Image Source: Unsplash

Indian gold demand remains firm according to the WGC

The Indian CEO of the World Gold Council (WGC) has been on the wires discussing his thoughts on the Indian gold market. P.R. Somasundaram said that demand was affected by the pandemic due to lockdowns and the lack of weddings but there has been an increase in demand.

He noted, "In the last quarter of 2021, there was a spurt in demand as the festivals and weddings came back. Savings rates in India were higher as expenditure was down". He added "even equities markets performed well but gold played its part very well"

In regards to central bank buying Somasundaram noted "the RBI has also been buying gold. He said central bank buying does not move local market sentiment. India is driven by weddings and savings rates into gold" Read More

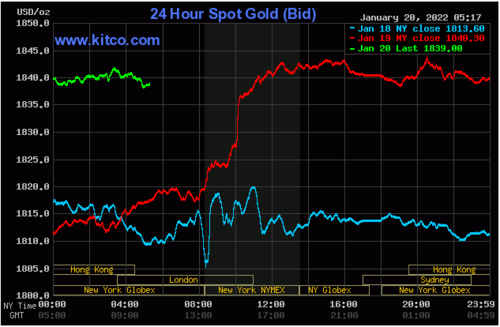

Inflation fears fuel strong rallies in gold, silver

Gold and silver futures prices are sharply higher and at two-month highs in midday U.S. trading Wednesday. The precious metals are seeing good buying interest amid growing worries about rising global price inflation, as well as some geopolitics presently at play. Bullish outside markets—a weaker U.S. dollar index and higher crude oil prices—are also working in favor of the metals market bulls at mid-week. February gold futures were last up $29.10 at $1,841.50 and March Comex silver was last up $0.718 at $24.21 an ounce.

Technically, February gold futures hit a two-month high today. Bulls have the firm overall near-term technical advantage and gained more power today. Bulls' next upside price objective is to produce a close above solid resistance at the November high of $1,881.90. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the January low of $1,781.30. First resistance is seen at today’s high of $1,843.40 and then at $1,850.00. First support is seen at $1,833.00 and then at $1,820.00. Wyckoff's Market Rating: 7.0 Read More

Gold to shine as investor apathy to risk falls in 2022 - Sprott's Grosskopf

Overconfidence and apathy towards risk dominated investor sentiment in 2021, but, according to one precious metal fund manager, that could all change in the new year as the Federal Reserve looks to tighten its monetary policy, reducing the liquidity sloshing through financial markets.

Despite gold's struggle in 2021, Peter Grosskopf, CEO of Sprott Inc., said that the precious metal still remains an attractive hedge to protect against growing risks in equity markets. While Grosskopf isn't expecting equities to fall into a bear market, he said that the unprecedented run in the last two years appears to be slowing.

He added that slowing equities could also drag down economic growth, forcing the Federal Reserve to be less aggressive with its monetary policy this year.

"The stock market's going to have a more difficult year than people expect," he said. Read More

Global platinum group metals autocatalyst demand to hit record levels in 2022 – report

According to Metals Focus, a growing global automotive sector has driven combined autocatalyst demand for platinum, palladium, and rhodium (PGM), which rose by 5% in 2021 and expected to hit record levels in 2022.

The consultancy said that the total PGM demand is expected to grow 11% breaching 12.8Moz in 2022.

“This is 1.2Moz more than 2021 and 200koz higher than pre-pandemic levels, despite expectations that vehicle numbers will still be lower than in 2019,” the authors of the report noted.

The growth in demand will be driven by two key factors, Metals Focus said. First, automotive manufacturing is expected to improve by 12.5% y/y.

“After a period of dramatic downward revisions in car production forecasts last year, since late December 2021 we have seen vehicle production forecasts for 2022 revised upwards, albeit modestly,” the report found. Read More

Inflation at a 40-year high, risk-off sentiment, and geopolitical uncertainty create a perfect storm for precious metals

It was a combination of events that resulted in dynamic gains across-the-board in the precious metals markets today. Three primary concerns have elevated the bullish market sentiment that has already been in play in the precious metals markets, today however it seemed as though these concerns were magnified.

The primary concern is the current level of inflation in the United States which according to the most recent data provided by the government is at 7%. The last time inflationary pressures were this high was in 1982, 40 years ago. Also, market participants are focusing on inflationary concerns in regards to upcoming action by the Federal Reserve at the upcoming FOMC meeting which will begin on Tuesday, January 25, and conclude exactly a week from today. Lift-off, a term used to describe the initiation of interest rate hikes is almost a certainty.

Silver futures gained 2.99% taking the most active March futures contract to $24.195, after factoring in today’s gain of $0.70. Lastly, gold futures basis the most active February contract is currently fixed at $1840.70 after gaining $28.30 or 1.56%.

Image Source: Kitco News

All of the precious metals had strong upside breakouts today with gold blowing past the current resistance level of $1833. Our technical studies currently indicate that the next level of resistance comes in at $1851.60. The studies also indicate that the former resistance level could become the new support level at $1830. Read More

Gold price rallies $30, silver price surges more than 3% as investors flock to safe-havens

Both gold and silver are seeing unexpected rallies, with prices hitting two-month highs. Investors are flocking to safe-haven metals as inflation and geopolitical tensions are triggering increased volatility ahead of the Federal Reserve meeting next week, analysts tell Kitco News.

February gold futures were up more than $30 on Wednesday, last trading at $1,842.90 an ounce. In the meantime, March silver futures surged more than 3%, last trading at $24.21.

As prices began to move, markets were digested more signs of problematic inflation on a global scale. In Britain, annual inflation rose more than expected, advancing 5.4% in December — the highest reading since March 1992. Canada's inflation rate also rose to the highest in 30 years, with the consumer price index climbing to 4.8% on an annual basis in December. Read More

Gold is holding at higher levels leading into the European open

Gold is flat leading into the European open but this comes after a decent price rise on Wednesday ($1840/oz). Silver is also largely flat and is trading at $24.10/oz. In the rest of the commodities complex, copper is trading 1.30% higher while spot WTI has lost around -0.88% of its value.

Risk sentiment in the Asia Pac area was mixed overnight. The Nikkei 225 (1.11%) and ASX (0.14%) traded well while the Shanghai Composite fell -0.09%. Futures in Europe are pointing towards a positive open.

In FX markets, AUD/USD was the winner from the majors climbing 0.42%. The dollar index is down 0.16% as EUR/USD also gained overnight. In the crypto space, BTC/USD is up 1%. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.