Silver Price News: Silver Ends Week Down By 3.6%

Silver prices edged lower on Friday, following softer gold prices, as the precious metals markets were more subdued after a bout of mid-week volatility.

Prices eased as low as $31.23 an ounce on Friday, down from around $32.05 an ounce in late deals on Thursday.

Silver KAG/USD – 1hr view – Kinesis Exchange

Both gold and silver prices fell sharply on Wednesday after the uncertainty of the US election result passed following a win by Republican nominee Donald Trump. Silver fell as low as $30.87 an ounce on Wednesday. The grey metal managed a modest rebound on Thursday but this quickly ebbed away on Friday, leaving prices lower day-on-day, and down about 3.6% over the week as a whole.

Dollar strengthens after US election, Fed cuts rates

The US dollar strengthened against other major currencies following the US election result, which naturally put downward pressure on dollar-denominated gold and silver prices in the second half of the week.

Thursday saw a modest rebound in silver prices after the US Fed cut interest rates by 25 basis points – a bullish factor for non-interest-bearing assets like precious metals. However, the Fed’s move was widely expected and likely fully priced into the market in advance, meaning any gains were limited. Read More

Gold Price News: Gold Eases In Post-US Election Calm

Gold prices were marginally lower on Friday, ending a bearish week for the precious metal overall, as the dust settled following the US Presidential election on November 5.

Prices eased slightly to around $2,690 an ounce on Friday afternoon, compared with a high of $2,709 an ounce on Thursday. The latest price action showed a degree of calm had prevailed over the gold market following sharp volatility mid-week as it became clear on Wednesday that Donald Trump had won the US Presidential election.

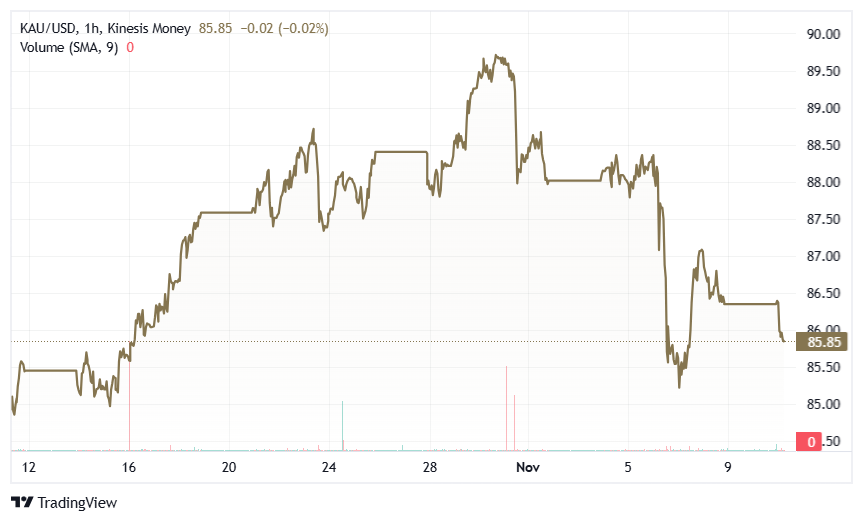

Gold KAU/USD – 1hr view – Kinesis Exchange

Gold prices had traded as high as $2,750 an ounce ahead of Tuesday’s vote, with uncertainty over the outcome driving investment in safe-haven assets. With the election uncertainty over, prices fell sharply to $2,653 an ounce on Wednesday.

Markets weigh impact of Trump win on gold

The implications of Trump’s political victory for gold are somewhat mixed. On the one hand, the markets generally expect more trade tariffs, a stronger dollar and higher interest rates, all of which are bearish factors for gold prices. On the other hand, inflation is expected to be higher and this can support investment demand for gold as an inflation hedge.

Geopolitics is a further wildcard factor, as any peace deals in current conflict zones could work to curb safe-haven demand for precious metals. However, it remains to be seen what can be done by the incoming Trump administration to diffuse conflicts in Ukraine and the Middle East.

Elsewhere, the US Federal Reserve cut interest rates by 25 basis points as widely expected on Thursday, which did appear to provide some support for gold, albeit with prices still some way off the highs seen earlier in the week. Read More

Gold could outgain stocks as economic risks rise – Mike McGlone

The gold rally to new all-time highs has coincided with a seemingly non-stop ascent in the stock market, but that could soon change according to one analyst, who said rising geopolitical tensions and economic concerns could push more investors out of risk assets and into the world’s oldest safe haven.

“The question of ‘why buy gold with the US stock market on a tear and Treasury bills yielding over 4%?’ may be changing, given the metal's kept pace with the AI-driven S&P 500 total return for about three years,” said Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence. “Consensus that US equities will go up under a second term for president-elect Donald Trump might be a top factor buttressing gold.”

According to McGlone, “Gold's on-par performance with the S&P 500 the past three years may suggest it's gaining an upper hand vs. the AI-driven stock market.”

“Rising geopolitical tensions are a top gold tailwind, indicated by its almost 50% gain vs. 40% for the S&P 500 Total Return Index (SPXT) and crude oil's 20% decline since China and Russia announced ‘unlimited friendship’ in February 2022,” he noted. “Our graphic shows what might matter most for the metal going forward: its relationship with the stretched US stock market.” Read More

Gold price has room to hit $8,000 in this bull cycle as Fed deals with next crisis – Brien Lundin

The Federal Reserve's money management will trigger the next crisis and force the U.S. central bank to embrace zero or even negative interest rates, warned Brien Lundin, Editor of Gold Newsletter and CEO of New Orleans Investment Conference.

"The Fed's management of the price of money is going to create the next crisis, and when that happens, they are going to be forced to get back to zero interest rates," Lundin told Kitco News' anchor Jeremy Szafron.

Lundin noted that the Fed's decision to cut rates by 25 basis points this week, following a 50-basis-point cut in September, is just the start of a longer rate-cutting cycle driven by the unsustainable cost of servicing the national debt.

"Successive rate cuts are baked into the cake because of the tremendous cost of servicing the federal debt at these interest rate levels. The debt rate tsunami on a corporate level – we're going to see a lot of debt resets coming up in the months just ahead," he said. "Companies had trouble paying and servicing those debts in a zero-interest rate environment. They will find it nearly impossible to service those debts at current interest rates. The Fed really has to get rates down. The longer it waits, the more urgently it will have to do so at some point." Watch the podcast

Gold likely headed lower after election risk bid dissipates

As the results rolled in late Tuesday evening, precious metals markets also cast their vote, with gold selling off sharply from the $2,750 per ounce area all the way down to $2,659.

What did this move signify? In the run-up to the U.S. election, political pundits and economic experts were in broad agreement that both a Harris or a Trump administration would be inflationary, at least in the near term. Was it simply a rotation into risk assets as traders watched equity markets and cryptocurrencies rocket higher?

With a couple of days of perspective, and with the gold price since stabilizing above $2,700 per oz, experts are now suggesting that this was simply the risk bid related to prolonged domestic political strife evaporating from the market.

“Gold lost over 3% in value on the day the presidential election results were tallied,” noted Alex Kuptsikevich, senior market analyst at FxPro. “Cumulatively, from the peak in late October to the recent low, the losses exceed 5%. So far, it does not look like a tragedy. On Thursday, the price added 2.5% from the lows to the high intraday, recovering most of the decline from the day before.” Read More

Wall Street and Main Street both bearish on gold for next week as risk assets reign supreme

As was widely expected, the markets this week were dominated by the U.S. presidential election, and precious metals were no exception. What was surprising was the speed with which the contest was resolved, and the sharp sell-off in gold prices left market participants wondering about the yellow metal’s direction going forward.

Spot gold kicked off the week trading at $2739.34 per ounce, and it spent the early part of the week oscillating within a narrow $20 range between a low of $2,726 at 9:30 pm EST Monday evening and a high just below $2,748 on the morning of Election Day.

This was one of the narrowest and least volatile multi-day stretches for gold in some time, and it was clear that traders didn't want to make a move in either direction until the polls gave them good reason. Read More

Gold, silver pounded by bearish outside-market forces

Gold and silver prices are sharply lower, with gold strongly down and hitting a four-week low, in midday U.S. trading Monday. A surge in the U.S. dollar index to a 4.5-month high, solidly lower crude oil prices and rising U.S. Treasury yields are all bearish outside-market elements working against the metals markets today. Also featured is technical selling pressure and more profit taking from the shorter-term futures traders. Metals traders are also concerned about less demand coming out of China. December gold was last down $74.70 at $2,620.10 and December silver was down $0.814 at $30.635.

U.S. stock indexes are mixed at midday but hit record highs early on. That’s also bearish for the precious metals, from a competing asset class perspective. Today is the U.S. Veterans Day holiday, and the U.S. government and Treasury markets are closed. Other markets will operate under normal hours today.

Technically, December gold bulls have lost their the overall near-term technical advantage for the first time in months. Bears are now working on a price downtrend on the daily bar chart. This suggests a near-term market top is in place. Bulls’ next upside price objective is to produce a close above solid resistance at $2,700.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,550.00. First resistance is seen at $2,650.00 and then at $2,675.00. First support is seen at the October low of $2,618.80 and then at $2,600.00. Wyckoff's Market Rating: 5.0.

Image Source: Kitco News

December silver futures bulls have also lost their overall near-term technical advantage, as prices are starting to trend down on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $32.50. The next downside price objective for the bears is closing prices below solid support at $29.00. First resistance is seen at $31.00 and then at the overnight high of $31.66. Next support is seen at today’s low of $30.53 and then at $30.00. Wyckoff's Market Rating: 5.0. Read More

Image Source: Kitco News

Gold’s dramatic decline is not Trump-specific, silver demand from solar boosts long-term projections – Heraeus

Gold’s price decline since Trump’s electoral victory is as much about the party as it is the candidate, while global silver demand from the solar industry continues to rise as technology evolves and countries surpass their installation targets, according to precious metals analysts at Heraeus.

In their latest precious metals update, the analysts noted that historically, Republican victories have not been good for gold’s near-term prospects.

“Gold dropped to $2,643/oz, the lowest price in 19 days, and the dollar strengthened as it became clear that Trump would return as US president,” they wrote. “The dollar index saw more than a 1% gain against most major peers on the day of Trump’s win. Following the 2016 Trump victory there was an 11.6% fall in the price of the yellow metal.” Read More

Bitcoin closes in on $89k as equities and crypto rocket higher, gold and silver approach key support

The market-wide rally across risk assets continued on Monday with stocks, Bitcoin and multiple cryptocurrencies setting fresh all-time highs while gold and silver completely erased their gains over the last month.

At the closing bell, all the major North American equity indices were in the green, with the S&P 500 closing above 6,000 and the Dow over 44,000 for gains of 0.10% and 0.69%, respectively, while the Nasdaq finished up 0.06%.

Precious metals, on the other hand, continued to sell off, with both gold and silver setting new lows as equities and King Crypto rocketed higher. Spot gold continues to tick down toward support at $2,600 per ounce, setting a session low of $2,610.69 shortly after 1 p.m. EST.

At the time of writing, spot gold trades at $2,622.35 for a decline of 2.31% on the session, while spot silver was down fallen 1.76% and trades at $30.716 per ounce after hitting a low of $30.407 around 11 a.m. EST. Read More

Live From The Vault - Episode:198

Silver Supply Crunch: Goldmine for Investors! Feat Peter Krauth

In this week’s Live from the Vault, Andrew Maguire is joined by Peter Krauth, author of the bestseller The Great Silver Bull, to discuss silver’s rising demand from the solar and tech sectors, with a focus on India’s role in reshaping the global market.

With silver’s price on the verge of a major shift, Peter explains how the explosive growth in industrial demand, coupled with the rapid depletion of available supply, is creating an ideal environment for investors.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.

Featured Image - Source: Unsplash