Image Source: Unsplash

Silver Price News: Silver Shrugs Off Resistance

Silver enjoyed a positive end to the week, gaining over 5% and closing above $29/oz for the first time this month. However, it remains over 10% below its multi-year high on 20 May against uncertain growth prospects. Today’s open sees it slightly softer, just below $29/oz.

Silver’s recent performance was helped by news that China’s industrial production slowed by less than expected in July, though data also suggested that US industrial production in July was unexpectedly weak. Looking forward to the early part of this week, Japan Machinery Order data today and Tuesday’s China key rate setting period might also be of interest to silver investors.

The most recent CFTC Commitments of Traders (CoT) report published late on Friday indicates that silver speculators continued to cut net long futures positions. These are now c. 26% below the 53-month high recorded on 19 July, and current levels constitute the lowest net long since late March. However, physical silver ETFs/ETCs show little net inflow or outflows in recent days. Read More

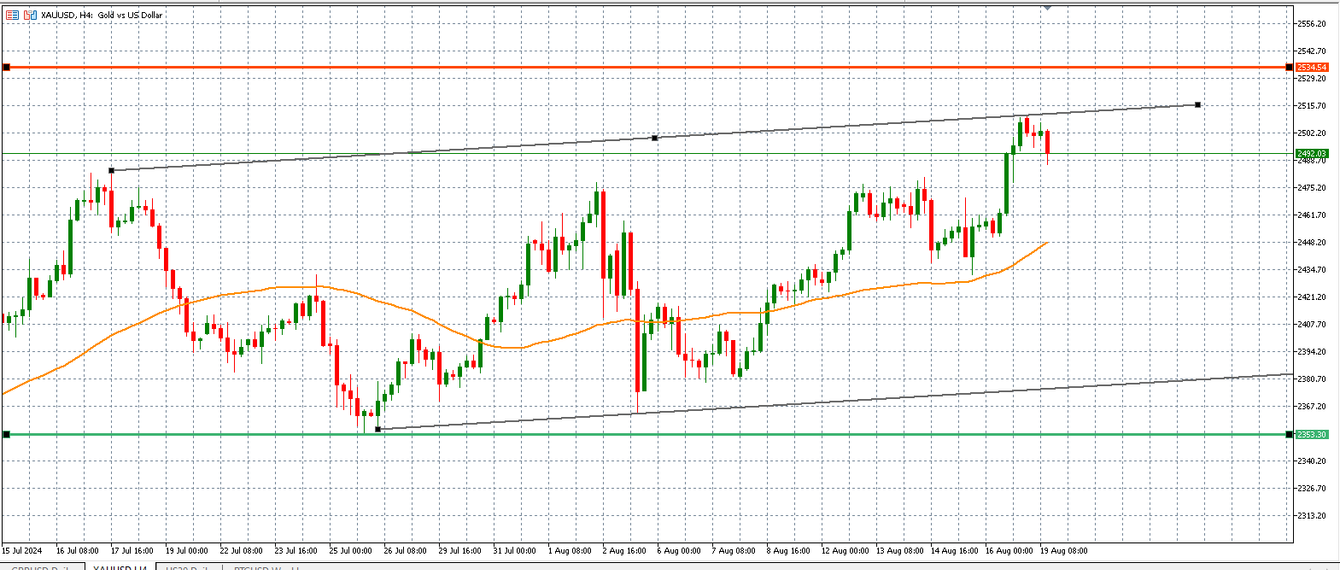

Gold Price News: Gold Hits Another High

Gold surged to another all-time high on Friday, topping $2509/oz in intraday trade and bringing a weekly gain to over 3%. The yellow metal has once again proven resilient to renewed firming in US rates markets and opens the week having already reached a new high of $2515/oz.

The latter half of last week saw expectations of a September Fed rate cut pared from an even chance of a 0.25% or 0.5% cut to just a 25% probability of a 0.5% reduction. This was seemingly prompted by better-than-expected US July US Retail Sales on 15 July. However, the follow through to the long end of the yield curve was limited, with 10-year US Treasury yields down marginally on the week. Looking to the end of the year, futures are still pricing in a total of 3-4 quarter-point cuts in total and an average of 7 quarter-point cuts by June next year, according to CME FedWatch.

The most recent CFTC Commitments of Traders (CoT) report published late on Friday indicates that speculators increased net long gold futures positions over the previous week and are now close to the 41-month high recorded on 26 July. Conversely, physical gold ETFs/ETCs show some net outflow late last week, possibly a sign of profit-taking. Monday sees Fed Board Member Waller (voter, dove) speak, followed by Fed Board Member Waller (voter, centrist) and Atlanta Fed President Bostic (voter, hawk) on Tuesday. Read More

Gold prices comes off its high as traders price in new information

Image Source: Kitco News

Gold prices are off their highs from earlier today and last week as investors factor in some new important ingredients into their trading decisions.

Background:

Gold prices closed in positive territory last week, as the shining metal recorded some really solid gains and closed above the important level of 2,500. Now, traders are asking themselves if the rally will continue or if this is a good time for them to take some profit off the table, given the fact that geopolitical tensions have eased off to a large extent.

New Ingredients for Gold Prices:

Well, most traders are likely to take some profit off the table, and it is possible that the price may see further retracement, and this is purely because the gold price went too far and too quick last week. The price level of 2,500 is very hot for many traders, and they are not going to feel very comfortable buying gold above this price point under the current circumstances. This is due to a multitude of factors that are currently in play. Read More

U.S. economy faces mounting challenges as debt levels rise and inflation persists, warns Daniel Lacalle

The U.S. economy is entering a dangerous economic phase as debt levels continue to rise and inflation remains stubbornly high. In an interview with Jeremy Szafron, Anchor at Kitco News, Daniel Lacalle, Chief Economist at Tressis, warned that the U.S. national debt, which has now surpassed $35 trillion with a debt-to-GDP ratio of 122%, poses a significant risk to long-term economic stability. Tressis, a leading Spanish financial advisory firm, specializes in wealth management, financial planning, and investment strategy, providing Lacalle with a comprehensive understanding of the global economic environment.

"The first signal that it is not sustainable is the fact that the United States, having the world reserve currency and record level of oil production, has persistent and elevated inflation," Lacalle stated. He pointed out that inflation is evidence of the destruction of purchasing power, a clear sign that the current debt levels are unsustainable. Watch the podcast

Silver set to soar on Samsung’s solid-state battery breakthrough – analysts

Gold has had a breakout year as the yellow metal surged to new heights above $2,500 while its grey counterpart, silver, has struggled to keep pace, but that could soon change, according to one analyst, as silver demand is expected to increase thanks to one new technological development from Samsung.

According to retired investment professional Kevin Bambrough, Samsung has developed a new solid-state (SS) battery. The inclusion of silver as a key component, combined with the increasing demand for electric vehicles, means that demand for the grey metal will soon increase.

“The key drivers that will ramp up demand for EVs are range, charge time, battery life and safety,” Bambrough said. “Samsung's new solid-state battery technology, incorporating a silver-carbon (Ag-C) composite layer for the anode, exemplifies this advancement. Silver's exceptional electrical conductivity and stability are leveraged to enhance battery performance and durability, achieving amazing benchmarks like a 600-mile range and a 20-year lifespan and 9-minute charge.” Read More

Dollar Weakness provides support for gold, tempering today's price decline

The precious metals market witnessed a marginal decline in gold futures today, with the most active December contract closing slightly lower. Despite this minor setback, the yellow metal found support from a weakening U.S. dollar. Over the past two trading sessions, the greenback has experienced a significant drop of over one percentage point, providing a cushion for gold prices.

The dollar's recent performance has been noteworthy. Opening above 103 last Friday, the dollar index closed at 102.397 after a 0.62% decline. Today's trading saw further weakness, with the index dipping below 102 for the first time since early January 2024. This marks a substantial 2.11% loss for the dollar in August alone, following a 1.74% decline in July. The cumulative effect is a nearly 4% decrease in the dollar's value over the past two months.

Image Source: Kitco News

This dollar weakness has played a crucial role in gold's recent surge to record highs. Last Friday, gold made history by closing at an unprecedented $2546.20, surpassing the previous record of $2521.50 set on July 16. This year has seen gold achieve four new record closing prices, with two occurring in the last six weeks. Read More

BRICS Bridge digital payment system ‘will be a bombshell globally’ – Chair of Russia’s Federation Council

The BRICS nations continue to make progress on the road towards de-dollarization as Valentina Matviyenko, the Speaker of Russia’s Federation Council, recently announced that the trading bloc has made significant progress on the BRICS digital payment platform as part of their efforts to revolutionize global financial transactions.

“The creation of the independent financial payment platform BRICS Bridge, a standalone mutual payment system on a firm joint platform, is now being discussed within BRICS,” Matviyenko said at a press conference on August 1, as reported by TAAS. “I have spoken both with the Central Bank and the Finance Ministry; things are moving along nicely. It is being discussed with colleagues from central banks, finance ministries of all BRICS countries, including new members.”

During the BRICS Summit held in Johannesburg in 2023, six new countries were admitted into the bloc, including Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates (UAE), underscoring the group's growing influence on the world stage. Read More

Silver prices catching up to gold; testing critical resistance above $29

The gold market continues to attract significant attention as prices hover around new all-time highs of approximately $2,500 per ounce. However, some analysts suggest that investors might want to turn their focus to silver.

Silver has struggled to keep pace with gold during its surge to record levels, but sentiment is slowly starting to shift. The grey metal is beginning the new trading week with a push above $29 per ounce, its highest level in four weeks.

Spot silver last traded at $29.34 per ounce, up more than 1% on the day.

The new momentum is helping to decrease the gold/silver ratio, which had rallied significantly since early July. The gold/silver ratio is currently trading at 85.5 points, down sharply from last week’s high of around 90 points.

Christopher Lewis, senior market analyst at FXEmpire, said in a note on Monday that he expects silver’s upward momentum is just beginning, and any selling pressure should be viewed as a buying opportunity. Read More

Gold hits all-time record high; more upside likely

Gold prices are modestly higher in midday U.S. trading Monday. December Comex gold futures today notched a record high of $2,549.90. Spot (cash) gold prices hit a new all-time high of $2,521.00 overnight. Bullish charts and safe-haven demand are driving the yellow metals prices higher and more upside is likely. Silver is sharply up and is likely to continue to be supported by gold’s price updraft. December gold was last up $7.50 at $2,545.40. September silver was up $0.531 at $29.37.

Broker SP Angel said today in a dispatch that gold prices started to climb Friday afternoon on reports China’s central bank has given new gold- import quotas to Chinese banks, “triggering speculation of a renewed wave of buying.” Chinese 10-year yields fell to record lows last week, with institutions rushing to buy over concerns of growth slowdown and deflation. “As a result, Chinese buyers are seeking alternative safe-haven protection, with gold an obvious candidate,” said the broker.

Technically, December gold bulls have the strong overall near-term technical advantage. Bulls’ next upside price objective is to produce a close above solid resistance at $2,600.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,450.00. First resistance is seen at the overnight contract/record high of $2,549.90 and then at $2,575.00. First support is seen at today’s low of $2,523.70 and then at $2,500.00. Wyckoff's Market Rating: 8.5.

Image Source: Kitco News

September silver futures bulls and bears are on a level overall near-term technical playing field. Bulls have momentum on their side now. Silver bulls' next upside price objective is closing prices above solid technical resistance at $30.00. The next downside price objective for the bears is closing prices below solid support at $27.50. First resistance is seen at $30.00 and then at $30.50. Next support is seen at the overnight low of $28.78 and then at $28.50. Wyckoff's Market Rating: 5.0. Read More

Image Source: Kitco News

Live From The Vault - Episode: 186

Is the dollar doomed? Feat. Andy Schectman

In this week’s episode of Live from the Vault, Andrew Maguire is joined by Andy Schectman, President & Owner of Miles Franklin, one of the first companies to be approved as an authorised reseller of minted products.

The precious metals experts open with a discussion about the Bank of International Settlements Project mBridge, before discussing the widespread repatriation of gold by global central banks amid continued developments in the BRICS saga.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.