Silver Price News: Silver Ends Week on Back Foot

Silver prices fell further on Friday, ending the week on a bearish note, and adding to sharp losses seen on Thursday.

Prices fell as low as $32.52 an ounce by early Friday evening, down from an intraday high of $33.16 an ounce. That compares with around $32.69 an ounce in late trades on Thursday.

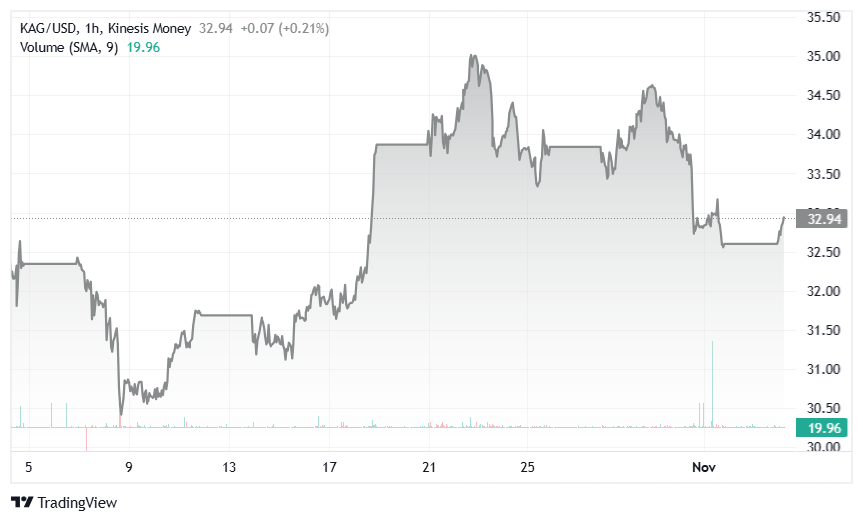

Silver KAG/USD 1-hourly Kinesis Exchange

Gold leads silver lower as markets mull economic data

Silver’s downward move at the end of the week largely tracked the gold price lower, with the yellow metal falling sharply on Thursday from a new all-time high of $2,792 an ounce on Wednesday. The precious metals markets were left mulling a mixed set of US economic data released Friday which showed an unusually low number of non-farm jobs added in October, while unemployment figures for the same month came out in line with market expectations.

Silver’s losses at the end of last week have raised interest in whether this could be the beginning of a downward trend for the grey metal or simply a pause for breath before resuming its recent bullish trajectory. Read More

Gold Price News: Gold Gives Up Gains to End Lower on Friday

Gold prices ended up slightly lower on Friday, reversing course after a bullish start, as the markets digested a mixed set of US economic data and looked ahead to Tuesday’s US Presidential election.

Prices rose as high as $2,764 an ounce on Friday, compared with around $2,747 an ounce in late trades on Thursday. However, the gains couldn’t hold, and prices fell back to as low as $2,735 an ounce by Friday evening.

Gold KAU/USD 1-hourly Kinesis Exchange

Non-farm payrolls come in below expectations:

US non-farm payrolls figures came out on Friday showing a paltry 12,000 jobs were added in October, far below market expectations of 113,000. While the figures may have initially helped the case for more aggressive interest rate cuts by the US Fed – a positive factor for gold prices – the market appeared to shrug off the latest figures, which were seemingly skewed by the effects of Hurricane Milton, which hit Florida in early October.

Beyond that, US unemployment figures for October were released on Friday, which were in line with market expectations at 4.1%. US ISM manufacturing PMI figures also came out for October, which showed a surprise fall to 46.5, compared with expectations of 47.6. Taken together, the latest data appeared to give gold little reason to push higher.

Goldman Sachs sees gold hitting $3,000 an ounce:

In other news, US bank Goldman Sachs forecasts that gold prices will reach $3,000 an ounce by the end of 2025, according to a report it published on October 29.

The bank said the traditional relationship between gold and interest rates is still a major driver for gold prices, but that large central bank purchases of gold bars have ‘reset the relationship’ between rates and gold. In addition, this renewed interest in gold among central banks has been linked to the freezing of Russian assets following the country’s invasion of Ukraine in 2022, it said. Read More

Gold's surge sees setback ahead of U.S. election and Fed meeting

Not only has gold faced solid selling pressure after reaching an intraday high of $2,800 an ounce, but its weekly winning streak has also come to an end.

Gold's performance heading into the weekend raises the risk that the precious metal could see further correction as Americans head to the polls next week.

Many analysts have noted that political uncertainty, driven by the statistical tie between former President Donald Trump and Vice President Kamala Harris, has been a major factor behind gold’s recent momentum. However, some analysts suggest that a classic “buy the rumor, sell the news” pattern may be forming in the marketplace.

Simultaneously, as fundamental support wanes, gold is beginning to see a shift in its technical outlook, with some analysts viewing the yellow metal as overbought.

“There is no doubt that gold prices have gone too far and too quickly, and investors must exercise caution,” said Naeem Aslam, Chief Investment Officer at Zaye Capital Markets.

Phillip Streible, Chief Market Strategist at Blue Line Futures, said he expects to see market volatility ease after Tuesday’s election, which could impact gold’s appeal as a safe-haven asset. Read More

Gold stays steady despite U.S. election uncertainty and Fed policy expectations

Gold prices remained stable on Monday as investors watched key events in the United States, including the presidential election and the Federal Reserve's choice on interest rates. Spot gold went up 0.1% to $2,739.25 per ounce close to last Thursday's record high of $2,790.15, while U.S. gold futures showed a similar small increase, hitting $2,752.20. The valuable metal has seen a big jump this year, going up 33% as it keeps acting as a safe place to invest during times when the economy and politics are uncertain.

U.S. Election: A Key Factor for Gold Prices:

Tuesday's U.S. presidential election has a major impact on gold this week. Polls show a tight race between Democratic nominee Kamala Harris and Republican incumbent Donald Trump. This keeps investors nervous. They know the result will affect global markets gold.

Gold often does well when politics get shaky. If the election is close or disputed, markets might get jumpy, and investors could turn to gold to play it safe. If Trump wins, gold might hit $2,900 an ounce. This could happen because he might spend more and cause prices to rise, which helps gold. On the flip side, if Harris wins, gold might drop a bit at first. Markets might think things will be more stable, so fewer investors might want gold as a safety net right away.

Federal Reserve's Impact: A Rate Cut Is Almost Certain: Read More

Bitcoin and gold edge higher as U.S. election looms, volatility expected

Financial markets started the week subdued as traders limited their activity ahead of tomorrow's election in the U.S. The outcome is still too close to call and is expected to lead to volatility, especially if it takes an extended period of time to announce a winner.

Stocks declined at the market open but have since climbed back to even, while Bitcoin (BTC) and gold enjoyed slight gains after rallies during overnight trading provided a boost.

“The crypto market lost 1.7% of its cap in 24 hours to $2.24 trillion,” noted Alex Kuptsikevich, chief market analyst at FxPro. “The market is correcting as Trump's chances of winning national polls diminish ahead of the election. For now, it looks like a de-risking ahead of an important event where both major candidates have roughly equal chances of winning.”

“The price of Bitcoin has fallen back below $68.5K and was bottomed out at levels $1K lower on Sunday,” he added. “The pullback has not yet broken the overall bullish pattern that has been forming since September. We will be able to talk about the bears' clear superiority when the price breaks below $65K, which would be a failure below the local lows from the end of last month and the 50-day moving average.” Read More

Spot gold to hit $2,900/oz by year-end, above $3,100 in Q1 2025 – IG Markets’ Rudolph

Spot gold will rise as high as $2,900 per ounce by the end of this year and will trade between $3,000 and $3,113 in Q1 2025, according to Axel Rudolph, market analyst at IG Markets.

In an analysis published Nov. 1, Rudolph noted that gold has been in a strong bull market for the past two years, and last week’s record price of $2,790.00 per ounce was just short of the key $2,800 level.

“Even if a significant retracement lower were to be seen, the gold price will remain in a long-term uptrend as long as the 2024 uptrend line at $2,550.00 underpins,” he wrote. “Any such potential retracement lower would thus represent a buying opportunity, provided that no fall through the $2,278.00 late April low were to occur.”

Image Source: Kitco News

“Support on the weekly chart can be spotted around the September peak at $2,685.00 and also at the early October $2,605.00 low,” he added.

Rudolph said that beyond the psychological $2,800 - $2,900 per ounce level, which the spot price is expected to reach by the end of 2024, he sees the $3,000 level coming into focus in the early months of next year. “This level coincides with the 261.8% Fibonacci extension of the September 2022-to-May 2023 advance, projected higher from the October 2023 low, at $2,999.46,” he said. “It is not expected to be reached before the first quarter (Q1) of 2025, though.” Read More

Gold markets brace for post-election volatility

As Americans head to the polls for the presidential election, the gold market stands at a critical juncture, with investors closely monitoring potential price movements in this key safe-haven asset. With opinion polls showing an almost equal divide between candidates and stark policy differences, the outcome could significantly impact precious metals markets.

The election's implications for gold prices are multifaceted, driven by several key factors. Perhaps most concerning is the possibility of a contested result, which could trigger market uncertainty and political instability. Christopher Louney, commodities strategist at RBC Capital Markets, highlights this risk: "In the event of a contested election outcome and a more drawn-out process, there is an upside risk for gold prices versus our forecast, especially in the short term." He likens this scenario to gold's historical performance during crisis periods, noting the metal's tendency to rally during times of uncertainty.

Image Source: Kitco News

Recent market activity reflects pre-election caution, with gold prices experiencing significant volatility. After last week's notable decline, the December futures contract has shown signs of stabilization, trading at $2,747.40 with a modest gain of $1.70. This price action suggests traders are positioning themselves defensively ahead of potential election-related market turbulence.

The election's impact on gold prices isn't occurring in isolation but rather against a backdrop of crucial monetary policy decisions. The Federal Reserve's upcoming meeting this week adds another layer of complexity to the market outlook. Analysts widely expect the Fed to implement a 25-basis point rate cut, following its previous 50-basis point reduction. This anticipated monetary policy shift could provide additional support for gold prices, as lower interest rates typically enhance the appeal of non-yielding assets like precious metals. Read More

Is the gold rally done? 2025 and 2026 could be silver’s time to shine - World Bank

Gold has been the shining star in the commodity space, as prices have rallied roughly 33% so far this year, trading near recent record highs of $2,800 an ounce. However, analysts at the World Bank suggest that silver is the precious metal to watch in 2025.

The World Bank recently released its updated commodity market forecast. While gold is expected to continue outperforming the broader sector, the latest projections show analysts anticipate weaker demand next year through 2026.

“Demand from central banks and jewelry production, which together account for about two-thirds of global gold demand, is likely to ease over the forecast horizon due to record-high prices,” the analysts said in the report. “Gold prices are expected to increase by 21 percent in 2024 (y/y) and remain around 80 percent higher than their 2015-2019 average throughout the forecast period, edging down by just 1 percent in 2025 and 3 percent in 2026.”

However, the World Bank sees greater potential for silver, as it expects growing demand and constrained supply to support prices. Read More

U.S. election sparks market jitters, Bitcoin and gold traders prepare for volatility

Financial markets were relatively flat on the eve of the U.S. presidential election as traders braced for a predicted wave of volatility, with polls showing the election remains too close to call. And if that isn’t enough, Thursday’s interest rate decision from the Federal Reserve also has investors cautious about their exposure to the markets.

“Market volatility has surged across both cryptocurrency and traditional sectors,” noted analysts at Secure Digital Markets. “The Deribit Bitcoin volatility index has reached heights not seen since late July, as traders anticipate increased fluctuations post-election. Similarly, the MOVE index, which tracks the implied volatility of U.S. Treasury notes, escalated to its peak since October 2023 last Friday.”

“Additionally, the financial markets are on alert for the Federal Reserve's upcoming interest rate decision,” they added. “Market consensus currently shows a 96% expectation of a rate reduction at this week's Fed meeting. The key consideration for traders will be whether the Fed opts for a cut of 25 basis points or 50 in December, heavily influenced by forthcoming economic indicators. Investors will be keenly awaiting remarks from Fed Chair Jerome Powell for further guidance on the central bank's prospective monetary policies.” Read More

Gold, silver tread water as of big-event week unfolds

Gold and silver prices have traded both sides of unchanged so far today, in subdued U.S. trading Monday. It’s arguably the biggest markets-events week of the year, which has many traders and investors on the sidelines. December gold was last down $3.40 at $2,745.80 and December silver was up $0.071 at $32.61.

Most of the marketplace is quieter early this week as it appears many traders and investors are holding off on placing bigger trades until after the U.S. presidential election Tuesday. However, many believe the election’s final result may not be known soon after polls close due to a very close presidential race. An Iowa poll released over the weekend showed a surprising lead by Kamala Harris. That poll threw a curve ball at the “Trump trades” that had been recently placed in belief that Donald Trump would win the election.

Also on tap this week is the FOMC meeting of the Federal Reserve. The meeting starts Tuesday morning and ends Wednesday afternoon with the FOMC statement and press conference from Fed Chair Powell. Most believe the Fed will cut its main interest rate by 0.25%, especially after a weaker U.S. employment report released last Friday.

Technically, December gold bulls have the strong overall near-term technical advantage. Bulls’ next upside price objective is to produce a close above solid resistance at $2,900.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,675.00. First resistance is seen at today’s high of $2,757.50 and then at last Friday’s high of $2,772.40. First support is seen at the overnight low of $2,739.40 and then at $2,722.10. Wyckoff's Market Rating: 9.0.

Image Source: Kitco News

December silver futures bulls have the overall near-term technical advantage but have faded a bit. A three-month-old uptrend on the daily bar chart is now in some jeopardy. Silver bulls' next upside price objective is closing prices above solid technical resistance at the October high of $35.07. The next downside price objective for the bears is closing prices below solid support at $31.00. First resistance is seen at today’s high of $33.00 and then at $33.25. Next support is seen at the overnight low of $32.415 and then at $32.00. Wyckoff's Market Rating: 7.0. Read More

Image Source: Kitco News

Live From The Vault - Episode: 197. BRICS Loads A $200 Silver Bullet

In this week’s Live from the Vault, Andrew Maguire examines the transformative impact of BRICS’s latest currency initiatives, as the multi-polar alliance positions gold at the heart of international trade, bypassing conventional financial systems.

As the world’s largest economies shift from the dollar, Andrew reveals how central banks are fortifying their reserves with gold and silver to hedge against market instability, setting the stage for substantial impacts on precious metals prices.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.

Featured Image - Source: Unsplash