Image Source: Unsplash

European Economic Recovery Remains on Track But Ukraine Could Derail Optimism

The continued escalation in tensions over Ukraine has proved supportive for gold as investors seek out the haven asset and reduce their exposure to equities in the event of a stock market plunge if military conflict were to break out.

Image Source: Kinesis

The price is now challenging the $1,900 an ounce mark, or $61 a gram, levels not seen since June 2021.

So far, the precious metal has met resistance as it tries to successfully clear these psychologically important levels so the next few days will be key in determining whether fears over Ukraine can outweigh the encouraging data on the economic front as well as the likelihood of a series of interest rate hikes this year by central banks with the latter two factors applying the brakes to further gold gains. Read More

Inflation peak - high risk or opportunity for gold?

Not only won't inflation end soon, it's likely to remain high. Whether gold will be able to take advantage of it will depend, among others, on the Fed.

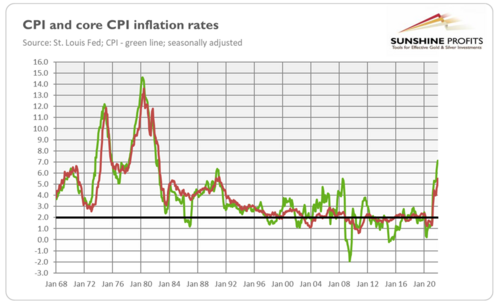

Do you sometimes ask yourself when this will all end? I don't mean the universe, nor our lives, nor even this year (c'mon, guys, it has just started!). I mean, of course, inflation. If only you weren't in a coma last year, you would have probably noticed that prices had been surging recently. For instance, America finished the year with a shocking CPI annual rate of 7.1%, the highest since June 1982, as the chart below shows. Read More

Image Source: Kitco News

Gold stalls at lofty levels with U.S. markets closed

Gold has hit its highest level since June 3, 2021, off the back of the risk-off sentiment and geopolitical issues between Russia and Ukraine. At the beginning of the week, some headlines hit the wires suggesting that Russia's Putin would be willing to talk to U.S. president Biden.

Subsequently, the price of gold fell very slightly at the start of the session, but the most recent headlines have been noting some fire between the two nations. It seems like price action is governed by fundamentals at the moment.

Looking closer at the technicals on the daily chart, the price is approaching a key technical area. The orange resistance line is a low volume node on the volume profile indicator, but it is also the resistance zone at $1919.4/oz from June 1, 2021. If the level is broken, that would be the highest gold price for around nine months. Another key point about that price area is that it is close to the 61.8% Fibonacci retracement zone measuring from the all-time high to the swing low at $1673.3/oz. Read More

Image Source: Kitco News

Gold, silver, and platinum stall but Strong

Gold, silver, and platinum have had quite the move; all three pushed to new recent high. Now they are stuck at resistance as they figure out if they will break out or break down. That answer will take days or weeks to be answered.

All three are in similar patterns, but are slightly different. Gold has had the most dramatic move. In other words, the speed of the gold rally was too parabolic. It must rest or consolidate before continuing the rally. The critical level for gold is $1,900, like the $1,800 level seen a few weeks ago.

Platinum, like gold, has also moved too fast to $1,100 and must build a base before continuing the rally. Once again, the speed of the up move cannot be sustained, and consolidation should be next.

From a pattern standpoint, silver has been the best and most complete. The pace of the silver rally has been more consistent with the steadiest move and is the most likely to continue higher from here. Read More

Geopolitical uncertainty dominates gold market as prices hold near $1,900

The precious metals market remains at the mercy of geopolitical uncertainty as gold prices appear to be consolidating below $1,900 an ounce in thin holiday trading.

Overnight gold prices pushed to a fresh eight-month high of $1,910.80 an ounce as investors digested news over the weekend that Russia and Belarus announced they would extend their military drills, which were expected to end Sunday.

However, gold prices fell from their session highs following news that France's President Emmanuel Macron proposed summit talks between Russia and the U.S.; however, either side has officially agreed to talks.

Looking ahead, most analysts have said that if geopolitical tensions remain elevated, then gold prices have a good shot of holding gains above $1,900. On the other side of the argument, analysts note that if tensions start to relax, gold prices could easily give up all their recent gains. Read More

Geopolitical uncertainty isn't sustainable, gold price to head to $1,600 by year-end - Capital Economics

Gold prices are trading near their highest level since June, just below $1,900 an ounce; however, one research firm said that at some point, geopolitical uncertainty will give way to bearish fundamentals.

In a report published Monday, analysts at Capital Economics reiterated their bearish stance on the precious metal. It still sees the price falling to $1,600 an ounce by the end of the year.

The comments come as rising geopolitical tensions between Russia and U.S. created new safe-haven demand for gold, pushing prices above $1,900 an ounce Sunday evening. However, Oliver Allen, markets economist at the U.K.-based research firm, said it's only a matter of time before raising interest rates weigh down the precious metal.

Allen noted that gold prices had rallied about 4% in the first two months of 2022. At the same time, 10-year Treasury Inflation-Protected Securities (TIPS) yields have risen around 60 basis points. Read More

Gold price will power to $7,400; Rally is far from over as ‘perfect storm’ brews - Chris Vermeulen

While geopolitical tensions may provide a short-lived rally in safe-haven assets like gold, there is no denying that the metal is still in a long-term technical bull cycle that mirrors the beginning of 2008, said Chris Vermeulen, chief market strategist of TheTechnicalTraders.com.

Vermeulen told David Lin, anchor for Kitco News that gold is set to hi $2,700 an ounce in one year, and up to $7,400 in five years.

“I think we’re coming into a pretty major supercycle in precious metals. I think we started back in 2019 and this is about a five-year cycle for gold, and it has been a very tough year for equities, we’ve had a very long bull market, I think things are getting a little long in the teeth in terms of the equities side,” he said. “When the stock markets get to the late stages, this is where we see commodities come to life.” Read More

Hedge funds seeing gold as a safe haven again

Rising geopolitical fear is once again making gold an attractive safe-haven asset among hedge funds, according to the latest data from the Commodity Futures Trading Commission.

According to commodity analysts at Societe Generale, the latest report from the CFTC showed that money managers bought $7.1 billion in gold last week, the fourth-biggest week of bullish flows since the CFTC started its new report in 2006.

The French bank said that rising inflation fears and the geopolitical uncertainty in Eastern Europe fueled the latest gold-buying spree.

The CFTC disaggregated Commitments of Traders report for the week ending Feb. 15 showed money managers increased their speculative gross long positions in Comex gold futures by 34,296 contracts to 151,530. At the same time, short positions fell by 3,943 contracts to 43,824.

Gold's net length now stands at 107,706 contracts. This is the first time net bullish positioning in gold has pushed above 100,000 since mid-November. In the last two weeks, gold's positioning increased by 55%. Read More

Gold and silver move higher overnight as geopolitical issues escalate

Gold (0.48%) pushed higher once again overnight as developments with Russia and Ukraine sent the safe-haven higher. Silver also moved higher overnight and is 1.39% in the black leading into the European open. In the rest of the commodities complex, copper is trading flat and spot WTI has dropped 0.45%.

Stocks were understandably weak overnight. The Nikkei 225 (-1.71%), Shanghai Composite (-0.96%) and ASX (-1.00%) all traded lower. Futures in Europe are also pointing towards a negative cash open.

FX markets were pretty cagey as the majors all traded within their ranges. The biggest mover overnight was NZD/USD which rose 0.16%. In the crypto space, BTC/USD took another tumble to trade at $36,675 this morning. Read More

UBS forecast a drop in gold by year-end

Swiss investment bank UBS strategist Joni Teves predicts that recent strength in gold prices will be “short-lived.” Teves noted that the gold market is expected to revert back to focusing on macro drivers such as real rates, U.S. Federal Reserve policy as well as the growth outlook.

In an interview on CNBC Teves said the gold market is expected to revert back to focusing on macro drivers such as real rates, U.S. Federal Reserve policy as well as the growth outlook. In fact, UBS sees gold prices falling to $1,600 per ounce by the end of 2022. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.