Silver Price News: Silver Holds Steady Ahead of Rate Cuts

Silver prices were largely range bound on Tuesday, with the markets apparently in wait-and-see mode ahead of Wednesday’s interest rate decision by the US Fed.

Prices moved a few cents on either side of $30.50 an ounce on Tuesday, compared with around $30.78 an ounce in late trades on Monday.

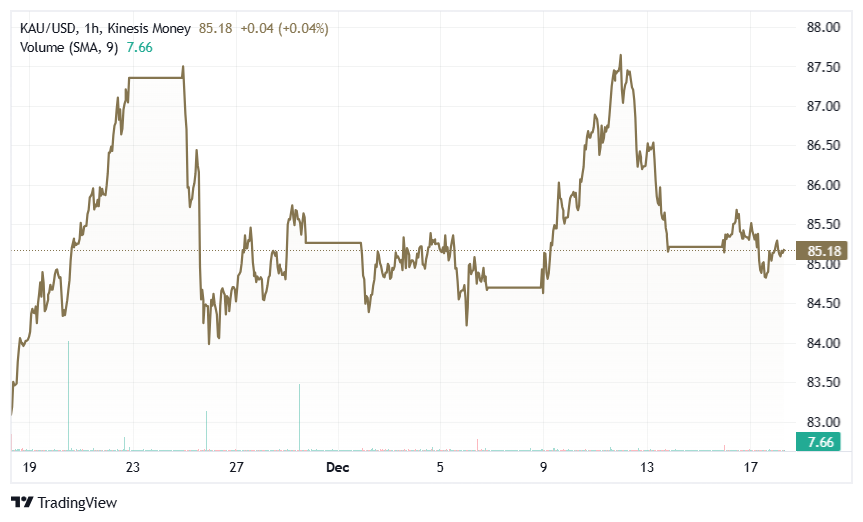

Silver KAG/USD – 1hr view – Kinesis Exchange

Markets weigh outlook for monetary policy:

The markets are pricing in a 95% chance of a 25-basis-point cut by the US Fed to be announced after the European markets have closed on Wednesday evening. However, the outlook for early 2025 is less clear, as data from interest rate traders indicate that a large majority expect the Fed to keep rates steady at its next meeting on January 29th. Lower interest rates tend to support gold and silver prices as they reduce the opportunity cost of holding non-interest-bearing investments.

Elsewhere, US industrial production fell by a marginal 0.1% in November, against expectations of a 0.3% increase, and showing the third straight monthly decline, according to figures released on Tuesday, in a bearish sign for industrial demand for silver in the US.

Technical analysis:

On the technical charts, silver twice tested the downside at just below $30.00 an ounce on November 14th and 28th, providing potential horizontal support at this area in the coming days. Should that level fail, the next potential support zone is provided by ascending oblique major support, currently at $28.48 an ounce. This is the trend line that goes back to March 2024, and which provided a bullish rebound for silver in early August. Conversely, silver’s upside may be limited by rising oblique minor resistance at $31.84 an ounce. Read More

Gold Price News: Gold Eases by 0.3% as Investors Brace for US Rate Decision

Gold prices were marginally lower on Tuesday, as the markets awaited fresh direction and ahead of a US interest rate decision on Wednesday.

Prices eased to an intraday low of $2,634 an ounce on Tuesday, down slightly from around $2,653 an ounce in late trades on Monday. Later on Tuesday, they regained some ground to around $2,645 an ounce.

The gold market was relatively subdued at the start of the week, compared with last week’s gains of almost $100 an ounce to over $2,730 an ounce and subsequent fallback.

US Fed set to cut rates, but outlook uncertain:

The financial markets were watching out for Wednesday’s US Fed interest rate decision, which is widely expected to constitute a 25-basis point cut. However, the outlook for US monetary policy next year looks less certain. Recent strong economic data from the US have cast doubt on the need for further interest rate cuts, and other potentially inflationary factors have contributed to this outlook, which could weigh on non-yield-bearing assets like gold.

At the same time, ongoing geopolitical risks linked to conflicts in Ukraine and the Middle East continue to limit gold’s downside.

Market positioning:

Investment in gold-backed ETFs showed a slowing of outflows in recent days, with net outflows of 1.7 tonnes in the week to December 13th, compared with larger net outflows of 8.4 tonnes in the week to December 6th, according to World Gold Council figures: Gold ETF: Stock, Holdings and Flows.

Meanwhile, in the futures market, open interest in gold futures across all the main exchanges increased to $167.2 billion in the week to December 13th, compared with $160.2 billion in the previous week, according to WGC figures. Read More

Gold is the brightest star in 2025, silver remains in second place - BMO Capital Markets

Gold and silver are expected to remain key commodities to hold in 2025, and they are two of only a handful of metals that one Canadian bank is upgrading ahead of the new year.

Commodity analysts at BMO Capital Markets warned investors that they made slightly more downgrades than upgrades in the broader commodity sector for 2025. The analysts said the growing trend of deglobalization could slow the economy and weigh on industrial demand for some metals.

“There is no getting away from the fact that tariffs are not helpful to the metals and mining sector,” the analysts said in the report published Monday. “While final structures will not be known until next year, in our view, metals and bulk commodity markets had generally factored bilateral U.S.-China tariffs into demand projections, but not a multilateral trade war that drags in Canada, Mexico, Europe, and key Asian economies. As such, we are now running lower demand estimates than was the case three months ago. Moreover, should trade friction escalate further, there would be enhanced downside risk to our demand forecasts.”

The analysts noted that the potential for a global trade war will continue to fuel geopolitical uncertainty, providing further momentum for the gold market.

“We expect the push for de-dollarization of trade to re-emerge in Q2 as trade friction grows, and this could push gold to new nominal highs,” the analysts said. Read More

Gold price treading water as U.S. housing starts drop 14.6% in the last 12 months

The Federal Reserve’s rate-hiking cycle is not having a significant impact on the U.S. housing sector, as residential construction continues to decline. At the same time, disappointing housing data is having little effect on the gold market.

Housing starts declined by 1.8% in November to a seasonally adjusted annual rate of 1.289 million units, the Commerce Department announced on Wednesday. The data was worse than expected, as economists had forecast a slight increase to 1.35 million units.

For the year, housing construction is down 14.6%.

The weaker-than-expected economic data is not significantly impacting gold, as investors continue to focus on the Federal Reserve’s monetary policy decision, which will be announced later in the afternoon. Spot gold futures last traded at $2,645 an ounce, nearly unchanged on the day.

Although residential construction remains lackluster, the sector could be stabilizing as the number of building permits increased last month.

The report noted that building permits for future homebuilding rose 6.1% in November to a rate of 1.505 million, exceeding the consensus estimate of 1.430 million permits. Read More

Gold will hit $2,900/oz in 2025 on rising sovereign and investor demand, lower interest rates and USD – UBS

While gold prices have come off their pre-election highs, the combination of strong central bank demand, rising investor interest and a weaker U.S. dollar in the medium term should help the yellow metal post new all-time highs in 2025, according to UBS.

In their latest CIO gold update, UBS noted that even though prices have fallen 5.5% since setting the all-time high in late October, spot gold is still 28% higher year-to-date and outperforming the S&P 500, and they expect further gains in 2025.

“The latest International Monetary Fund data showed that global central banks’ net gold purchases in October rose to the highest monthly level this year,” they noted. “Based on the agency’s historical pattern of underreporting this metric, we now expect the official sector to buy 982 metric tons of gold this year, up from our previous estimate of 900mt. While this remains lower than levels seen over the past two years, it represents a significant step-up from the average of around 500mt in the years since 2011.”

“We think the strong buying momentum will continue amid de-dollarization efforts, and expect central banks to buy another 900mt of gold or more in 2025,” they added.

UBS also expects the demand for gold in investor portfolios to rise next year. Read More

Fed decision on interest rate cut is not as important as Feds 2025 policy projections

The Federal Reserve concluded its final FOMC meeting of the year today with an anticipated 25 basis point rate cut, setting the benchmark "Fed funds" rate between 4¼% and 4½%. However, the Fed's forward monetary policy projections for next year triggered widespread selling pressure across financial markets.

Image Source: Kitco News

The impact was immediately visible in precious metals and equities. Gold futures for February delivery dropped $55, representing just over 2%, settling at $2,607. Silver futures experienced an even steeper decline of 3.22%, falling $0.995 to $29.92.5.

Image Source: Kitco News

U.S. equities reversed their earlier gains dramatically after the Fed's Summary of Economic Projections (SEP) indicated a more conservative approach to rate cuts in the coming year. With the Standard & Poor’s 500 falling over 3% and the NASDAQ composite falling closer to 4% on the day.

Jon Faust, who served as a senior advisor to Chairman Powell until earlier this year, accurately predicted that the meeting's significance would lie not in the rate decision itself, but in the Federal Reserve officials' commentary regarding upcoming rate cuts in 2025. As Faust noted, "Right now, either a cut or a hold could be justified. What officials say about the path of the fed-funds rate is likely to be more important than whatever they decide about the December meeting in particular." Read More

Silver needs to hold crucial support at $30/oz to maintain long-term bullish trend

While silver’s longer-term demand projections support higher prices, in the near term the gray metal faces a test of key support levels, and this afternoon’s Federal Reserve announcement will likely determine its immediate price direction, according to independent analyst Damian Nowiszewski.

Nowiszewski wrote on Wednesday that silver is struggling to maintain its year-end gains amid increasingly hawkish signals from the Fed. “Despite strong long-term fundamentals supporting silver's upward trajectory, the precious metal faces a challenging short-term outlook, with key technical levels in focus,” he said.

“Over the past year, the narrative around silver pricing has remained largely unchanged. Analysts and forecasts continue to point to long-term growth, driven by rising demand from industries such as electromobility, renewable energy, and defense,” the analyst noted. “With supply remaining relatively constant, this growing demand fuels optimism for silver’s future. This trend is expected to persist into 2025, keeping long-term bullish sentiment intact.”

In the short and medium term, however, silver’s price remains very vulnerable to market fluctuations, especially given current liquidity conditions. “Right now, the bulls are on the defensive, and all eyes are on the crucial $30 per ounce support level.” Read More

Gold price sells off after as-expected Fed rate cut

Gold and silver prices are solidly down in afternoon U.S. trading Wednesday and sold off more from earlier losses, following an as-expected interest rate cut by the U.S. Federal Reserve. February gold was last down $24.70 at $2,638.10 and March silver was down $0.491 at $30.42. Both markets hit two-week lows just after the FOMC statement.

The Fed’s FOMC committee lowered the main U.S. interest rate by a quarter-point, as widely expected. Some are calling it a “hawkish rate cut.” The FOMC statement said the Fed is now expected to cut rates by a quarter point only twice in 2025. That’s down from four rate cuts the Fed had expected at the last FOMC meeting. The FOMC also upped its inflation forecasts slightly over the next year or two. Traders now await Fed Chair Powell’s press conference, which some expect to see Powell also signal fewer rate cuts next year than previously projected.

Technically, February gold bulls have the overall near-term technical advantage but have faded. Prices are still in an uptrend on the daily bar chart, but just barely. Bulls’ next upside price objective is to produce a close above solid resistance at the December high of $2,761.30. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,600.00. First resistance is seen at today’s high of $2,667.60 and then at Tuesday’s high of $2,675.80. First support is seen $2,635.60 and then at $2,629.70. Wyckoff's Market Rating: 6.5.

Image Source: Kitco News

March silver futures bulls and bears are on a level overall near-term technical playing field but are fading. Silver bulls' next upside price objective is closing prices above solid technical resistance at the December high of $33.33. The next downside price objective for the bears is closing prices below solid support at $30.00. First resistance is seen at $31.00 and then at this week’s high of $31.24. Next support is seen at the November low of $30.095 and then at $30.00. Wyckoff's Market Rating: 5.0. Read More

Image Source: Kitco News

Gold prices take a hit as the Fed cuts rates by 25bps but signals only two cut in 2025

The gold market is struggling as the Federal Reserve cuts interest rates following the final monetary policy meeting of 2024 and suggests a slower path in its easing cycle through 2025.

As expected, the U.S. central bank lowered the Fed Funds rate to a range of 4.25% to 4.50%.

The central bank reiterated its stance that the economic outlook remains uncertain and that risks to both sides of its dual mandate are growing.

“Recent indicators suggest that economic activity has continued to expand at a solid pace. Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low. Inflation has made progress toward the Committee’s 2 percent objective but remains somewhat elevated,” the central bank said in its monetary policy statement.

In this environment, the updated Summary of Economic Projections shows the estimates of the Fed Funds rate, also known as the dot plot, moving slightly higher in 2025. The Federal Reserve projects interest rates to fall to 3.9% by the end of the year, suggesting only two rate cuts next year, down from the September estimate of 3.4%.

“The median expectation now points to the Committee delivering just two 25bp cuts in 2025, compared to the 100bp of easing penciled in during the prior 'dots' back in September, hinting strongly that the journey back toward a more neutral policy stance will be a slower one next year,” said Michael Brown, Senior Research Analyst at Pepperstone, in a note. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.

Featured Image - Source: Unsplash