In today’s competitive labor market, providing competitive health care for small business while managing costs is critical for attracting and retaining top notch talent.

Why are innovative solutions for employee health care paramount?

Health insurance ranks as one of the most significant expenses for small businesses, second only to wages and salaries.

According to the Kaiser Family Foundation, the average annual cost of group health insurance premiums per employee stood at $8,435 for single coverage and a hefty $23,968 for family plans in 2022.

This is not sustainable.

But to attract and retain quality employees, you’ve got to offer some form of health benefits. Otherwise, your good employees will quickly leave for another employer who can give them a better deal.

And you’ll be left to try to higher and retrain other employees. If you can attract any at all.

So what is a small business owner to do?

The good news is: You’ve got options.

In addition to costly traditional health insurance solutions, there are several innovative, outside-the-box solutions that are undergoing increasing popularity that help make offering a solid health benefit or set of benefits much more affordable for smaller employers.

These strategies can not only make healthcare protection for your workers more affordable but also potentially cut your current health benefits costs in half.

Employees and their families have many different kinds of healthcare needs.

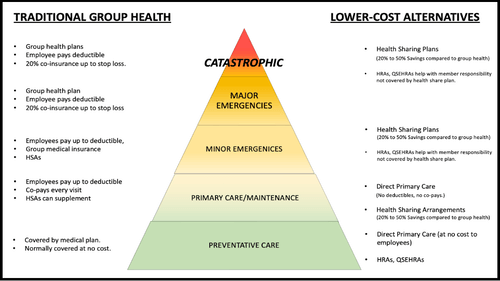

They run the gamut from from small, frequent, routine, predictable, and relatively inexpensive services on one end of the spectrum to severe and catastrophic illnesses and injuries requiring extensive surgery, lengthy hospital stays, trauma care services, and expensive medical equipment that would bankrupt most families many times over.

A good employee health benefit will address each level of the Employee Health Care Pyramid, from the frequent and inexpensive to the infrequent and catastrophically expensive, and leave no gaps.

Traditional group insurance is good at covering major emergencies and catastrophic medical events.

But it is an abject failure when it comes to helping patients with the lower tiers.

That’s because insurance is a risk transfer vehicle. It’s designed to cover infrequent, high-cost events that occur with little predictability. These are called “insurable risks.” The idea is that by paying a premium, the customer transfers risks that they cannot afford to bear as individuals to the insurance company and capital markets, which can.

Frequent and routine costs, such as basic primary care costs, on the other hand, don’t lend themselves to risk transfer. These aren’t risks. These are near certainties.

And so there’s not much risk to transfer. Without risk transference, an insurance company can add little value except to add costs.

Meanwhile, ill-advised regulation and bad legislation have added a mountain of poorly-thought-out additional mandates and costs to traditional insurance companies – driving up premiums but without adding value for most people.

So traditional group health insurance is no longer a cost-effective solution for many small businesses. You should look for alternatives that still deliver solid protection for employees against high unexpected medical costs, but at a lower price.

A comprehensive solution will need to involve multiple approaches, strategies, products, and solutions.

As you can see from this illustration, traditional medical insurance solutions at each level of the Pyramid are listed on the left side of this graphic, while some cost-saving alternatives are on the right.

A comprehensive employee health benefits package should cover every tier of the Employee Healthcare Pyramid, from preventive care to primary care access and catastrophic incidents.

Non-insurance Alternatives like health sharing can significantly help your bottom line while providing quality care for your team.

The Affordable Care Act requires employers with 50 or more full-time equivalents to provide health insurance for workers, or pay a significant penalty.

However, if you have fewer than 50 FTEs on the payroll, you are exempt from that requirement. You do not have to offer a traditional health insurance plan at all.

That opens a number of more affordable, cost-effective solutions that are possible for small employers that aren’t available to large employers unless they’re willing to eat the ACA penalty.

Health sharing plans are quickly becoming a popular, cost-effective non-insurance alternative to overpriced employer group health insurance plans.

These plans typically cost up to 50% less than traditional health insurance.

They also usually offer much more freedom to members to choose their own healthcare providers.

Unlike traditional health insurance plans, however, health sharing plans impose waiting periods for pre-existing conditions. So health sharing plans may not be a suitable solution for everyone.

Consider combining HSPs with HRAs for a more comprehensive approach to employee health benefits.