Image Source: Unsplash

Gold & Silver Market Analysis for Monday 24th January

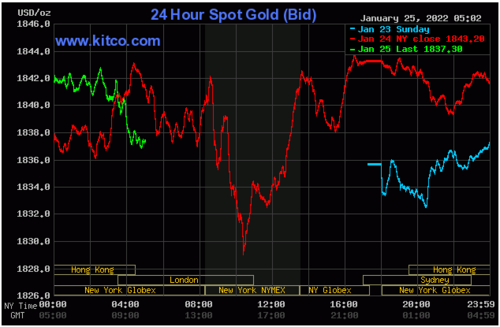

Kinesis Gold Price Analysis: After briefly smarting into action in the middle of last week, gold has returned to its preferred, more ambulatory mode and is drifting along in its new elevated range of $1,835-$1,845 an ounce. The negative start to the trading week on equities has seen gold find support and the metal is pushing up towards the upper end of that range.

It will be interesting to see whether the sell-off on bitcoin and other cryptocurrencies proves beneficial to gold. The exit from risk-related assets typically benefits gold, but so far it seems the crypto investors haven’t flooded to gold with this more traditional of assets lacking appeal for this new wave of investors.

Kinesis Silver Price Analysis: Continuing the recent theme of silver and gold losing their correlation, silver is little changed so far today, while gold is gaining. Last week saw silver smash through the $24 an ounce mark so, after such sharp gains, it is unsurprising to see that fury of activity pause for breath. Read More

Is Fed about to make a mistake? Here's what gold is saying

Gold and silver hit two-month highs this week, while the crypto market suffered major losses, with bitcoin plunging below $35,000.

To explain all of this, analysts pointed to rising U.S. treasury yields triggered by an aggressive Federal Reserve. Markets are now pricing in four rate hikes and a balance sheet runoff this year. Here's a look at Kitco's top three stories of the week: Read More

Gold price is fighting to breakout

Gold, silver, and platinum have rallied nicely since the trends have reversed. Silver and platinum have outperformed gold during that period. Gold continues to fight the major resistance level of $1,840. Siler and platinum have broken out and should pull back to support.

As we watch the equity sell-off, which started with the new year, it proves our point that precious metals are not a hedge but a hard asset commodity. There is nothing wrong with hard asset commodities; we believe all portfolios should have a representation of gold, silver, and platinum. Read More

Image Source: Kitco News

Gold price reverses morning gains despite U.S. manufacturing PMI dropping to multi-month lows

Gold reversed its early-morning gains after the release of preliminary manufacturing and service-sector sentiment data.

The flash U.S. manufacturing Purchasing Managers Index for January dropped to 55.0, marking a 15-month low, research firm IHS Markit said in its latest report. The January number missed the market’s expectations of a reading of 56.7.

“The health of the manufacturing sector improved to the least marked extent since October 2020 in January,” the IHS Markit’s news release stated. “Again, the headline figure was supported by a greater deterioration in vendor performance which would ordinarily be a signal of improving operating conditions. That said, supply chain issues abounded, which further hampered production and weighed on client demand.” Read More

Gold gains on safe-haven demand as equities melting down

Gold futures prices are modestly higher in midday U.S. trading Monday. Safe-haven buying is featured amid a “risk-off” trading day in the marketplace to start the trading week. Silver prices are sharply down as that market is not seeing the safe-haven bid that gold is getting. Sharp losses in crude oil prices and a rally in the U.S. dollar index today are negatives for the metals markets, and they are also limiting the upside in gold. February gold futures were last up $2.50 at $1,834.20 and March Comex silver was last down $0.605 at $23.71 an ounce.

Image Source: Kitco News

Technically, February gold futures bulls have the firm overall near-term technical advantage. Prices are in a five-week-old uptrend on the daily bar chart. Bulls' next upside price objective is to produce a close above solid resistance at the November high of $1,881.90. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,800.00. First resistance is seen at today's high of $1,844.90 and then at the January high of $1,848.50. First support is seen at Friday's low of $1,828.40 and then at $1,820.00. Wyckoff's Market Rating: 7.0. Read More

Lithium, the 'white gold' is just getting started after 300% rally in 2021 - Bank of America

The lithium market's unprecedented run to record highs may slow down a little in 2022 as the market find a short-term fundamental balance; however, Bank of America expects this is just the start of a bigger move in the long term.

In a telephone interview with Kitco News, Michael Widmer, commodities analyst at Bank of America, said that the battery metal's supply and demand fundamentals support current prices. Lithium, also known as "white gold," rallied nearly 300% last year, according to data from Benchmark Mineral Intelligence. Benchmark said that lithium prices exceeded $40 per kilogram at the start of the year; some analysts project that prices could rise above $50 per kilogram by the end of 2022.

"If you look at just the supply and demand fundamentals, I think the current lithium price is justified," said Widmer. Read More

5% inflation through 2022 can propel gold price back above $2,000 - State Street's George Milling-Stanley

The gold market still has a path back to $2,000 an ounce even as the Federal Reserve looks to tighten its monetary policy this year, according to one market strategist.

In Kitco News's inaugural gold market podcast, George Milling-Stanley, chief market strategist at State Streat Global Advisors, said that although the Federal Reserve is looking at raising interest rates with the potential for three or four rate hikes this year, high inflation pressure means that real yields will remain in negative territory.

Milling-Stanley joined Kitco News editor Neils Christensen and Phillip Streible, chief market strategist at Blue Line Futures, for a discussion on what is driving the gold market as prices remain near a two-month high around $1,840 an ounce.

"If we do get four rate hikes in 2022, interest rates are going to be a 1%. That's nothing to be terrified about. Paul Volcker took interest rates up into the teens in percentage terms back in the 1980s, when we had much higher inflation," he said. Listen to the podcast

GLD holdings explode as investors rush to safety

Now, this bearish sentiment around gold is shifting, with the precious metal once again touching 2-month highs on Monday. The risk-off sentiment in the marketplace is being fuelled by a more hawkish Federal Reserve and increased geopolitical tensions.

"Gold prices performed nicely compared to the pain that hit most commodities. Gold got good news on Friday after the largest bullion-backed exchange-traded fund, SPDR Gold shares, posted its biggest net inflow in dollar terms since listing in 2004. A laundry list of geopolitical risks will likely lead to safe-haven flows for gold that should help it soon break above the $1,850 level," said OANDA senior market analyst Edward Moya.

All eyes are on the Federal Reserve monetary policy announcement coming this Wednesday. Markets are pricing in a rate hike in March and hoping to get some clarity around the timing of a possible balance sheet runoff.

"Market expectations going into the Fed's January FOMC policy decision have violently swung from a gradual tightening to an aggressive hawk. Powell's latest testimony signaled that the balance sheet runoff decision could take two, three or four meetings." Said Moya. "The current Fed pivot has proved disruptive to growth forecasts and that may unsettle many at the Fed." Read More

Hedge funds got caught with their bearish bets on gold

Market expectations that the Federal Reserve will act aggressively to tamp down the growing inflation threat is prompting some hedge funds to increase their bearish bets on gold, according to analysts, after reviewing the latest data from the Commodity Futures Trading Commission.

The CFTC disaggregated Commitments of Traders report for the week ending Jan. 18 showed money managers increased their speculative gross long positions in Comex gold futures by only 510 contracts to 119,807. At the same time, short positions increased by 3,027 contracts to 48,014.

Gold's net length now stands at 71,793 contracts, relatively unchanged during the survey period. Despite the rise in short bets, the gold price was relatively stable, holding well above $1,800 an ounce. Read More

Market participants pay attention to the upcoming Fed meeting and Ukraine

Gold had moderate gains today as market participants await the policy decisions that will be revealed on Wednesday when the Federal Reserve concludes its FOMC meeting, releases its most current policy statement, and holds a press conference with Chairman Powell. Also, on the minds of the investment community are the geopolitical uncertainties as tensions grow regarding a buildup of Russian troops on their border with Ukraine.

As of 4:05 PM EST gold futures basis, the most active April 2022 Comex contract is fixed at $1842.70, after factoring in today’s net gain of $11 or 0.60%. The Federal Reserve has already begun the process of tapering their asset purchases which were at $120 billion per month. At their current pace, they will complete this process by March of this year, at which time the Fed will no longer be purchasing any new assets. However, once complete, the asset balance sheet will have ballooned to approximately $8.9 trillion. It is anticipated that the Federal Reserve will reduce its asset balance sheet at some point towards the end of this year.

The overwhelming consensus is that the Federal Reserve will tighten its monetary policy with a series of rate hikes over the next two years. Currently factored into market sentiment is the high probability of three to four ¼% rate hikes in 2022, which will be followed by an additional three rate hikes of ¼% in 2023. Read More

Image Source: Kitco News

Gold hangs on to gains ahead of the European open

Gold is heading into the European open flat after holding on to gains made on Monday's session. Silver is -0.71% lower trading at $23.78/oz. In the rest of the commodities complex, copper is -1.31% lower and spot WTI has dropped around half a percent.

Equities in the Asia Pac area were weak despite the late recovery in the U.S. indices. The Nikkei 225 (-1.66%), ASX (-2.49%) and Shanghai Composite (-2.58%) all traded lower overnight. Futures in Europe are pointing towards a mixed open.

In FX markets, USD/CHF was the biggest mover. The pair rose 0.41% overnight with the rest of the majors remaining pretty static. NZD/USD has broken the previous wave low on the daily chart to keep the downward trend intact. In the crypto space, the pressure on BTC/USD continues as the asset fell nearly -2% overnight. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.