One in four adults report having to skip doses of medicine, cut pills in half, or not fill prescriptions in the past year because of the expense.

Under a self-insured plan, you can implement pharmacy rebates that significantly lower prescription costs and encourage employees to take the medications they need.

Consolidation of Hospital Systems

Consolidation among hospitals and hospital systems is one of the major drivers of why health insurance is expensive.

When out-of-market hospital systems acquire hospitals, prices can rise by 17% compared to independent hospitals.

Merging hospitals across markets increases their bargaining power with insurers.

For example, hospital systems may require insurers to include all hospitals in their networks, even when lower-cost alternatives are nearby, resulting in increased expenses for people seeking care.

Providing a simple way for your members to navigate the healthcare system in your provider network can help ensure you are getting the highest quality care and not overpaying for services.

Hospital labor costs have also skyrocketed, which is another reason why health insurance is so expensive. Total contract labor expenses jumped 257.9% from 2019 to 2022, according to Healthcare Finance News.

Lack of Transparency in Data and Cost

Finding consistent and transparent pricing information from hospitals or insurance companies is challenging for most consumers. According to the Centers for Medicare and Medicaid Services (CMS), insurers often raise rates without explaining their reasons to regulators or the public.

Most consumers are unaware of proposed premium increases and the reasons for raising rates. As a result, insurance companies can operate with little scrutiny from consumer markets.

One advantage to self-funded insurance is data transparency. You can track every cent of your benefits spend, which means you can institute cost containment costs to lower costs and save money on health insurance. Roundstone’s specialized team works one-on-one with you to optimize savings and improve care quality for your employees.