Image Source: Unsplash

Gartman's back and he is holding gold as equity market starts bear run

It is time investors pay attention to gold as equity markets look to be entering a bear market, according to famed investor Denis Gartman.

After two years in retirement, Gartman, chairman of the University of Akron's endowment committee, has started writing a new letter, publishing his views on markets.

In a recent note, he highlighted how gold is helping to protect the University's investments.

"As the Chairman of the University of Akron's endowment/investment committee, I urged the other committee members and our outside chief investment officer at our February quarterly investment meeting last year to reduce our exposure to equities and to initiate an investment in gold via GLD," he said. "We have a reasonable exposure to gold as a hedge against inflation and a weakening equity market." Read More

Gold price will power to $7,400; Rally is far from over as 'perfect storm' brews - Chris Vermeulen

While geopolitical tensions may provide a short-lived rally in safe-haven assets like gold, there is no denying that the metal is still in a long-term technical bull cycle that mirrors the beginning of 2008, said Chris Vermeulen, chief market strategist of TheTechnicalTraders.com.

Vermeulen told David Lin, anchor for Kitco News that gold is set to hi $2,700 an ounce in one year, and up to $7,400 in five years.

“I think we’re coming into a pretty major supercycle in precious metals. I think we started back in 2019 and this is about a five-year cycle for gold, and it has been a very tough year for equities, we’ve had a very long bull market, I think things are getting a little long in the teeth in terms of the equities side,” he said. “When the stock markets get to the late stages, this is where we see commodities come to life.” Read More

Watch palladium, gold, and silver prices as West sanctions Russia in response to Ukraine crisis

With sanctions piling up against Russia in response to the escalating situation in Ukraine, investors should be watching the price of precious metals as commodities' supplies could get derailed, according to the BMO's report.

Tensions escalated on Tuesday as the West reacted to Russian Vladimir's Putin announcement recognizing two self-proclaimed republics in eastern Ukraine and ordering to send troops there as "peacekeeping forces."

In response, U.S. President Joe Biden said he is releasing the first tranche of sanctions against Russia, which target two Russian banks (VEB bank and Russia's military bank, Promsvyazbank) and sovereign debt.

"We are implementing full blocking sanctions on two large Russian financial institutions … We are implementing comprehensive sanctions on Russia's sovereign debt. That means we've cut off Russia's government from Western financing," Biden told the press on Tuesday. "Starting tomorrow, we'll also impose sanctions on Russia's elites and family members … We'll continue to escalate sanctions if Russia escalates." Read More

As Russia begins invasion, these strategic commodities will benefit the most - Phil Streible

Russia is a key supplier of not just oil but several strategic commodities, all of which should benefit from heightened geopolitical tensions in Eastern Europe, said Phil Streible, chief market strategist of Blue Line Futures.

Streible’s comments come as The White House on Tuesday called Russia’s latest advances “the beginning of an invasion.”

Russian President Vladimir Putin announced that he recognizes the territorial claims of two self-declared separatist republics in eastern Ukraine and has deployed troops to those regions.

The U.S. and the U.K. have moved ahead with sanctions; U.S. President Joe Biden announced Tuesday that the first wave of sanctions will target Russian banks and sovereign debt. Biden vowed tougher punishments if Russia continues its aggression.

“What [the Russians] would do is they would divert their oil. Instead of selling it into the current export structure that they have, they could easily make agreements with other countries to buy that oil, like China. Also, they can take off some of that oil, they can hold back. There’s no reason for them necessarily to sell, they have too many other key commodities that prices can drive up on,” Streible told David Lin, anchor for Kitco News. Read More

Gold, silver traders buy early dips amid bullish technicals, fundamentals

Gold and silver prices are firmer in midday U.S. trading Wednesday, as bullish traders stepped in to buy the early price declines. Gold prices Tuesday hit an eight-month high and silver today notched a four-week high. Risk aversion is still elevated at mid-week, and that's also supportive for the safe-haven metals markets. April gold futures were last up $3.50 at $1,911.00 and March Comex silver was last up $0.234 at $24.535 an ounce.

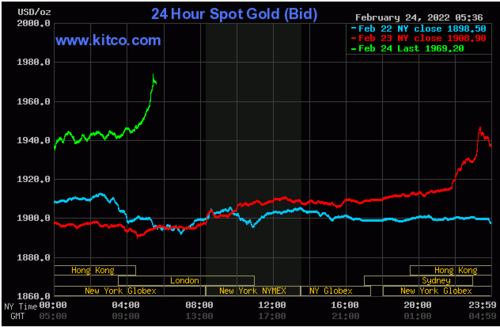

Image Source: Kitco News

Technically, April gold futures prices are poised to close at an eight-month high close today. Bulls have a solid overall near-term technical advantage. Prices are in a steep uptrend on the daily bar chart. Bulls' next upside price objective is to produce a close above solid resistance at the May 2021 high of $1,922.40. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,850.00. First resistance is seen at this week's high of $1,918.30 and then at $1,922.40. First support is seen at $1,900.00 and then at this week's low of $1,889.70. Wyckoff's Market Rating: 8.5. Read More

Inflation fear: Traders point to inflation as 'biggest' market mover in 2022 – JPMorgan survey

The most significant impact on markets will come from inflation in 2022, JPMorgan said in its annual survey that polled 700 traders.

"48% of traders surveyed believe inflation will have the greatest impact on markets in 2022," the results of JPMorgan's annual FICC e-trading survey showed.

This is a major shift from last year when traders pointed to the pandemic as the number one market mover for 2021.

"The expectation is that this focus and concern will likely lead to more market activity and volatility given that inflation has not been a theme for over a decade," said Scott Wacker, head of FICC e-Commerce sales at J.P. Morgan. "This will continue to reinforce the importance of liquidity and consistency of pricing, which continues to play into the hands of electronic trading." Read More

Gold's path to $2k: Fed rate hikes won't hurt gold price rally this year, says Wells Fargo

The gold's bull market won't be stopped by the slate of Federal Reserve rate hikes expected to begin in March, according to Wells Fargo.

One of this year's more bullish forecasts for the precious metal comes from Wells Fargo, which sees gold trading at $2,100 by the year-end.

However, with many questioning how gold could do well in light of the very hawkish Federal Reserve's monetary policy stance, Wells Fargo decided to elaborate.

“Our 2022 year-end gold price target is $2,000 - $2,100 per troy ounce. One of the more common concerns we hear is whether a hawkish Fed — set to hike rates in March — will render our positive gold outlook incorrect," said Wells Fargo's investment strategy analyst Austin Pickle. Read More

Gold closes above $1900 as the geopolitical tensions escalate

Gold continues to find support at $1900 per ounce as geopolitical tensions escalate and has now been labeled as a crisis. As of 4:25 PM EST gold futures basis, the most active April 2022 Comex contract is currently fixed at $1910.70 after factoring in today's gain of $3.30 or 0.17%. Gold futures opened at $1901.20 today, traded to a high of $1912.90 and a low of $1891.10. Gold did not break yesterday's high of $1918.30; however, on a closing basis, gold futures have not closed at this level since January 2021. The recent daily highs have now matched the highs achieved in June 202, the last time gold rallied solidly above $1900 as it traded to an intraday high of $1918.50. Read More

Image Source: Kitco News

Gold is going to $3,000 when war breaks out but Bitcoin will still lag, here’s why – Frank Holmes

Tensions continue to rise in Eastern Europe as Russian President Vladimir Putin vowed a “strong response” to the West if sanctions continue.

Frank Holmes, CEO of U.S. global investors said that gold has historically performed well during political crises and sees the price climbing as much as 50% higher from current levels.

“It’s a non-event for gold to go up or down 20% in a year,” Holmes told David Lin, anchor for Kitco News. “Two years ago it went up two standard deviations for the first nine months, so it were to do that again, then it could go to $2,800. That would be up two standard deviations, and that wouldn’t be extraordinary. Three standard deviations over twelve months is. I think [gold] is undervalued. I think it’s probably worth about over $4,000 if you use money printing number data, then you’re talking $7,000 or more. I feel comfortable that gold can easily run to $2,500 or $3,000.” Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.