Image Source: Unsplash

Gold price in neutral territory as U.S. consumers seeing inflation at 4.9% in one year

The gold market is not finding much traction even as U.S. consumers expect inflation pressures to remain elevated through 2022, according to the latest University of Michigan Consumer Sentiment Survey.

Andrew Hunter, senior U.S. economist, at Capital Economics, said that rising inflation pressure could lead to weaker economic activity through the year.

“With the squeeze on purchasing power from surging prices unlikely to end any time soon, this all suggests that the sharp slowdown in real consumption growth flagged by the December retail sales data may be a sign of things to come in 2022,” Hunter said. “The additional bad news is that consumers’ longer-term inflation expectations rose to a near-11 year high of 3.1% in January. That provides another reason to suspect that the Fed’s hawkish turn won’t be derailed by weaker economic growth.” Read More

Don't let these market risks wipe out your portfolio in 2022 - Peter Grandich's biggest predictions

Speaking to David Lin, anchor for Kitco News, Grandich said that currently, a shift of sentiment is about to take place for cryptocurrencies and for precious metals.

“We pretty much spent 2021 for stocks and bonds and things like Bitcoin at the top of the cycle,” he said. “Now, maybe a couple of them slipped into anxiety because they’re off their highs. But then, you look at things like gold and silver, they’re down at despondency and depression. Even people who would once speak about them on a regular basis tried to hide and talk about something else. So there’s a real shift in sentiment.” Read More

The Metals, Money, and Markets Weekly by Mickey Fulp - January 14, 2022

Gold bulls see potential for higher prices as inflation remains a threat

The gold market has started the new year on solid footing as prices look to end the week above $1,800 an ounce and short-term sentiment remains significantly bullish, according to the latest Kitco News Weekly Gold Survey.

According to some analysts, not only is gold seeing some renewed technical bullish momentum, but economic data highlighting rising inflation and weaker consumption, and rising geopolitical uncertainty is providing some fundamental support for the precious metal.

However, other analysts have said that hawkish expectations that the Federal Reserve will aggressively raise interest rates will provide some support for the U.S. dollar, creating headwinds for gold.

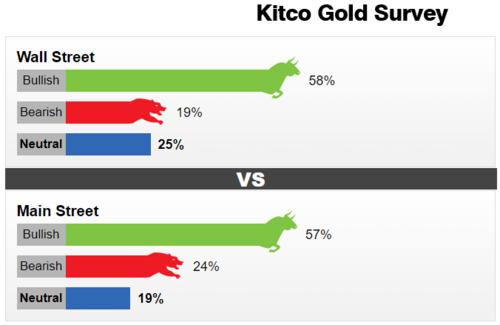

This week 16 Wall Street analysts participated in Kitco News' gold survey. Among the participants, nine analysts, or 58%, called for gold prices to rise next week. At the same time, three analysts, or 19%, were bearish on gold in the near term, and four analysts or 25% were neutral on prices.

Meanwhile, a total of 928 votes were cast in online Main Street polls. Of these, 529 respondents, or 57%, looked for gold to rise next week. Another 225, or 24%, said lower, while 174voters, or 19%, were neutral. Read More

Image Source: Kitco News

Starting the new year on solid footing

The new year has kicked off with a bang as U.S. consumers continue to face rising inflation pressures, with consumer prices hitting their highest level in nearly 40 years.

Inflation continues to be a double-edged sword for the gold market. Although inflation will keep real interest rates low, rising consumer prices are being met with expectations that the Federal Reserve will take aggressive steps to cool down the economy.

The Federal Reserve is looking to end its monthly bond purchases in March. Markets also expect to see the first rate hike in March.

Markets are pricing in four rate hikes this year. In one last hawkish move, the Fed has signaled that it could start reducing its over-blown balance sheet before the end of the year.

At first blush, these seem like some pretty significant obstacles for the precious metals market; however, there is still a lot of bullish sentiment in gold and silver early in the new year. Read More

Gold has gained value during 4 of the last 5 weeks

Gold continues to trade in a range-bound manner, but over the last five weeks, gold prices have gained value during four of those weeks. Although gold has traded lower yesterday and today, ending the week with a moderate gain of 0.6%. For the most part, we have seen gold trade through the eyes of the weekly chart with a succession of higher lows. What has been lacking is a series of higher highs based upon the high achieved in June 2022 when gold topped out at $1920. Read More

Image Source - Kitco news

Gold price outlook improves as analysts weigh Fed policy mistake, hot inflation data

The price outlook for gold is looking better going into the third week of the new year. Analysts are weighing the consequences of a potential monetary policy mistake as the Federal Reserve gets more hawkish amid the latest inflation data.

The threat of inflation is finally pushing gold higher as investors expect price pressures to continue climbing. February Comex gold futures were last trading at $1,816.90, up more than 1% on the week.

The two key datasets keeping markets in a risk-off mood are inflation and retail sales. In the U.S., inflation ran at the hottest pace since 1982 in December, rising 7% over the past 12 months. Meanwhile, retail sales were down the most in ten months, falling 1.9%.

The two big drivers for gold going forward will be the U.S. dollar and bond yields. The dollar has retreated, giving some breathing room to gold, while the bond yields have just paused their climb.

"Take a look at how high Treasury yields have run. The market is pricing in well over 90% chance that the Fed will raise rates in March. And gold is having its best week in a couple of months," OANDA senior market analyst Edward Moya told Kitco News. "Gold is not able to break beyond its recent highs, but things are looking pretty good." Read More

Ep.58 Live from the Vault:

Gold and Silver Price Outlook 2022

This week, Andrew Maguire shares his gold and silver price trajectory projection for the year ahead and explores the bullish momentum, triggered by the Basel III implementation that is now carrying through the market.

The precious metals expert drills down the evidence of a tightening physical supply and analyses the liquidity providers’ behavior, in anticipation of the explosive changes that are looming on the financial horizon. Read More

Recession watch: How far will Fed go to control inflation?

Gold is seeing an encouraging start to the year as analysts weigh the consequences of a potential mistake by the Federal Reserve. The precious metal is up more than 1% as the inflation narrative attracts new investors. Here's a look at Kitco's top three stories of the week: Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.