Silver Price News: Silver Awaits Growth Cues

Silver ended last week on a decidedly wobbly note, closing below $29/toz and locking in a marginal decline in a volatile August. We suggested in our recent monthly Silver Price Forecast that the upcoming Fed rate cut would herald a wave of global rate cutting that would ultimately benefit silver through higher industrial demand. In the meantime, however, recent Citi Economic Surprise indices suggests that economic data is disappointing by the highest margin in two years. Thus, the current investment case for silver remains conflicted, and silver has started the week trading around $28.5/toz.

The most recent CFTC Commitments of Traders (CoT) report published late on Friday indicates that silver speculators edged up their net long futures positions over the previous week. Although these positions are still c.15% below the 53-month high, they remain consistent with the relatively elevated silver net longs seen since late March, on 19 July and current levels constitute the lowest net long since late March. Conversely, physical silver ETFs/ETCs appear to have suffered net outflows in recent days. Read More

Gold Price News: Gold Consolidates Amid Speculative High

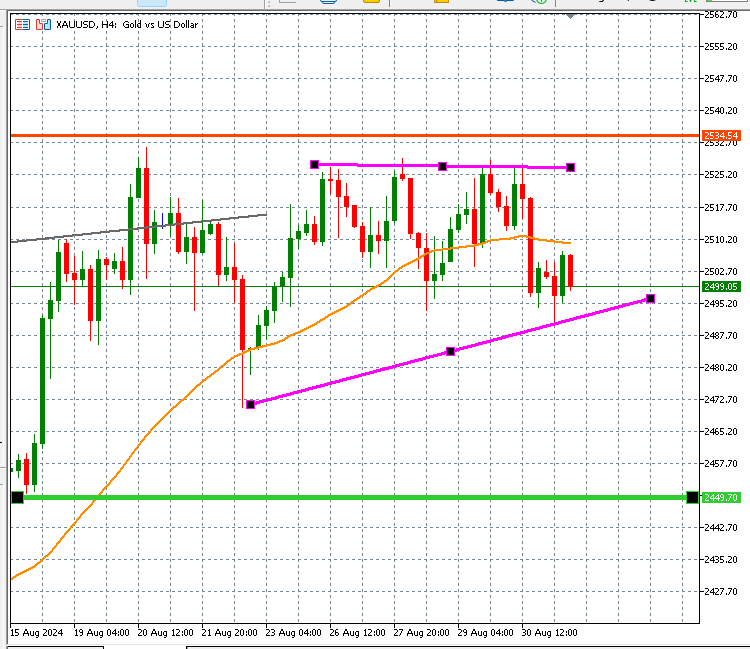

Gold begins the week still consolidating, albeit with weakening momentum. With earnings season now largely completed and a Fed rate cut on 18 September all-but guaranteed, investors appear content to remain long despite some recent firming of both short rates and the US dollar. High levels of geopolitical risk and portfolio diversification remain as additional supports. Gold starts the week trading around $2498/toz.

The most recent CFTC Commitments of Traders (CoT) report published late on Friday indicates that speculators further increased net long gold futures positions over the previous week to a 52-month high despite elevated prices. Physical gold ETFs/ETCs have also resumed net inflows, with inflows to North American and European-domiciled funds only slightly mitigated by outflows from Asian-based funds. A recent report from the World Gold Council suggesting that Swiss pension fund demand for gold is likely to increase completes a bullish investment demand picture.

From a technical perspective, gold’s recent consolidation has established some new markers. There now appears to be a line of horizontal support/resistance at $2513/toz which gold has been negotiating over the last week, without clear resolution. Read More

Gold’s rally to $2,500 was just the next stop in this supercycle – Wells Fargo’s John LaForge

As gold prices consolidate near record highs above $2,500 an ounce, one market analyst is warning investors not to try to pin down this market.

In a recent interview with Kitco News, John LaForge, Head of Real Asset Strategy at Wells Fargo, said that gold’s latest breakout move came just after he upgraded his year-end price target to $2,500 an ounce. In this latest push, gold prices have rallied 23% so far this year and have set new all-time highs more than 20 times.

LaForge noted that trying to predict where this rally will end is futile at best. He added that this rally is just the market catching up to the rest of the sector that rallied at the start of the supercycle.

“In the first few years of the gold market, in 2020 and 2021, gold’s performance was disappointing compared to other commodities. Most commodities doubled,” he said. “Gold has finally reacted, and this rally is a big deal for me because it confirms that we are in a supercycle.” Read More

China’s gold purchases will drive prices higher over the next decade – Capital Economics

Gold has had a strong 2024 thus far, climbing roughly 20% since the start of the year, with analysts highlighting China as the primary driving force behind the gains as the People’s Bank of China (PBoC) purchased large quantities of the precious metal for 18 months straight.

While the PBoC has refrained from additional purchases recently, analysts at Capital Economics said the pause in gold accumulation is only temporary as “China’s gold rush has much further to run” amid a backdrop of rising global tensions, economic uncertainty, and ongoing efforts to move away from the U.S. dollar.

“Against the backdrop of central bank buying, strong physical gold demand, and a surge in ETF holdings, China appears to have been a key driver of the rally in gold prices earlier this year,” they said. “Looking ahead, we think that China’s appetite for gold will grow as its economy slows down this decade. This will put upward pressure on gold prices and could be a greater source of volatility in gold markets over the coming years.” Read More

Gold prices may drop following the first Fed rate cut, but will rally over 6-12 months – Analysis

Gold tends to underperform during crises in the near term but rallies long-term following rate cuts, according to a historical analysis by strategist Kerry Sun.

“Gold prices are reaching new heights, hovering around record levels of US$2,516 per ounce,” Sun wrote in Market Index. “This surge comes amid growing expectations that the Federal Reserve will cut interest rates by 25 or 50 basis points in September.”

Sun then examines the performance of gold prices following the start of the Fed’s easing cycles over the past 30 years. “Since 1995, the Fed has undergone eight cutting cycles,” he said. Read More

Silver price could fall to $28.60 before making another run at $30 – Analysts

Silver has long held the promise of significant upside potential amid increasing demand from industrial uses, but as every silver bug knows, resistance at $30 has been a tough nut to crack and continues to stand in the way of all bullish attempts to break out higher.

Despite the potential for the first interest rate cut in four years coming in less than a month, David Scutt, market analyst at City Index, warned that betting the farm on silver’s rise is still not recommended as its chart suggests continued struggles.

“Silver’s been on a nice run recently, benefitting from an easing of concerns towards the trajectory for global US economy,” Scutt wrote. “That’s because unlike gold which has been heavily influenced by movements in the US dollar and bond yields, silver has been extremely correlated with copper futures over the past month, another industrial metal closely tied to economic activity.”

“While concerns have eased recently, we’re about to receive a whole bunch of economic data that could easily see them flare again next week,” he noted. “Perhaps unsurprisingly, silver has struggled to extend the bullish reversal sparked by Jerome Powell’s speech last Friday, wobbling ahead of downtrend resistance dating back to the highs struck this year.” Read More

A correction won’t shift momentum in gold and silver

Gold and silver have faced consistent selling pressure ahead of the Labor Day long weekend. While prices may have room to move lower, it’s important to remember that the market still has significant momentum.

Last week, as gold reached all-time highs above $2,500 an ounce, we noted that momentum indicators didn’t suggest an overheating market.

We also observed that despite gold’s all-time highs, there is very little of the froth and euphoria that traditionally marks a market top in gold. However, another interesting dynamic is unfolding in the marketplace.

Analysts point out that while gold is not at overbought levels, the U.S. dollar is oversold and poised for a potential bounce. This week, the U.S. dollar index, which measures the greenback against a basket of currencies, dropped to its lowest level since mid-July 2023, testing support at 100.50.

In the last two months, the U.S. dollar index has dropped roughly 5% as markets began to expect the Federal Reserve to cut rates in September. Ahead of the meeting, markets have fully priced in a 25-basis-point cut and see a 30% chance of a 50-basis-point move. Read More

Impact of Fed rate cuts: U.S. economy desensitized but expect major capital exit out of U.S. into these markets – Lyn Alden

A rate cut at the Federal Reserve's September meeting is practically baked in, but investors need to watch out for the impact on U.S. markets, warned Lyn Alden, founder of Lyn Alden Investment Strategy, who sees a scenario for a potential major capital exodus from the U.S. and into other markets.

Alden told Michelle Makori, lead anchor and editor-in-chief at Kitco News, that the Fed's rate cuts will, on the one hand, have a limited impact on the U.S. economy since the Fed won’t be returning back to a zero percent interest-rate environment. On the other hand, the markets may see a rotation out of the U.S. and dollar-denominated assets into other markets. Watch the podcast

Gold in wait-and-see mode as employment data will define Fed Monetary policy next week

While gold still holds significant bullish potential, some caution is creeping into the marketplace as investors await signs of the U.S. labor market's health and how it could impact the Federal Reserve’s monetary policy next month.

Analysts have noted that, given recent price movements, investors are taking a wait-and-see approach as next week’s employment data is expected to create some volatility during the shortened trading week. North American markets will be closed Monday for the Labor Day long weekend.

Heading into the weekend, gold prices are trading at an important initial support level as they consolidate near record highs. December gold futures last traded at $2,538.30 per ounce, down 0.3% from last week.

The selling pressure is also impacting silver, which has been unable to maintain critical support above $30 per ounce. December silver futures last traded at $29.335 per ounce, down 3% from last week. Read More

Consumers continue to cash in on higher gold prices - House of Kahn Estate Jewelers

While the U.S. economy continues to exceed economists’ expectations, consumers on Main Street face ongoing struggles.

In further anecdotal evidence of difficult economic conditions, Tobina Kahn, President of the House of Kahn Estate Jewelers, said that with gold trading at record highs above $2,500 an ounce, she continues to see a steady stream of people coming in to sell their broken and unwanted jewelry.

“Inflation may be down, but prices are still going up, and that means people continue to need money because their paychecks aren’t going very far,” she said in an interview with Kitco News.

Kahn’s comments come as the U.S. economy exceeded expectations, growing 3.0% in the second quarter. At the same time, the core Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s preferred inflation gauge, showed a muted annual rise of 2.5% on Friday.

“Inflation is coming down, but the cost of living keeps increasing,” said Kahn. Read More

Gold Price Today: Gold Traders On The Edge As Key Economic Data Will Determine The Next Trend

Image Source: Kitco News

Gold traders are taking it easy on the first trading day of the week because there are a number of important economic events that will impact the precious metal price. The dollar index has shown strength in light of recent data, but gold traders are still very optimistic that gold prices will continue to move higher given that the precious metal has remained above important price points in the past week.

The price of the precious metal has been trading above the 2,500 level, which many traders consider highly important for a variety of reasons. First of all, it is an important psychological price point because it shows the strength of the overall price trend. Secondly, gold traders believe that as long as the price continues to trade above these important price points, the odds are that it will continue its bull run for the rest of the year. However, many speculators believe that gold bulls must face reality, and the ugly truth for them is that most of the optimism about the gold price moving higher on the back of the potential Fed interest rate cut is based on the price, so when the event happens, we may actually make a move to the downside. Read More

Ignore U.S. dollar volatility and focus on gold in euro terms as prices test April highs - MKS’ Nicky Shiels

Gold continues to consolidate around its recent record highs above $2,500 an ounce, but its bullish momentum is at risk as the U.S. dollar appears oversold. However, one market analyst suggests that investors should pay attention to another gold/currency cross to determine the precious metal’s true trend.

In her latest note, Nicky Shiels, Head of Research and Metals Strategy at MKS PAMP, said she is paying more attention to gold against the euro as it trades near record highs. She noted that XAUEUR is a good proxy for “gold-only” demand, as it removes the broader U.S. dollar volatility.

While the U.S. gold futures market is closed Monday for the Labor Day long weekend, spot gold against global currencies continues to trade. Gold is trading in neutral territory against the euro, at €2,259.60 an ounce, roughly unchanged on the day.

Shiels warned that gold is trading at a critical resistance level against the euro, which could set the stage for a broader trend. Read More

Live From The Vault - Episode: 188

Manipulated markets controlling conservatives Feat. Bill Holter

In this week’s episode of Live from the Vault, Andrew Maguire and former stockbroker, branch manager and GATA contributor Bill Holter dive into the upcoming BRICS gold-backed currency: The Unit.

The precious metals experts share views on the current geopolitical climate and the rising threat of war, discussing how gold and silver markets have been manipulated to control the behaviours of certain groups.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.

Featured Image - Source: Unsplash