Gold Price News: Gold Holds Steady Below $2,950

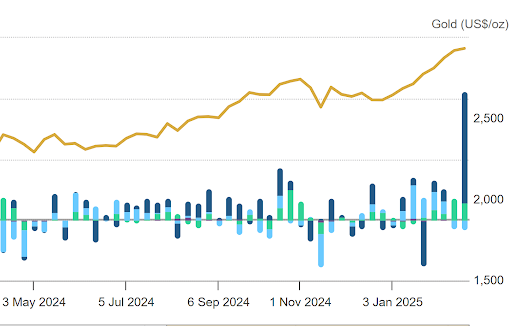

Gold prices were range bound on Friday, holding just below their recent all-time highs.

Prices moved in a range of $2,917 to $2,951 an ounce on Friday, compared with Thursday’s all-time intraday high of $2,956 an ounce.

The relative stability followed strong gains earlier in the week as gold prices continued to benefit from a flight to safety amid economic uncertainty and heightened geopolitical risk. These factors have been driven by worries over the impact of US trade tariffs and concerns over the shape of any deal to end the war between Russia and Ukraine.

China’s central bank continues to buy gold:

On the demand side, China’s official gold holdings rose for a third straight month in January, after the People’s Bank of China bought five tonnes, according to the World Gold Council: China’s gold market update: Central bank purchases continue in January. The bank’s latest purchases lifted China’s official holdings to 2,285 tonnes, or 5.9% of total foreign reserves. This followed total gold purchases of 44 tonnes by the PBoC in 2024 which came despite a six-month pause in the middle of the year. Read More

Silver Price News: Silver Drifts as Early Gains Unwind

Silver prices eased on Friday, having scaled the $33.50 mark earlier in the day.

Prices briefly spiked as high as $33.49 an ounce on Friday, although this level could not be sustained, and prices fell back to $32.50 an ounce later in the session. That compared with around $33.00 an ounce in late trades on Thursday.

Political uncertainties maintain safe-haven interest:

Precious metals continued to attract safe-haven interest amid uncertainty over the Russia/Ukraine conflict after US President Donald Trump called Ukrainian President Volodymyr Zelensky a ‘dictator’, raising tensions as efforts continue to find a peace deal.

Uncertainties also continued on the macroeconomic front, after President Trump last week announced plans to impose a 25% tariff on cars, pharmaceuticals and semiconductors as soon as April 2nd. The latest announcements further amp up the risks of a wider trade war between the US and its global trading partners. While this outcome could dent demand for industrial goods which rely on silver, it can also trigger increased investment in silver due to its role as a safe-haven precious metal. Read More

Gold price surging: record highs and bullish momentum point to $3,000

Volatility in the gold market is picking up as the yellow metal set another record high this week. And while risks are building, the bullish trend is difficult to ignore as analysts continue to keep an eye on $3,000 an ounce next week.

The gold market has been on an unprecedented winning streak, ending the last eight weeks not only in positive territory but at all-time highs. The precious metal is on its longest weekly rally since mid-2000, when prices made their first run to $2,000 an ounce. Spot gold last traded at $2,935.80 an ounce, roughly flat on the day and up more than 2% from last Friday’s close.

At the same time, silver is seeing its fifth consecutive week of gains in an environment of higher volatility. Spot silver last traded at $32.51 an ounce, down more than 1% on the day but up 1% on the week.

Although the gold market is looking a little overpriced, Christopher Vecchio, Head of Futures & Forex at Tastylive.com, said he can’t ignore the bullish momentum that is supported by solid fundamentals. Read More

Mining industry faces investor apathy despite rising gold prices – S&P Global analyst

The mining industry is grappling with a severe case of investor apathy despite soaring gold prices, according to Kevin Murphy, Research Director for Metals and Mining at S&P Global Market Intelligence.

Speaking with Kitco Mining at the 2025 Mines Money conference in Miami, Murphy highlighted a divergence in the commodities market, with gold prices "flirting with $3,000 an ounce" while other metals like nickel and zinc are "languishing."

Murphy noted that junior mining companies are finding it increasingly difficult to raise capital. "If you're trying to finance a project right now, it's not the easiest financing is on in general or on a downtrend," he said. Critical mineral projects in the advanced stages are more likely to receive funding, while raw exploration projects struggle.

The reluctance to invest in junior mining firms can be traced back to the 2010-2011 bull run, which was followed by a cataclysmic downturn. Many companies entered that period with significant debt, and when commodity prices crashed, shareholders suffered. "We saw a definite turn away at that point from a lot of institutional investors," Murphy explained.

Traditional institutional investors have aged out, and younger investors are not drawn to the mining sector. "We're not a cool industry for kids," Murphy lamented, adding that millennials often view mining negatively. The industry has also failed to advocate for itself, allowing negative perceptions to persist. Watch the podcast

Trump will tag along as Musk visits Fort Knox gold reserve: “We want to see if the gold is still there”

Following Elon Musk’s announcement last week that he wants to personally audit the United States’ gold reserves at Fort Knox on behalf of the Department of Government Efficiency (DOGE), President Trump now says that he intends to come along.

Trump announced on Saturday during his appearance at the Conservative Political Action Conference (CPAC) that he would be going with Musk. “Would anybody like to join us?” he asked the audience. “Because we want to see if the gold is still there.”

“We’re going to take a look and if there’s 27 tons of gold, we’ll be very happy,” Trump told the audience. “I don’t know how the [expletive] we’re going to measure it, but that’s okay. We want to see lots of nice, beautiful, shiny gold in Fort Knox.”

“Wouldn’t that be terrible if we opened it up and there was no gold there?” Trump continued. “So we’re going to open those doors.”

As Musk had done previously, the president also suggested that the gold may actually be missing, saying “Don’t be totally surprised [if] we opened the door, we say, ‘There’s nothing here, they stole this too!’”

Treasury Secretary Scott Bessent said last week that there is an audit every year and that “all the gold is present and accounted for.”

Neither Trump nor Musk have provided a timeline for when they would visit the gold reserve. Read More

Gold may be peaking before a bear market slump; silver supply rises as coin demand slides – Heraeus

Gold prices may be peaking before they enter a prolonged period of decline, while silver mining production is growing even as coin demand shrinks, according to precious metals analysts at Heraeus.

In their latest precious metals update, the analysts warned that while gold’s performance over the last 18 months has been remarkable, prices may be reaching a top. “As the price nears $3,000/oz, signs of excess frothiness are becoming clearer, despite what appear to be firm fundamental drivers,” they wrote.

On the one hand, strong buying from central banks and investors is continuing to support the gold price. “Central banks look set to continue to accumulate gold this year, though perhaps at a slower pace than last year,” they said. “The PBOC added another 5 tonnes to its reserves in January. Investor ETF inflows have been robust since the start of the year, netting 34.5 tonnes of inflows year-to-date, versus 6.8 tonnes of net outflows in 2024.”

But, the analysts noted that not all the fundamental drivers are positive for the yellow metal.

“A high gold price has eroded jewellery demand in many countries, most significantly in China, the largest market, where demand fell by 24% last year while recycling increased,” they said. “A ceasefire in the Middle East and tentative steps to a ceasefire in Ukraine may ease safe-haven flows, although uncertainty around US tariffs could shift the focus. The flows of metal to the US ahead of potential tariffs have been notable, but it is unclear how much is new demand and how much is just a reorganisation of the location of storage for the bars.” Read More

Equinox merging with Calibre Mining to create Canada’s second-largest gold producer

Momentum in the gold market is not just attracting investor attention—it’s also driving new activity in the mining sector, with another friendly merger between equals.

On Sunday, Equinox Gold and Calibre Mining announced that they were merging to create a major Americas-focused gold producer. The new Equinox company would become Canada’s second-largest gold producer.

Under the agreement, Equinox will acquire all issued and outstanding common shares of Calibre through a court-approved plan of arrangement. Under the terms of the agreement, Calibre shareholders will receive 0.31 Equinox common shares for each Calibre common share held immediately. Equinox stated that the implied market capitalization of the combined company is estimated at C$7.7 billion.

The merger will create a diversified gold producer with a portfolio of mines in five countries across the Americas, anchored by two high-quality, long-life, low-cost Canadian gold mines: the Greenstone Mine in Ontario and the Valentine Gold Mine in Newfoundland & Labrador.

Valentine is still under construction and is expected to see its first gold pour in mid-2025. Equinox noted that collectively, these two cornerstone assets are expected to produce an average of 590,000 ounces of gold per year once operating at full capacity. Read More

Gold pokes to record high as traders/investors seek safety

Gold prices are modestly higher at midday Monday but did inch to another all-time high today. Safe-haven demand, including via investors purchasing gold ETFs, and technical buying continue to be featured. Silver prices are lower at midday and are starting to lag gold. April gold was up $7.20 at $2,960.10. March silver prices were last down $0.392 at $32.625.

Geopolitical worries that include a shaky Israel-Hamas ceasefire, uncertainty regarding Russia-Ukraine war ceasefire talks, and U.S. trade protectionism threats are all working to support the gold market.

Technically, April gold futures bulls have the strong overall near-term technical advantage. Prices are trending up on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $3,000.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,850.00. First resistance is seen at today’s contract/record high of $2,974.00 and then at $2,985.00. First support is seen at the overnight low of $2,936.80 and then at $2,900.00. Wyckoff's Market Rating: 9.0.

Image Source: Kitco News

March silver futures bulls have the overall near-term technical advantage amid a price uptrend in place on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at the February high of $34.24. The next downside price objective for the bears is closing prices below solid support at $31.65. First resistance is seen at the overnight high of $33.12 and then at $33.50. Next support is seen at $32.00 and then at $31.65. Wyckoff's Market Rating: 6.5. Read More

Image Source: Kitco News

About time… gold-backed ETF demand surges to a nearly five-year high

Image Source: Kitco News

Gold’s climb to the $3,000 level may be slowing, but it hasn’t stopped, and it appears investors are finally getting the message as demand for exchange-traded funds has surged higher.

Data from the World Gold Council shows that last week, 48 tonnes of gold valued at $4.6 billion flowed into North America-listed gold-backed ETFs, the biggest one-week surge since early April. The renewed investment demand came as gold prices posted their eighth consecutive weekly gain while setting a new record high.

The gold market continued to inch higher on Monday, with spot gold last traded at $2,941.40 an ounce, up 0.21% on the day.

Some analysts have said that it may only be a matter of time before investment demand pushes gold to $3,000 an ounce.

“At 84.2 million ounces on Feb. 20, total known gold ETF holdings have recovered to the highest level since the start of 2024,” said Mike McGlone, senior commodity strategist at Bloomberg Intelligence. “It's not surprising to expect a shift to gold ETF inflows in 2025, especially if there's a bit of a reversion in the rapidly rising U.S. stock market and high interest rates.” Read More

Gold shines on: record-breaking rally approaches $3,000 milestone amid global uncertainties

In what appears to be an extraordinary display of market resilience, gold prices are entering their ninth consecutive week of gains, consistently closing higher than their Monday opening bids.

This remarkable performance has propelled the precious metal to unprecedented heights, with April gold futures closing at a record $2,953.20 last week after advancing $52.50 (1.81%). The momentum continues unabated, with gold briefly touching an all-time intraday high of $2,973.40 last Thursday—a record that proved short-lived as investors pushed prices to an intraday high of $2974 today.

As of 4:45 PM EDT, the most active April gold futures contract stands at a new historic peak of $2,963.20, representing a daily gain of $10 (0.34%). This positions gold merely $37 away from the psychologically significant milestone of $3,000 per troy ounce, a threshold that seemed distant just months ago.

Image Source: Kitco News

Gold has appreciated approximately 12% since the beginning of 2025, with recent price action largely attributed to major trade policy changes implemented by U.S. President Donald Trump. The administration's aggressive stance on international trade has introduced significant market uncertainties, as the president has threatened tariffs on both allies and adversaries.

Initially, Trump set in motion tariff impositions targeting China, Mexico, and Canada. While negotiations with Mexico and Canada resulted in a 30-day postponement of these measures, the United States proceeded to implement a 10% tariff on Chinese imports. Furthermore, the president has signaled intentions to expand these protectionist policies, promising additional tariffs on steel and aluminum products from various exporting nations beginning in March.

Notably, today's gold price advances occurred despite modest dollar strength, with the U.S. dollar index gaining 0.07% to reach 106.62. This suggests that gold's current rally transcends traditional inverse correlations with the dollar, highlighting the depth of investor conviction in the metal's safe-haven properties. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.

Featured Image - Source: Unsplash