Image Source: Unsplash

Gold, silver, and platinum reverse to long

For the past few days, we mentioned that gold, silver, and platinum looked like they were getting ready to reverse. Wednesday’s rally pushed them all to reversals and we are now long. Price action dictates market direction.

After struggling for weeks, gold has finally taken off to the upside. Like all trends and market moves, this could last for an extended period or could fail. If you are going to trade, you must be prepared for adverse price action.

All metals look good, which is amazing based on how bad they looked a few days ago. The only concern we have in all markets is the false breakouts and moves that show up out of nowhere. Remember, we are always long physical and will trade paper on either side. Read More

Gold prices struggle as U.S. PPI rises 0.2% in December

The gold market is struggling to hold the critical psychological level at $1,820 an ounce as it appears inflation pressures could have peaked with producer prices falling more than expected in December.

Thursday, the U.S. Labor Department said its Producer Price Index (PPI) rose 0.2% in December following November’s rise of 0.8%; the data was weaker than expected with economists forecasting an increase of 0.4%.

For the yea headline producer prices rose to another record high, hitting 9.7%, “the largest calendar-year increase since data were first calculated in 2010,” the report said. Economists were expecting to see an annual rise of 9.8%.

Meanwhile, core PPI, which strips out volatile food and energy prices rose 0.5%, following November’s increase of 0.7%. Core PPI rose in line with expectations. Read More

Gold, silver see profit-taking pressure Thursday

Gold and silver futures prices are weaker in midday U.S. trading Thursday, on some profit-taking pressure from the shorter-term futures traders following recent gains. The precious metals had been supported this week by friendly daily outside markets that included higher crude oil prices, a weaker U.S. dollar index, and a slight drop in U.S. Treasury yields. February gold futures were last down $8.30 at $1,819.00 and March Comex silver was last down $0.062 at $23.15 an ounce.

.gif)

Image Source: Kitco News

Technically, the February gold futures bulls have the overall near-term technical advantage. Bulls' next upside price objective is to produce a close in February futures above solid resistance at $1,850.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the January low of $1,781.30. First resistance is seen at today's high of $1,828.30 and then at the January high of $1,833.00. First support is seen at today's low of $1,811.80 and then at $1,800.00. Wyckoff's Market Rating: 6.5 Read More

First-rate hike, high inflation favors gold - WGC

Gold investors should expect to see a more nuanced market as the Federal Reserve looks to tighten its monetary policy through 2022, according to the latest research from the World Gold Council.

In a report published Thursday, the WGC said that although the precious metal faces some difficult headwinds this year, it still has some solid support. The comments come as gold prices fell nearly 4% in 2021, disappointing many investors.

The analysts noted that despite record-low real interest rates, the gold market struggled as investors focused on the impending pivot in the Federal Reserve's monetary policy. However, WGC said that gold's potential grows as the U.S. central bank's first-rate hike looms closer.

"Gold has historically underperformed in the months leading up to a Fed tightening cycle, only to significantly outperform in the months following the first rate hike," the analysts said. "U.S. equities had their strongest performance ahead of a tightening cycle but delivered softer returns thereafter." Read More

Surging inflation across the globe is a real test for gold price

Inflation is one of the biggest risks that could derail economic recovery this year, especially if central banks get the tightening wrong, according to analysts.

Surging price pressures are being felt all across the globe. In the U.S., inflation ran at the hottest pace since 1982 in December, rising 7% over the past 12 months. Inflation in the eurozone reached a new record high of 5% annually in December.

In the U.K., inflation hit 10-year highs, with the consumer price index (CPI) up 5.1% in the 12 months to November. Spain's price pressures climbed to nearly three decades highs, with the annual inflation up 6.7% in December. In Italy, the cost of living rose to the highest level in more than a decade in December, with the CPI advancing 4.2% compared to December 2020.

However, there are signs that global inflation might be close to peaking. Read More

Gold is in a good place no matter what the Fed does in 2022 - Axel Merk

With gold prices holding above $1,800 an ounce, the metal is building a solid foundation for the new year, and according to one fund manager, the precious metal remains an attractive asset no matter what the Federal Reserve plans to do with monetary policy.

In a telephone interview with Kitco News, Axel Merk, president of Merk Investments, said that he expects gold to weather expected rate hikes as a risk and inflation hedge.

"Gold should continue to do just fine as real interest rates will remain in negative territory," he said. "When I look at inflation protection, I am not looking for the next meme stock; that is no inflation protection. If rates were to move higher, then the 'funny season' may be over. And some of the meme stocks and other phenomena might deflate." Read More

Gold price has 'innate ability to rally when consensus is bearish' – MKS

Gold's top three drivers in 2022 are inflation, the Federal Reserve, and stock market volatility, according to MKS PAMP GROUP outlook for the year.

"We do not hold the view of most analysts (a downward trajectory of gold from here)," said MKS PAMP GROUP head of metals strategy Nicky Shiels. "Gold is a referee on the Fed and a policy mistake (either rampant inflation or an aggressive hiking cycle bringing forward recession risk), who are currently well behind the inflation curve."

Even though gold is slightly down on the year so far, prices have the ability to move higher from here, Shiels wrote.

"Gold has one more push higher as the 'inflation' or 'Fed policy mistake' peak is not yet in. A short U.S. labor market, future COVID variants and associated zero/low COVID policies create necessary persistent stagflationary forces," she said. Read More

U.S. equities and precious metals react to the real possibility of liftoff in March

Multiple sectors and asset classes in the financial markets came under pressure today as market participants prepare for the real possibility that the Federal Reserve will begin a series of multiple interest rate hikes beginning in March of this year. Testimony by Chairman Powell recently suggested that the Federal Reserve might maintain a slightly more accommodative monetary policy than perceived by the hawkish tone of multiple Fed members including himself last month. However, statements over the last few days by multiple Federal Reserve members suggest that liftoff will most certainly begin in March 2022.

Image Source: Kitco News

By far the largest percentage declines amongst asset classes was seen in U.S. equities rather than the precious metals. The Standard & Poor’s 500 gave up 1.42%, the Dow Jones Industrial Average, which fared the best today, gave up 0.49%. But it was the NASDAQ composite that showed the largest percentage decline today, losing 2.51% in value.

Precious metals had fractional declines, but all four precious metals traded on the futures markets exhibited slight declines. Concurrently the U.S. dollar had a fractional decline today of 0.06% taking the dollar index to 94.845. This is the lowest value that the dollar index has had since the first week of November 2021. After reaching a high just shy of 97.00 in December of last year the index traded to a low of 94.635 which is approximately a 2% decline from the highs seen just last month. Read More

Inflation is now at 7%, the highest in 40 years, and will stay until 2024 - Steve Hanke

Steve Hanke, professor of applied economics at Johns Hopkins University told David Lin, anchor, for Kitco News, that inflation will likely remain elevated until 2024, after which the Federal Reserve will have to focus on reducing the money supply.

“[Inflation] will stay with us in that 6% to 9% range going into 2024,” Hanke said, noting that the residual excess money supply that has been created over the past two years will continue to inflate consumer prices.

Contrary to what politicians have been claiming, inflation is not caused by bottlenecks in the supply chain, but rather, by increases in the money supply, Hanke said. Read More

Gold and silver trade higher leading into the European open

Gold (0.22%) and silver (0.30%) are heading into the EU session higher after some positive price action overnight. In the rest of the commodities complex, both copper (0.28%) and spot WTI (0.69%) are in the black.

After some softness in Wall St, the Nikkei 225 (-1.28%), ASX (-1.08%), and Shanghai Composite (-0.96%) struggled overnight. Futures in Europe are pointing towards a mixed open but most of the major index futures are negative.

In FX markets, USD/JPY was the biggest mover overnight. The pair fell -0.37% to trade at 113.75 as the rest of the majors remained relatively stable. In the crypto space, BTC/USD moved 0.67% higher to trade at $42,874. Read More

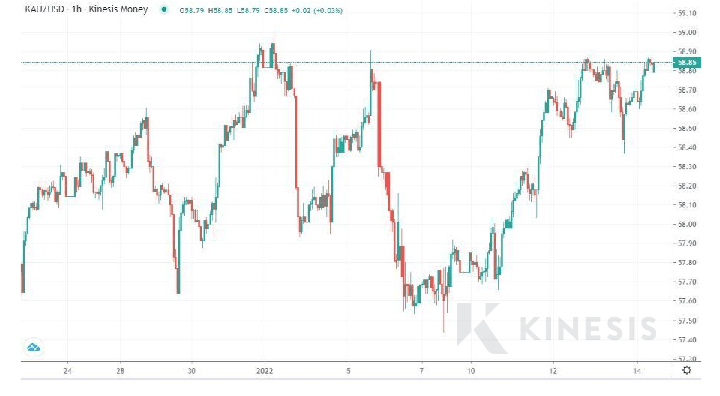

Gold & Silver Market Analysis for Friday 14th January

Gold price 1h chart ($/g) from Kinesis Exchange

Kinesis Money Gold Analysis:

Gold has started the new year showing significant resilience. The rebound seen in the last few days was certainly helped by the decline of the dollar, but we should consider that it happened while expectations for Fed rate hikes in 2022 jumped from 1 or 2 to 3 or 3.5. This all followed the December FOMC meeting and its hawkish meeting minutes, released earlier in January. Therefore, this positive movement should be considered significant.

From a technical point of view, the main levels to follow remain unchanged. Bullion is still being traded at around $1,825, with the first resistance just a few dollars above, in the region of $1,830-$1,832. A clear climb above this level could encourage more investors to buy gold, opening space for an extended rally, with a potential target of $1,870 - a level last reached in November 2021.

However, if gold doesn’t find the strength to break through $1,830, the price could continue its sideways dance between $1,800 and $1,830 seen in the last few days.

Indeed, the first support zone is placed at $1,800 but this doesn’t seem in sight for now. Of course, macroeconomic indicators (particularly inflation and secondarily labor data) and Treasury yields, remain the main catalyst to follow to understand the next steps for gold.

Looking at the price in dollars per gram, we can see that bullion is getting closer to $59 per gram.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.