Gold Price News: Gold Pulls Back from All-Time Highs

Gold prices pulled back slightly on Tuesday from their fresh all-time high on Monday, as the market took stock of the latest push into new territory.

Prices eased slightly to a low of $2,561 an ounce on Tuesday, compared with around $2,584 an ounce in late trades on Monday. Monday saw a fresh all-time high for gold at $2,590 an ounce in intra-day trading.

Tuesday’s pull-back was perhaps inevitable after the previous week’s steep gains, although bullish elements continue to keep the yellow metal supported.

The big-ticket item this week is the US Fed’s meeting on Wednesday, which is widely expected to see the central bank slash interest rates for the first time since March 2020.

Data from interest rate traders imply a majority of over 60% believe the Fed will cut rates by 50 basis points at the meeting, with less than 40% expecting a smaller 25-basis point cut, according to the latest figures from the CME FedWatch tool: CME FedWatch – CME Group

Lower borrowing costs tend to weaken the US dollar and support precious metals prices. Whatever is announced on Wednesday, the market’s focus will naturally also shift to the potential for any further rate cuts in the remainder of the year. Read More

Silver Price News: Silver Edges Lower After Two-Month Highs

Silver prices ticked slightly lower on Tuesday but held onto the sharp gains seen at the end of the previous week.

Prices nudged lower to $30.67 an ounce, compared with around $30.77 an ounce in late trades on Monday. Prices briefly spiked above $32.00 an ounce last Friday, but trading at that level could not be sustained.

Silver, like gold, continues to reflect the market’s expectation that the US Fed will cut interest rates at its meeting on Wednesday, representing the opening salvo in an expected rate-cutting cycle as the central bank seeks to stimulate the economy, now that inflation is moving closer to its target levels.

The markets appear to be pricing in a more than 60% chance of a 50-basis point cut this week and further cuts before the year is out – a scenario that would put wind in the sails of non-interest-bearing assets like gold and silver. Read More

Gold prices holding near record highs as U.S. housing starts jump 9.6% in August

Gold prices continue to consolidate near their recent record highs, above $2,580 an ounce, even as the U.S. housing market experiences a robust increase in construction activity.

Housing starts jumped 9.6% to a seasonally adjusted annual rate of 1.356 million units, the Commerce Department reported on Wednesday. This data exceeded expectations, as economists had anticipated a smaller increase to 1.31 million units. At the same time, the July data was revised downward to a rate of 1.237 million units. Housing starts are up 3.9% from the levels reported in August 2023.

Construction activity in the U.S. housing sector has surged to its fastest pace since April. However, some analysts note that despite the growing momentum, it is still not sufficient to meet the increasing demand. Read More

Banks' latest gold price forecasts show Fed decision poses upside and downside risks for gold, but gains through 2025

Gold could see a near-term pullback following the first Fed cut, but the future looks very bright for bullion heading into 2025, according to the latest research and analysis from Goldman Sachs, UBS, TD Securities, and Bank of America.

Goldman Sachs believes gold prices may see near-term declines if the Federal Reserve chooses a 25-basis-point cut this afternoon rather than a larger 50 bps reduction, but they still expect the precious metal to rally to fresh record highs afterward as flows into bullion-backed exchange-traded funds increase.

“Fed rate cuts are poised to bring Western capital back into gold ETFs, a component largely absent of the sharp gold rally observed in the last two years,” wrote analysts Lina Thomas and Daan Struyven in a research note.

“While we see some tactical downside to gold prices under our economists’ base case of a 25-basis-point Fed cut on Wednesday, we expect a gradual boost to ETF holdings — and thus gold prices — from the Fed’s easing cycle,” they said. Read More

Gold sector run-up reminds Barrick CEO Mark Bristow of a time when it didn’t end well

Maintain fiscal discipline, warns Mark Bristow, president and CEO of Barrick Gold.

This week, Bristow spoke to Kitco Mining at the Gold Forum Americas / XPL-DEV 2024 in Colorado.

Gold has hit several all-time highs in 2024. The gold miners, measured by the GDX, are up about 32% year to date. Barrick has been lagging its peers, up just 18% over the same period.

The run in gold has spurred some big transactions, notably AngloGold Ashanti buying Centamin for $2.5 billion and Gold Fields acquiring Osisko for $2.16 billion in an all-cash deal—all in the past month. Bristow warns that the sector could be getting ahead of itself.

“If you recall…back in 2010 when the gold price started moving materially, and it went through the $1,000 mark for the first time, everyone chased it,” noted Bristow, who was running Randgold Resources at the time. “Everyone was updating, using higher and higher gold prices. [We] decided to stay at $1,000, because there was no change in input costs.”

“That's really fundamental, because you can raise the gold price, but what it does is often takes you outside your old body and really dilutes the value of your asset,” warned Bristow. Watch the podcast

Gold rallies after Fed cuts main U.S. rate by more aggressive 0.5%

Gold prices are higher and hit daily highs in early-afternoon U.S. trading Wednesday, in the immediate aftermath of the first U.S. central bank interest rate cut in 4.5 years. December gold was last up $14.50 at $2,606.60 and December silver was up $0.06 at $31.06.

The just-released Federal Reserve Open Market Committee meeting (FOMC) statement shows the U.S. central bank reduced its main interest rate—the Fed funds rate—by a more aggressive 0.5%, to a range of 4.75% to 5.0%. About half of the marketplace expected a smaller 0.25% cut. The FOMC statement said the U.S. economy has made progress on lowering inflation, but it remains elevated.

Markets are now anxiously awaiting the press conference and comments from Fed Chairman Jerome Powell. The Bank of England and the Bank of Japan hold their regular monetary policy meetings Thursday.

Technically, December gold bulls have the strong overall near-term technical advantage. Bulls’ next upside price objective is to produce a close above solid resistance at $2,700.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,500.00. First resistance is seen at the record high of $2,617.40 and then at $2,625.00. First support is seen at $2,600.00 and then at this week’s low of $2,587.30. Wyckoff's Market Rating: 9.5.

Image Source: Kitco News

December silver futures bulls have the overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at the July high of $32.46. The next downside price objective for the bears is closing prices below solid support at $29.00. First resistance is seen at this week’s high of $31.46 and then at $32.00. Next support is seen at today’s low of $30.565 and then at $30.00. Wyckoff's Market Rating: 6.5. Read More

Image Source: Kitco News

Gold price at session highs as Federal Reserve cuts rates by 50 basis points signals start of easing cycle

The gold market is trading at new record highs as the Federal Reserve cuts interest rates by 50 basis points and signals that this is the start of a broader easing cycle.

Ahead of the much-anticipated decision, markets were pricing in the more aggressive 50-basis-point move. However, the Fed’s 25-basis-point cut was in line with most economists’ expectations. The Fed funds rate is now in a range between 4.75% and 5.00%.

“In light of the progress on inflation and the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/2 percentage point to 4-3/4 to 5 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks,” the Federal Reserve said in its monetary policy statement.

Along with the Federal Reserve’s move, many economists noted that its monetary policy is broader than one single adjustment. The updated economic projections, also known as the dot plots, indicate that the central bank expects interest rates to fall to 4.40% by the end of the year, down from June’s estimate of 5.1%. Read More

Bitcoin spikes to $61,250, gold hits new ATH above $2,600/oz as 50 bps cut sparks volatility across markets

Risk asset investors got what they wanted on Wednesday afternoon when Federal Reserve Chair Jerome Powell announced a 50 bps cut to the benchmark interest rate, lowering it to a range of 4.75% - 5.0%.

On top of announcing the first rate cut in over four years, the latest FOMC projections suggested that the Fed would lower interest rates two more times in 2024, helping to juice the markets as traders went risk-on at the prospect of the return of easy money.

According to the Fed's latest Summary of Economic Projections (SEP), the majority of Fed officials expect the central bank to cut interest rates by 100 basis points in total this year.

“The Fed has given the market what it was looking for with the bigger 50-basis point rate cut,” said LMAX Group market strategist Joel Kruger in a note shared with Kitco Crypto. “Our concern from here will be the market’s ability to continue to feel good about buying risk assets on future accommodative Fed gestures now that the accommodation has been priced to this extent.” Read More

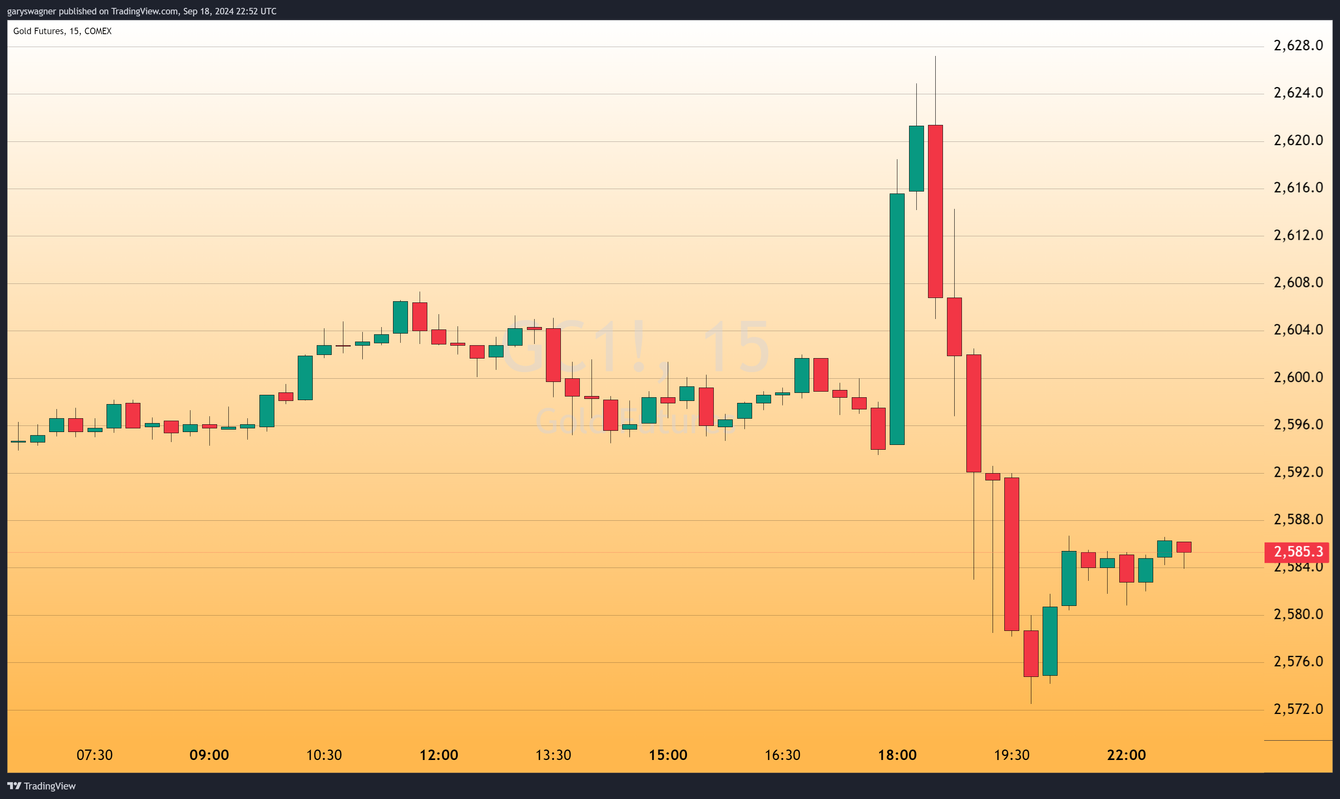

Gold Prices Fluctuate Wildly as Federal Reserve Implements Aggressive Cut

Image Source: Kitco News

In a significant shift in monetary policy, the Federal Reserve announced a more aggressive 50-basis point rate cut following its recent Federal Open Market Committee (FOMC) meeting. This marks the first interest rate reduction since 2020 and signals a pivotal change in the central bank's monetary policy.

The decision for a steeper cut, while anticipated as one of two options (50 or 25-basis points), sparked considerable volatility in gold prices. By late afternoon, gold futures for December delivery settled at $2,584.80, down $11.60 for the day. The precious metal experienced a rollercoaster trading session, opening at $2,596 and reaching an intraday high of $2,627.20 before retreating to settle just above the day's low of $2,572.50.

This policy shift underscores the Fed's dual mandate of maintaining full employment while keeping inflation at a reasonable level. Chairman Powell expressed confidence that previous rate hikes had effectively lowered inflation and that it would continue to approach the desired target. The new Fed funds rate now stands between 4.75% and 5%, with the Fed signaling its intention to normalize interest rates to around 3% over the coming year. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.

Featured Image - Source: Unsplash