Gold Price News: Gold Falls to Two-Month Low as Dollar Strengthens

Gold prices edged lower on Tuesday, falling to a two-month low as the US dollar made gains in the wake of the US Presidential election.

Prices eased as low as $2,590 an ounce on Tuesday, before edging back up to around $2,615 an ounce later in the session. That compared with around $2,624 an ounce in late trades on Monday.

Gold KAU/USD – 1hr view – Kinesis Exchange

Dollar rises, markets mull higher inflation

The US dollar strengthened against other major currencies on Tuesday, moving to a one-year high against the euro. A stronger dollar makes dollar-denominated gold more expensive for buyers in other currencies, weighing on demand.

Moreover, the US Presidential electoral win by Republican nominee Donald Trump has boosted expectations that America could impose trade tariffs, potentially driving inflation higher. This in turn suggests a lower probability of further interest rate cuts by the US Fed – a negative factor for non-yield-bearing assets like gold.

Meanwhile, global gold ETFs saw outflows of $809 million (12 tonnes) during the first week of November, with most of the outflows coming from North America, the World Gold Council said in a report Tuesday: Gold Market Commentary: Under pressure | World Gold Council. This may have reflected an unwinding of hedges placed ahead of the November 5th US election. Read More

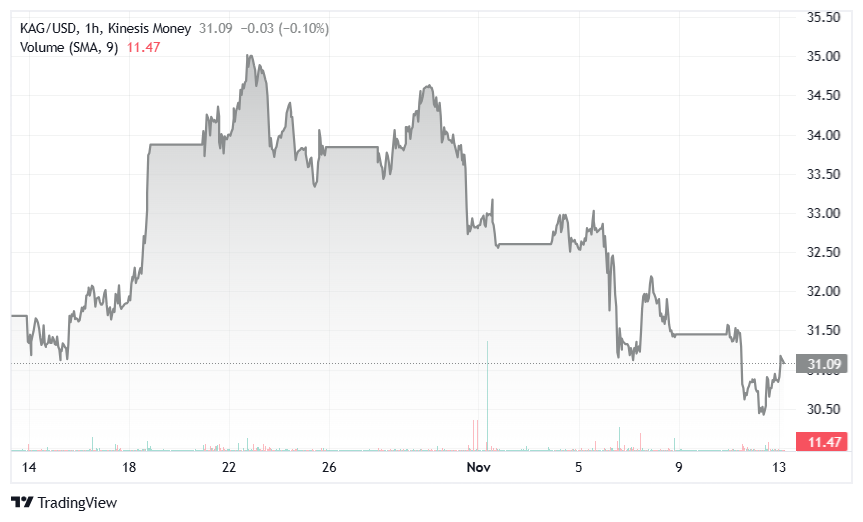

Silver Price News: Silver Dips as Gold Softens, US Dollar Gains

Silver prices were marginally lower on Tuesday, following further weakness in the gold market, as precious metals prices came under pressure from a stronger US dollar.

Prices edged to an intraday low of $30.23 an ounce on Tuesday, before recovering to around $30.60 an ounce later in the day. That compared with around $30.80 an ounce in late trades on Monday.

Both gold and silver prices have moved lower since the US election, with the markets seemingly unwinding hedged positions. Gold prices fell to a two-month low on Tuesday, providing a bearish backdrop for silver.

Silver KAG/USD – 1hr view – Kinesis Exchange

Precious metals prices were also under pressure from a resurgent US dollar, which strengthened against other major currencies on Tuesday following the US election.

Silver price weakness was also linked to disappointment over China’s recent debt package announced last Friday, which appeared not to include direct stimulus measures that could have boosted the economy. Read More

Industrial demand for silver to set new record high in 2024 as market sees fourth straight annual supply deficit – Silver Institute

The global silver market is on pace to record a physical deficit in 2024 for the fourth consecutive year, with the growth of demand from industry the main driver, according to the latest Interim Silver Market Review from the Silver Institute released Tuesday evening.

“Record industrial demand and a recovery in jewelry and silverware will lift demand to 1.21 billion ounces in 2024, while mine supply will rise by just 1%,” they said. “Exchange-traded products are on track for their first annual inflows in three years as expectations of Fed rate cuts, periods of dollar weakness and falling yields have raised silver’s investment appeal.”

The report was authored by Philip Newman, Managing Director at Metals Focus, and Sarah Tomlinson, Director of Mine Supply at the Silver Institute, and it features the latest price, supply and demand data for the current year.

“The silver price has posted a remarkable rally during 2024-to-date, nearly touching $35 for the first time since 2012,” they wrote. “Through to November 7, prices have surged by 34% since the beginning of this year. Leaving aside a brief drop to a three-year low of 73, the gold:silver ratio has largely held between 80 and 90 so far in 2024.” Read More

Gold prices near session highs as U.S. headline and core CPI remain steady in October

Gold prices were trading near session highs after U.S. headline consumer prices aligned with expectations in October, with steady month-over-month readings for both headline and core inflation.

The Consumer Price Index (CPI) rose 0.2% last month after September’s 0.2% rise, the U.S. Bureau of Labor Statistics announced on Wednesday. The inflation data was in line with expectations, as economists were looking for a 0.2% increase.

The report said that in the last 12 months to October, headline inflation rose 2.6%, also in line with expectations and up from September’s 2.4% print.

Core CPI, which strips out volatile food and energy prices, increased 0.3% in October as expected, and the same as September’s 0.3% reading.

The report said that annual core inflation rose by 3.3% in October, which was also in line with economists’ expectations and identical to the 3.3% reading from the prior month.

The gold market shot to session highs following the latest inflation data, with spot gold spiking to $2,618.92 in the moments following the CPI release. Spot gold last traded at $2,613.69 per ounce, for a gain of 0.59% on the daily chart. Read More

The Great Kentucky Hoard: $2 million in Civil War-era gold coins discovered

Gold has been recognized as a trusted store of value for centuries, allowing holders to maintain their wealth during times of uncertainty, and sometimes, hidden away treasures resurface in the modern age, as was the case for a Civil War-era coin stash recently found in Kentucky.

As reported on a special episode of Kentucky Life, a farmer in the state made a valuable discovery in 2023 that’s come to be known as The Great Kentucky Hoard, comprised of a cache of gold and silver coins dating to the Civil War era.

“I initially found the 1856 Seated Liberty Half Dollar probably 20 to 30 feet from where the hoard was located,” the farmer told Kentucky Life. “I would have never believed what came next. Things that only happen in dreams. When I continued walking and saw the glint of gold – a thick reeded edge.”

“When I pulled the coin from the ground, I was astonished when I realized I was holding a $20 Double Eagle from the 1860s,” he said. “After I flipped the first clump of dirt over the next 45 minutes to an hour, the coins kept coming. I knew it was hundreds.”

When his digging was complete, more than 700 gold coins were unearthed, and when combined with the silver found, more than 800 coins were pulled from the ground. Read More

Gold, silver near steady as strong USDX limits buyer interest

Gold and silver prices are near steady in midday U.S. trading Wednesday. Earlier gains in the two precious metals were lost when the U.S. dollar index rallied from lower levels to hit a new six-month high. December gold was last down $0.60 at $2,605.40 and December silver was up $0.046 at $30.805.

The U.S. data points of the week came this morning and saw the consumer price index for October come in just as expected, at up 2.6%, year-on-year, compared to a reading of up 2.4% in the September report. The “core” CPI (excluding food and energy) was also right in line with market expectations, at up 0.3%, month-on-month. While in line with trade expectations, the takeaway from today’s CPI report is that inflation is ticking back up a bit but is not deemed problematic.

Technically, December gold bulls and bears are on a level overall near-term technical playing field, but the bears have momentum. Prices are trending down on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $2,700.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support $2,500.00. First resistance is seen at today’s high of $2,625.00 and then at Tuesday’s high of $2,633.40. First support is seen at this week’s low of $2,595.70 and then at $2,575.00. Wyckoff's Market Rating: 5.0.

Image Source: Kitco News

December silver futures bulls and bears are on a level overall near-term technical playing field. However, prices are trending down on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $32.50. The next downside price objective for the bears is closing prices below solid support at $30.00. First resistance is seen at the overnight high of $31.255 and then at this week’s high of $31.66. Next support is seen at the overnight low of $30.625 and then at this week’s low of $30.28. Wyckoff's Market Rating: 5.0. Read More

Image Source: Kitco News

Bitcoin consolidates after $93.5k all-time high, stocks finished mixed while gold slides

Volatility returned to financial markets on Wednesday after the latest Consumer Price Index (CPI) report fell in line with expectations but showed that inflation remains ‘sticky,’ slightly dampening the expectations for a total of 100 basis points worth of interest rate cuts in 2025.

That said, the CME FedWatch tool shows that Wall Street remains confident that a 25 bps cut will come at the FOMC meeting in December, putting the odds at 82%.

After starting slow but climbing into the green following the CPI report, stocks faced pressure in the afternoon, leading to a mixed close for the major indices.

At the closing bell, the Dow finished in the green, up 0.11%, the Nasdaq lost 0.26%, and the S&P was flat.

Spot gold also struggled as traders focused on risk assets, with the yellow metal losing 0.98% on the session to trade at $2,572.30 at the time of writing.

Bitcoin (BTC) “took us on a wild ride, briefly touching $90,100 yesterday before dipping down to $86,300 earlier today,” noted analysts at Secure Digital Markets. “The alts got hit even harder, especially those meme coins. BTC didn't just bounce back—it smashed through to a new all-time high of $93,500.” Read More

With long-term support and constrained supply, gold around $2,600/oz is a buying opportunity – IG’s Rudolph

Central bank purchases and rising investor appetite have driven gold prices to record levels, but the recent pullback has some questioning the yellow metal’s ability to continue its rally. But gold still has medium and long-term support from fundamental and technical factors, according to Axel Rudolph, senior technical analyst at IG in London.

In a piece published on Nov. 13, Rudolph analyzed the stability of the precious metal’s long-term uptrend. The first major factor he looked at was sovereign buying.

“Central bank gold purchases have reached historic levels, with nearly 400 tons acquired in the first half of 2022 alone - the fastest pace in 55 years,” he wrote. “By July 2024, global purchases hit a near 14-year high.”

Rudolph said the surge represents a significant departure, as central banks have shifted “from net sellers to aggressive buyers” over the past decade. “Major institutions in Russia, China, India, Poland, and Hungary have substantially increased their gold reserves,” he noted.

“The primary motivation behind this trend is diversification, with central banks seeking to reduce their exposure to currencies and bonds,” he said. “With global debt at record levels, gold serves as a crucial hedge against market risks. These substantial purchases from central banks have created sustained upward pressure on gold prices, contributing to the record highs made near the $2,800.00 per troy ounce mark just a few weeks ago.” Read More

Gold could fall to $2,500 before ‘Trump Trade’ euphoria subsides – Nicky Sheils

Gold and silver have struggled in the wake of Donald Trump’s re-election, and with concerns such as the threat of World War III decreasing, one analyst said the bullish case for precious metals is on the back burner until the current market euphoria subsides.

Surveying the markets one week after Trump’s Victory, Nicky Shiels, Head of Research & Metals Strategy at MKS PAMP, said that “animal spirits have been reawakened,” highlighting that the “SPX is at $6k, Bitcoin is eyeing $100K, the US$ is flying, while the air has been taken out of precious & commodities, for now.”

Shiels underscored the similarities in how the markets responded to Trump’s victory in 2016 to today, noting that “Trump has a lot of ideas with Republicans close to House majority + thus Washington trifecta, which the market is rewarding through higher beta typical Trump trades (Bitcoin, Tesla, US$, tech, prison stocks).” Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.

Featured Image - Source: Unsplash