Image Source: Unsplash

Gold Price Pushing Forward With Three Month High as Ukraine Tensions Escalate

Kinesis Money Gold Analysis: As is well known, bullion has historically proven to be a safe haven during market turmoil, particularly during the escalation of geopolitical tensions. Therefore, it was little surprise to see gold at a 3-month-high last Friday afternoon.

After growing tensions between Russia and Ukraine, bullion sharply surpassed the $1,835 resistance level, accelerating to $1,860. In today’s early trading, gold is down but still holding above $1,850, while investors are looking for more clarity about the Ukraine situation.

Image Source: Kinesis

From a technical point of view, the surpass of the $1,835 resistance zone could be seen as a bullish signal, with the resilience shown last week after the release of U.S. inflation data, now becoming a strength.

After the spike seen last Friday afternoon, gold started today’s trading with lower volatility. The first support zones are placed at $1,850 and $1,835, while the top reached in November at $1,875-1,880 represents a clear resistance.

Kinesis Money Silver Analysis: Read More

Global fears drive gold and crude higher

In typical fashion, gold and crude oil exploded late Friday after news of a possible Russian push into Ukraine. The moves came after the old pit hour closings, which told us a couple of things. The sharp upside was a combination short squeeze and FOMO trade.

We have been long crude most of the year with a couple of reversals. Gold has reversed to the long side of the market, although I’m not a huge fan of short squeeze fear moves. However, I will follow the algorithm and have already reversed to the long side.

Although we are long now, I would not be surprised if gold fails. Moves based on fear tend to fizzle quickly; it would be no surprise to see gold, crude, and bonds be under some pressure. However, our reversal signal to flip back is far away. As of today, the reversal in gold to short is around 1800. Read More

Royal Mint sees record bullion demand from American investors

Investors avoided paper gold through most of 2021. However, according to the Royal Mint, investors had an insatiable appetite for physical gold and silver in the last quarter of 2021.

In a press release published last week, the British mint said that it saw record international demand for its bullion products, with American investors leading the drive for precious metals.

The Royal Mint said that international sales in the fourth quarter of 2021 increased 14.4%, compared to the same quarter of 2020. At the same time, purchases of one-ounce Britannia bars and coins from American consumers increased 96%.

Meanwhile, international sales of silver bullion increased 34% in the final quarter of last year. Read More

Gold, silver solidly up on geopolitical, inflation jitters

Gold and silver futures prices are posting good gains in midday U.S. trading Monday, with gold notching a nearly three-month high. This trading week is starting out "risk-off," which is prompting safe-haven buying in the precious metals markets. The other element supporting the metals markets is heightened inflation concerns, as U.S. inflation is running at a 40-year high. April gold futures were last up $21.70 at $1,863.80 and March Comex silver was last up $0.401 at $23.77 an ounce.

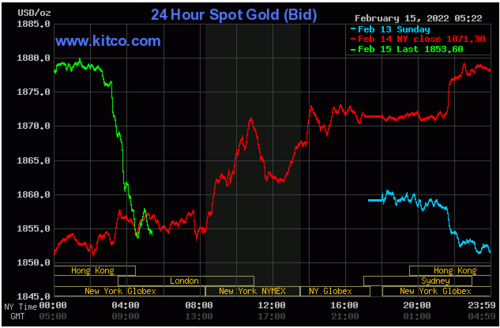

Image Source: Kitco.com

Technically, April gold futures prices hit a nearly three-month high today. Bulls have a solid overall near-term technical advantage and gained more power today. Bulls' next upside price objective is to produce a close above solid resistance at the November high of $1,882.50. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,800.00. First resistance is seen at today's high of $1,872.80 and then at $1,882.50. First support is seen at today's low of $1,851.90 and then at $1,840.00. Wyckoff's Market Rating: 7.5. Read More

TDS stopped out of short-gold bet, but remains bearish

Renewed safe-haven demand has caught one Canadian bank on the wrong side of the gold market as TD Securities announced that it was stopped out of its short gold trade.

TD Securities has been short gold since late January after the Federal Reserve announced that it would raise interest rates "soon." It has been short gold at $1,821 an ounce, looking for prices to fall to a low of $1,740 an ounce.

Monday, gold prices pushed it to a new three-month high of $1,872.80 an ounce as geopolitical tensions have intensified between the U.S. and Russia. The safe-haven push started on Friday after the U.S. government recommended U.S. citizens leave Ukraine during the weekend.

"U.S. reports of high risks of an imminent invasion sent gold prices through our stop," TDS commodity analysts said in their latest note. Read More

Inflation is at a four-decade high, could a recession be next?

Inflation is now at yet another four-decade high, with the headline consumer price index surpassing (CPI) December's reading of 7% to reach 7.5% in January, according to the latest data release from the Bureau of Labor Statistics.

All eyes are now on the reaction of the Federal Reserve. Michelle Makori, editor-in-chief of Kitco News, discussed likely responses from the U.S. central bank, as well as the assets that will benefit most from a high inflationary environment, with Mike Lee, founder of Mike Lee Strategy, and David Nelson, chief strategist of Belpointe Asset Management LLC. Read More

Gold is more than just a safe-haven asset and can fit in all portfolios - WGC's John Reade

Safe-haven demand is pushing gold prices to a three-month high but will rising geopolitical tensions create a sustainable bid in the precious metal.

On Monday editor Neils Christensen recorded a podcast with Phillip Streible, chief market strategist at Blue Line Futures. The guest was John Reade, chief market strategist of the World Gold Council. The three talked about the health of the global marketplace. Listen to the podcast

Gold price jumps $32 on confusion over Ukraine tensions

The gold market continues to benefit from its safe-haven appeal as Russia-Ukraine tensions confuse and add fear to the marketplace.

There was a lot of confusion over sarcastic comments made by Ukraine President Volodymyr Zelenskiy about February 16 being identified as the day Russia plans to attack Ukraine.

In a video message on Monday, Zelenskiy declared this upcoming Wednesday a “day of unity,” instead of what many in Western media cite as a possible start of a Russian invasion.

"They tell us Feb. 16 will be the day of the attack. We will make it a day of unity," Zelenskiy said. "They are trying to frighten us by yet again naming a date for the start of military action," Zelenskiy said. "On that day, we will hang our national flags, wear yellow and blue banners, and show the whole world our unity." Read More

Gold, dollar act as safe-haven assets as tensions continue between Russia-Ukraine

As geopolitical tensions continue to rise on the border of Russia and Ukraine, both gold and the U.S. dollar are truly acting as safe-haven assets. Currently, there has not been a diplomatic solution to the geopolitical tensions as Russia continues to move troops and equipment to the border of Ukraine and Russia. Russia continues to have military exercises on two of Ukraine’s borders. The United States has moved some troops into NATO countries. Collectively we are seeing a flight to safety which is playing out in exactly the scenario you would expect to see in such a tense geopolitical environment. U.S. equities continue to trade under pressure, although today’s declines are mild to moderate. Dollar strength is evident, and most importantly, gold has seen substantial gains with moves almost parabolic.

Image Source: Kitco.com

The dollar is currently up by almost 3/10 % (0.30%), with the dollar index currently fixed at 96.355. Gold has exhibited sharp gains, and as of 4:10 PM, EST is currently fixed at $1874.50, a gain of $32.40. Considering that gold hit a low just below $1780 on January 28, the precious yellow metal has risen almost $100 in the last 12 trading days. Looking at a candlestick chart, we can see an abundance of daily green candles (this occurs when a commodity or stock closes above its opening price). Read More

Mortgage rates have now reached 'breaking point'; Investors need to watch this major market risk - Ted Oakley

Mortgage rates are at the highest level since 2020, with the 30-year mortgage at 4%. This is in comparison to last year when the 30 year was down to 2.8%. "The consumer is going to be under pressure, and we already saw mortgage applications go way down in the last few months. That is what is happening in the marketplace," emphasized Ted Oakley, Founder of Oxbow Advisors. "I suspect that the 4% rate on the 30-year mortgage is a breaking point."

Oakley discussed mortgages and interest rates, and markets with David Lin, Anchor at Kitco News. Read More

Gold pushes higher again leading into the European open

Gold (0.25%) climbs again overnight as geopolitical concerns boost demand for the yellow metal. Silver is down almost half a percent in early trade. In the rest of the commodities complex, copper has risen 0.12% and spot WTI has dropped 0.26%.

Indices were mixed overnight as the Nikkei 225 (-0.79%) and ASX (-0.52%) both fell but the Shanghai Composite rose half a percent. Futures markets in Europe are pointing towards a negative cash open.

In FX markets the biggest mover overnight was NZD/USD which rose 0.20%. Lastly, in the crypto space, BTC/USD rose 2.76%. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.