Image Source: Unsplash

These are the commodities that will boom in EV transition - Kendra Johnston

As the world transitions into the electrical vehicle revolution, there will be a number of investment opportunities for commodities used in that transition. "There's huge opportunities for some of those critical minerals that are needed for electrification for the low carbon future for the green economy," Kendra Johnston, President, and CEO of AME explained.

"We absolutely need to explore more, find more of these commodities that are not only economic, but also that could be produced in an environmentally sustainable and socially responsible way." Read More

Gold prices are posting double-digit advances in midday U.S. trading Wednesday, as bullish bargain buyers stepped up to buy the early weakness. Bullish outside markets that include sharp gains in crude oil prices and a weaker U.S. dollar index also worked in favor of the precious metals market bulls today. April gold futures were last up $14.60 at $1,871.00 and March Comex silver was last up $0.213 at $23.555 an ounce.

Traders at midday were awaiting the afternoon release of the FOMC meeting minutes. The minutes may not provide much markets reaction as it appears the marketplace may have already dialed in an aggressive Federal Reserve monetary-policy-tightening pace in the coming months.

Technically, April gold futures bulls have a solid overall near-term technical advantage. Prices are trending higher on the daily bar chart. Bulls' next upside price objective is to produce a close above solid resistance at the November high of $1,882.50. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,821.10. First resistance is seen at $1,875.00 and then at $1,882.50. First support is seen at today’s low of $1,851.80 and then at this week’s low of $1,845.40. Wyckoff's Market Rating: 7.5. Read More

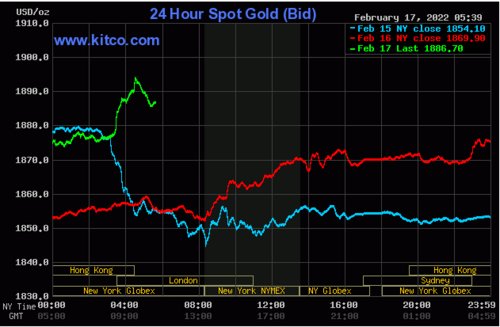

Image Source: Kitco.com

Gold price at session highs as Federal Reserve acknowledges inflation risks in latest monetary policy meeting minutes

The gold market is holding on to solid gains, trading at session highs as the Federal Reserve highlights the risk of rising inflation and the need for tighter monetary policy, according to the minutes from the January monetary policy meeting.

"Some participants commented that elevated inflation had broadened beyond sectors most directly affected by those factors, bolstered in part by strong consumer demand. In addition, various participants cited other developments that had the potential to place additional upward pressure on inflation, including real wage growth in excess of productivity growth and increases in prices for housing services. Participants acknowledged that elevated inflation was a burden on U.S. households, particularly those who were least able to pay higher prices for essential goods and services," the minutes said.

"In discussing why beginning to remove policy accommodation could soon be warranted, participants noted that inflation continued to run well above 2 percent and generally judged the risks to the outlook for inflation as tilted to the upside," the minutes also showed. Read More

Gold can fall 20% as Fed hikes rates, but there is a floor - Wharton professor

Over the long term, gold has proven itself to be a reliable hedge against inflation. However, its track record over the short term is not as stable, but that doesn't mean it doesn't have value as an investment asset, according to research from the top business school in the U.S.

In September, Wharton finance and economics professor Urban Jermann published a paper outlining the extra value in gold beyond its intrinsic value as jewelry.

"The model implies that on average more than half of the value of gold is due to its role as an investment asset," Jermann said in his research paper. "What the model does is show us a way to think about gold as bonds where interest rates matter. But it's not just a simple bond. It's a bond with an option [to sell at a floor price]."

Jermann's research in gold's investment value comes as the Federal Reserve looks to raise interest rates to combat rising inflation pressures. Read More

Gold price is ready for 'substantial' move as inflation gets worse, war looms in Europe - Gary Wagner

Tensions in Eastern Europe, as well as inflation that is unlikely to dissipate soon, are forces that will push gold to move "substantially", said Gary Wagner, editor of TheGoldForecast.com.

Importantly, if war does break out, a sustained geopolitical crisis would push both the U.S. dollar and gold up together, Wagner told David Lin, anchor for Kitco News. Read More

Rally for 'wrong' reasons? Gold price eyes high levels as Russia-Ukraine tensions get mixed with Fed policy mistake calls

Gold has benefited from its safe-haven appeal as markets assess the Russia-Ukraine risk. And according to MKS PAMP, this geopolitical conflict could have even a more significant impact because of the current macro environment that has investors pricing in a policy mistake by the Federal Reserve.

"The U.S. has the highest inflation since 1982, coinciding with a Fed that is still technically easing (the market incorrectly assumes tapering is tightening, but the Fed is simply adding less liquidity)," said MKS PAMP's head of metals strategy Nicky Shiels.

With inflation running at new four-decade highs in the U.S., markets are worried that the Federal Reserve has already made another policy mistake by acting too late.

"Markets are shifting from pricing in a past recent Fed mistake (incorrectly reading inflation & calling it transitory) to a potentially new Fed mistake (early recession on aggressive rate hikes or untamable inflation)," Shiels noted. Read More

Ukraine – Russia conflict and inflationary levels continue to move gold to higher ground

The same two factors that have dominated gold’s recent advance to higher pricing remain firmly fixed in the sentiment of market participants. Inflation continues to run hot, with the continuity of recent reports which indicate that the level of inflation continues to spiral to higher ground. The geopolitical tensions between Russia and Ukraine continue to grow. Today the United States indicated that Russia continues its troop buildup on the borders of Ukraine.

Image source: Kitco.com

As of 4:50 PM EST gold futures basis, the most active April 2022 contract is fixed at $1870.70, after factoring in today’s net gain of $14.40 or 0.78%. Spot-Forex gold has also shown significant gains today of $15.60 or 0.85% and is fixed at $1868.30. Silver futures basis the most active March contract had respectable gains of 1.34% or $0.233 and is currently fixed at $23.57. Read More

Could rising mortgage rates trigger the next housing crisis? These are the best real estate investment strategies – Briton Hill

With mortgage rates now at the highest level since January 2020, homeowners may be worried about a slowdown in demand and a correction in prices.

Briton Hill, president of Weber Global Management, discusses with David Lin, anchor for Kitco News his outlook for the real estate markets in the U.S., as well as some of the best property investment strategies.

Hill said that there are three main macroeconomic forces at play that will affect the real estate markets: inflation, supply chain issues, and rising interest rates. Read More

60% market crash, governments seizing your money, shortage of food: Todd Horwitz's scary outlook

The Federal government of Canada recently invoked the Emergencies Act for the first time in Canadian history in response to the trucker protest in Ottawa.

Todd Horwitz, chief market strategist of BubbaTrading.com told David Lin that the stripping away of personal freedoms is not exclusive to Canada, and is only going to get worse around the world.

“That’s where governments are going anyways,” Horwitz said. “When people continue to vote in the directions that they vote and they give up their freedoms, you are proving to the government to do this because you keep voting in the same people that don’t belong there.” Read More

Gold pushes higher ahead of the European open as Russia/Ukraine tensions rise

Gold (0.3%) has managed to push higher once again as the Russia/Ukraine-inspired risk-off tone kicks in once more. Silver (-0.30%) has lost ground and now trades at $23.53/oz. In the rest of the commodities complex, copper is 0.29% lower and spot WTI rose 2.29%.

In the Asia Pac area, the Nikkei 225 (-0.83%) fell but the ASX (0.16%) and Shanghai Composite (0.06%) managed to hold up. Futures in Europe are pointing towards a negative open.

FX markets were quiet overnight and NZD/USD was the biggest mover and rose 0.28%. In the crypto space, BTC/USD fell 0.14% to reach $43,835. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.