Gold Price News: Gold Price Rises As Risk Intensifies

Gold prices pushed higher on Tuesday, building on Monday’s gains, as the markets reacted to a weaker dollar and a rise in geopolitical tensions linked to the Russia/Ukraine conflict.

Prices climbed as high as $2,640 an ounce, compared with around $2,613 an ounce in late trades on Monday. The gains came as the US dollar pulled back at the start of the week from recent highs against other major currencies. The renewed strength came after gold prices sank to a two-month low on November 14th.

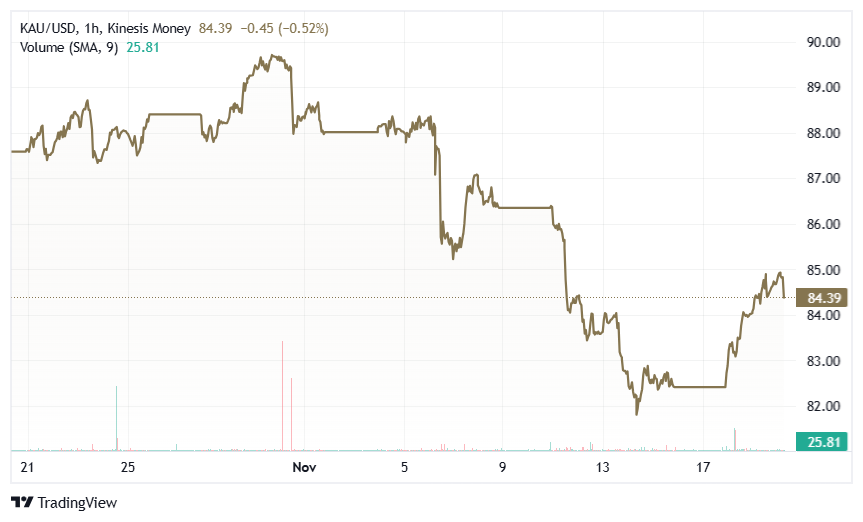

Gold KAU/USD – 1hr view – Kinesis Exchange

Markets fret over conflict risks:

Gold found renewed interest due to its safe-haven appeal at the start of the week, as tensions continued to simmer over the conflict between Russia and Ukraine. Ukraine for the first time fired US-supplied longer-range missiles into Russian territory this week, according to news reports, raising concerns over a general escalation in the conflict.

Market positioning:

Gold’s recent drop to two-month lows came alongside a clear net outflow from gold-backed ETFs in recent days. Investment flows had been declining since late October, but the trend became more pronounced as November got underway. Europe saw outflows of 18.2 tonnes in the week to November 15th, while Asia saw an outflow of 5.7 tonnes, according to World Gold Council figures released on Monday. That followed a net outflow of 10 tonnes from North America the previous week, the figures showed. Read More

Silver Price News: Silver Rebounds from Two-Month Low

Silver prices briefly spiked higher to a one-week high on Tuesday, lifted by strengthening gold prices, although prices drifted later in the session to pare the day-on-day gains.

Prices hit an intraday high of $31.64 an ounce on Tuesday, up from around $31.20 an ounce in late trades on Monday.

Silver KAG/USD – 1hr view – Kinesis Exchange

Silver’s initial strength came as gold prices rebounded from a two-month low on Tuesday, lifted by a weaker US dollar and safe haven interest as the markets were spooked by Ukraine’s use of US-supplied longer-range missiles against targets in Russia. However, silver gave up the earlier gains to trade at just above $31.30 an ounce later on Tuesday afternoon.

Prices fall back from 12-year high:

Silver prices hit a 12-year high in late October, but have since lost ground, falling to their lowest for two months as markets scaled back bets on upcoming interest rate cuts by the major economy central banks. Nevertheless, the markets are pricing in a roughly 60% probability of a 25-basis-point cut by the US Fed in mid-December.

Technical analysis:

On the technical charts, silver’s action on Tuesday shows that the price has moved back up above rising oblique minor support at $30.76 an ounce and is still some way below its 20-day moving average at $32.13 an ounce. In addition, a Fibonacci analysis of the August-to-October bullish move for silver points to support at the 50% retracement level at $30.69 an ounce. Meanwhile, the 10-day Relative Strength Index gives a neutral reading at 46.49 as of Tuesday. Read More

Is the U.S. economy on the brink? The Fed is 'illegal' & there are 'cracks in the empire,' gold price to quadruple if this happens, says Ron Paul

Former U.S. Congressman Dr. Ron Paul doubled down on his long-standing call for the abolition of the Federal Reserve, arguing that the institution is unconstitutional, illegal, and detrimental to the U.S. economy, which is already showing significant cracks.

In an interview with Kitco News, Paul stressed the urgency of addressing the Fed's unchecked power and its impact on the dollar's value.

"The whole system is illegal and unconstitutional," Paul told Kitco News anchor Jeremy Szafron, expressing concern over Fed Chair Jerome Powell's assertion that the president cannot fire him. Paul found it ironic that Powell would invoke the law to defend his position while simultaneously overseeing an institution that Paul considers fundamentally unlawful. Watch the podcast

Investors interest in gold continues to grow as GLD celebrates 20th anniversary

This week, the gold market celebrated a significant milestone, showcasing its growing importance in investment portfolios and the broader global financial marketplace.

The world’s largest gold-backed exchange-traded fund (NYSE: GLD) marked its 20th anniversary. The milestone comes at a mixed time for the precious metal. Investment demand struggled through the first half of the year, even as prices rallied to record highs.

ETF inflows began to improve in late summer as investors positioned themselves for potential interest rate cuts from the Federal Reserve. However, momentum has faltered in recent weeks due to a stronger U.S. dollar and rising bond yields. Since Donald Trump’s decisive victory in the 2025 presidential election, GLD has seen its gold holdings decline by 11.2 tonnes. For the year, holdings are down nearly two tonnes.

Despite the volatility in the gold market, the latest investor survey, published by State Street Global Advisors on GLD’s anniversary, indicates that investment sentiment remains broadly optimistic. Read More

Safe havens rally: Bitcoin taps $95k, gold soars as stocks slide

The safe haven play was in full effect on Wednesday morning, with gold and Bitcoin (BTC) trending higher while stocks sank lower as geopolitical tensions weighed on the minds of investors, who also pared back their stock trading ahead of Nvidia’s earnings report.

While gold is climbing as traders embrace its long history of being a store of wealth, multiple factors are pushing the price of Bitcoin higher, including its cyclical post-halving bullishness and an improving regulatory outlook as Donald Trump continues to nominate pro-crypto individuals to his administration.

“I'm not so sure the price movement is directly tied to the Ukraine-Russia conflict,” said Haider Rafique, a Chief Marketing Officer at OKX. “What seems to be driving the supply shock and price pressure is the sheer volume of large institutional orders.”

“When you analyze the sell pressure below $90K, it’s minimal compared to the overwhelming buy pressure — mostly from institutions, not just retail investors,” he added. “Michael Saylor's continuous large purchases are fueling anticipation, and Cathie Wood's bold $1M target by 2030 has people doing the math, which adds to the momentum.” Read More

Indian gold market fired on all cylinders in October despite record high prices – WGC’s Chacko

Indian gold demand was healthy by all measures through the Diwali festival season despite record-high prices, with investment appeal supporting strong sales, according to Kavita Chacko, Research Head for India at the World Gold Council (WGC).

Chacko wrote in the latest WGC update that the domestic gold price in October “mirrored movements in the international price, although with a slightly higher gain due to the 0.2% depreciation of the Indian rupee (INR) and festive buying support,” with India’s gold price closing the month up 5.5%.

“The rally in gold paused post the US election as the dollar strengthened and Treasury yields rose,” she noted. “In fact, both international and domestic gold prices have fallen by 8% since the end of October. Despite this recent pullback, gold remains one of the best-performing assets this year, with a y-t-d return of 17% in INR terms at the time of publication.” Read More

Gold surges on geopolitical tensions and Putin's nuclear doctrine revision

Gold futures have continued its impressive gains, marking three consecutive days of price advances amid escalating global tensions and significant geopolitical developments. The precious metal's value has been bolstered by recent statements from Russian President Vladimir Putin, who has modified Russia's nuclear doctrine, creating ripples of concern in international markets.

Putin's revised nuclear strategy introduces a provocative interpretation of potential aggression, suggesting that any attack supported by a nuclear power would be considered a joint assault on Russia, potentially triggering a nuclear response. This dramatic policy shift comes shortly after the United States authorized Ukraine to deploy long-range American-made missiles, further intensifying the already complex geopolitical landscape.

Despite the alarming rhetoric, world leaders and strategic analysts are cautiously interpreting Putin's nuclear doctrine update. Many experts view the change as a sophisticated diplomatic maneuver designed to intensify deterrence against Western intervention, rather than a genuine indication of imminent nuclear escalation.

Image Source: Kitco News

The financial markets have responded predictably to these mounting uncertainties. Gold futures have demonstrated remarkable resilience, experiencing substantial gains this week. As of 6 PM ET, the December contract is priced at $2,631, representing a net increase of $16.40 or 0.63%. The cumulative gains this week have reached an impressive $86.70, with significant daily increments of $49 on Monday, $20 the following day, and an additional $18 today. Read More

There is no reason to revise gold forecasts after correction - Mind Money CEO

Despite some selling pressure overnight, the gold market has managed to push to another key resistance point at $2,650 an ounce.

Gold’s recovery from last week’s significant selloff has prompted a growing chorus of analysts to assert that the precious metal’s rally is not over yet. At the start of the week, Goldman Sachs reiterated its forecast for gold prices to hit $3,000 an ounce, and they are not the only ones anticipating record highs in 2025.

“The current drop in gold is a correction, not a reason to revise forecasts,” said Julia Khandoshko, CEO of the European brokerage Mind Money, in an exclusive comment to Kitco News.

Khandoshko said it's only a matter of time before gold pushes back to last month’s all-time high of $2,800. She added that she expects gold prices to reach $3,000 an ounce in 2025.

“Despite the current short-term fluctuations, the long-term prospects for gold remain the same. The main factors driving gold's growth, such as geopolitical tensions, the strengthening role of the East, and global inflation, remain unchanged and continue to push the price of the metal,” she said. “These trends will not be altered by the outcome of the U.S. elections. Even if short-term euphoria arises in markets like cryptocurrency, it does not change the overall trends.” Read More

Gold rallies on more bargain hunting, short covering

Gold prices are solidly higher and silver slightly down in midday U.S. trading Wednesday. Gold bulls have momentum as the market is seeing some mild safe-haven demand and more short covering and bargain hunting at mid-week. December gold was last up $21.00 at $2,652.20 and December silver was down $0.077 at $31.18.

Market participants are less nervous at mid-week, following Russia saying it is lowering its bar on using nuclear weapons against adversaries. There was some relief after Russian foreign minister Sergei Lavrov said Russia would "do everything possible" to avoid a nuclear war.

Technically, December gold bulls and bears are back on a level overall near-term technical playing field. However, bulls have momentum as a price downtrend on the daily bar chart has been negated. Bulls’ next upside price objective is to produce a close above solid resistance at $2,700.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the November low of $2,541.50. First resistance is seen at $2,675.00 and then at $2,700.00. First support is seen at the overnight low of $2,621.90 and then at $2,600.00. Wyckoff's Market Rating: 5.0.

Image Source: Kitco News

December silver futures bears have the slight overall near-term technical advantage. However, a price downtrend on the daily bar chart is now in jeopardy. Silver bulls' next upside price objective is closing prices above solid technical resistance at $33.00. The next downside price objective for the bears is closing prices below solid support at the November low of $29.75. First resistance is seen at this week’s high of $31.615 and then at $32.00. Next support is seen at the overnight low of $30.89 and then at $30.50. Wyckoff's Market Rating: 4.5. Read More

Image Source: Kitco News

Gold is giving back $250 election premium, $300 China premium at risk from stimulus – Société Générale

Gold delivered the predicted returns in the run-up to the U.S. election, and while the long-term drivers remain in place, the precious metal is likely to take a breather in the near term, according to analysts at Société Générale.

“Gold has recently disconnected from its traditional drivers, such as US real interest rates and the strength of the US dollar,” they wrote in the latest 2025 Outlook – Global Asset Allocation published on Nov. 19. “This divergence has largely been influenced by the uncertainty surrounding the US election and the build-up of a premium in gold prices. Now that the election is over, the key question is what the future holds for gold in both the short and long term.”

The analysts said that $250 per ounce worth of the gold price rally that was seen ahead of the U.S. election was not justified by the usual drivers, and that additional premium is now evaporating. “With the US election behind us, gold is gradually reconnecting with the strong appreciation of the US dollar and the increase in real interest rates observed in October and November started to exert downward pressure on prices,” they said.

“Long speculative future positions started to be liquidated from overextended levels and we expect this to continue in the short term,” the analysts wrote. “This should lead to the election premium partially fading and should see gold price weakness in the short term. The long-term drivers, namely large central bank gold purchases, growing US public debt, increased geopolitical risks, and global uncertainties stemming from a polarising world, all point to continued support for gold.” Read More

The U.S. to be forced into 'something drastic' to save the dollar: Revalue gold or adopt Bitcoin standard? Mark Moss weighs in

Bitcoin is experiencing not just a price rally, but a revolution, according to Mark Moss, host of the Mark Moss Show, as the digital asset hit new all-time highs above $94,000.

In an interview with Kitco News, Moss argued that the U.S. government's increasing debt levels are pushing asset prices up, with Bitcoin being one of the few assets that can consistently outpace the rate of monetary inflation.

"Most people were expecting a crash," Moss told Kitco News anchor Jeremy Szafron. "But there's a reverse crash where prices go up so fast that I also can't afford the same quality of life. The outcome is the same as the crash – 'I can't afford the same quality of life.' But instead of crashing down, it crashes up, and that is what's happening."

Moss pointed out that investors need to beat not the inflation rate but the real rate of debasement, which is around 10%, to succeed in this environment. "When the S&P 500 is adjusted for M2 money supply, it hasn't made a new all-time high since 2000," he said. Watch the podcast

Rollercoaster markets: Bitcoin breaks $95k, gold rises, stocks see mixed results

Traders experienced a bit of a rollercoaster ride on Wednesday as asset prices fell under pressure early in the day but rallied higher into the market close despite anxieties about Nvidia’s earnings report and escalating geopolitical tensions.

Amid the volatility, gold did what it does best and offered investors a safe haven from the turmoil, climbing back above $2,645 per ounce while other markets were seeing red. At the time of writing, spot gold trades at $2,649.60/oz for a gain of 0.71% on the session.

Equities markets opened lower amid the mounting headwinds and traded in the red for most of the day before rallying in the last hour of trading. At the market close, the Dow finished up 0.32%, the Nasdaq lost 0.11%, and the S&P finished flat.

Data provided by TradingView shows that Bitcoin (BTC) started the day with a rally to a new all-time high of $95,000 but fell under pressure after notching the new record, sliding back down to support at $92,000. But that pullback was short-lived, and bulls soon pushed it back above $94,000. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.

Featured Image - Source: Unsplash