Image Source: Unsplash

Gold & Silver Market Analysis for Wednesday 26th January

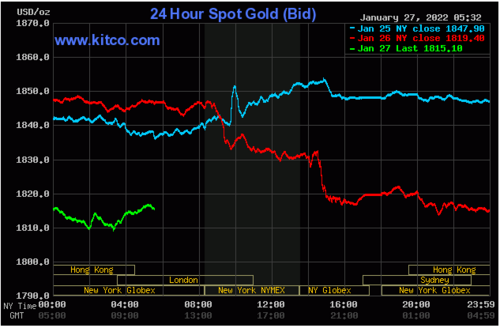

Kinesis Gold Price Analysis: At first glance, it could be easy to conclude that gold has failed to react to the rise in fear on markets and the corresponding drops on equities; the price is tracking steadily higher rather than any demonstrating any sharp spikes.

However, in the context of falling markets with most asset classes losing money in recent days, even standing still is helpful for an investor’s portfolio. Gold is still performing its role as a safe haven, it seems.

The lack of a more sustained breakout can be attributed to two factors: the likelihood of rising interest rates punishing gold for its lack of yield, and the psychologically important level of $1,850 an ounce providing substantial resistance to gold’s ability to climb much higher.

Image Source: Kinesis

Gold’s direction from here will be strongly influenced by the Federal Reserve’s decision on interest rates later today. If the rate remains unchanged as is forecast, then there may be more room for gold to gain, but an unexpectedly early hike would see gold drop.

Kinesis Silver Price Analysis: Read More

U.S. dollar 'apocalypse' coming in 10 years, more countries will make Bitcoin legal tender

Over the last 300 years, most major global fiat currencies have depreciated substantially, if not lost all of their value, and investors should not bet against this trend said Max Keiser, host of The Keiser Report and co-host of The Orange Pill Podcast.

"I think over the next 10 years, as you see these major economies like the U.S. and China, who are carrying debt loads at 300% of GDP, and they're going to just print their way out of this, we're talking about a fiat money apocalypse," Keiser told Michelle Makori, editor-in-chief of Kitco News.

Keiser's solution for hedging against an inevitable dollar debasement is to buy Bitcoin.

"I'd rather be cautious and load up on as much Bitcoin as I possibly can now and not try to play games on the timing side. What I do know now for sure is that these fiat [currencies are] going to go to zero. The reason is why Bitcoin is already in the tens of thousands of dollars a coin is because all of the major fiat money in the world is in a hyper-inflationary collapse against Bitcoin," he said. Read More

Gold price in CAD trims daily losses as Bank of Canada holds off hiking rates

The Bank of Canada held its interest rates steady at 0.25% on Wednesday, deciding not to begin hiking in January. Gold priced in Canadian dollars responded by reversing some of the daily losses.

While holding rates steady on Wednesday, the BoC opened the door for a potential rate hike in March, stating that the Canadian economy is operating at full capacity.

“In Canada, GDP growth in the second half of 2021 now looks to have been even stronger than expected. The economy entered 2022 with considerable momentum, and a broad set of measures are now indicating that economic slack is absorbed,” the BoC said. Read More

Goldman Sachs long gold, sees prices rising to $2,150

Even after a dismal 2021, Goldman Sachs is not ready to give up on gold as the investment banking giant is raising its price forecast and recommending a long gold trade for the year.

In a report published Thursday, the bank said that it is raising its 12-month price forecast to $2,150 an ounce, up from its previous target of $2,000. The bank also recommends buying December 2022 gold futures.

The new bullish outlook comes after a disappointing 2021 for gold as prices ended the year down nearly 4%. Goldman said that the decline in gold last year made sense in an environment of strong economic activity and expectations that rising inflation would only be temporary.

"Crucially, high growth and seemingly stable prices led to a surge across all risk-on assets, in particular cryptocurrencies. As a result, not only did gold face falling investment demand from investors no longer looking for a debasement hedge, it faced direct competition in bitcoin as a store of value," the analysts said in the report. "On top of waning investor interest, the divergence in global growth expectations helped support the dollar beyond our expectations." Read More

Gold sees more price weakness after hawkish but as expected FOMC statement

Gold futures prices are sharply lower and modestly extended those losses in early-afternoon U.S. trading Wednesday, in the immediate aftermath of the U.S. data point of the week: The FOMC meeting. February gold futures were last down $5.30 at $1,847.10 and March Comex silver was last up $0.079 at $23.975 an ounce.

The just-concluded Federal Reserve Open Market Committee (FOMC) meeting’s statement said it left interest rates unchanged but suggested inflationary pressures will warrant future rate hikes this year. The monthly bond-buying program will wind down in early March. The statement said the U.S. economy is improving but the pandemic is weighing on activity. The statement said inflation levels remain elevated. The statement was hawkish, but maybe not as hawkish as some market watchers expected. The gold market sold off a bit more after the FOMC statement, while U.S. Treasury yields rose.

Image Source: Kitco News

Technically, February gold futures prices hit a two-month high Tuesday. Bulls still have the overall near-term technical advantage. Prices are in a six-week-old uptrend on the daily bar chart. Bulls' next upside price objective is to produce a close above solid resistance at the November high of $1,881.90. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,800.00. First resistance is seen at today’s high of $1,850.20 and then at this week’s high of $1,854.20. First support is seen at $1,825.00 and then at $1,820.00. Wyckoff's Market Rating: 6.5. Read More

Gold price down but not out as Fed looks to raise interest rates soon

Gold prices remains under pressure but is seeing little reaction after the Federal Reserve signals that it is ready to raise interest rates to tame rising inflation pressures.

As expected, the Federal Reserve left interest rates unchanged at the zero-bound range; however, it signaled that markets should expect to see a rate hike “soon.”

“With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate,” the central bank said in its monetary policy statement.

Currently, markets are pricing in a hike in March with the potential for a 50-basis point move. Read More

Gold price tumbles $35 as Fed's Powell says inflation 'is slightly worse' than in December, signals March rate hike

Federal Reserve Chair Jerome Powell described the current inflation situation as "slightly worse" than in December, stating that there is plenty of room to raise rates without hurting the jobs market.

"There's quite a bit of room to raise interests without threatening the labor market. This is by so many measures a historically tight labor market — record levels of job openings, quits, wages are moving up at the highest pace they have in decades," Powell told reporters.

All eyes were on the Fed Chair Wednesday afternoon after the U.S. central bank held rates steady but signaled a rate hike in March.

Powell clarified the Fed's thinking around the March rate hike, stating: "The committee is of the mind to raise the federal funds rate at the March meeting." Read More

Gold is hit hard even though the Fed's updated monetary policy came in as expected

The FOMC meeting concluded today and as many expected, extreme volatility came into both the U.S. equities markets as well as gold. What was unexpected was the statement released by the Federal Reserve and how gold reacted to their updated monetary policy. Clearly, market participants had not factored in analysts' and economists' consensus of the outcome. The expectations were that interest rates would remain where they are, and the Federal Reserve would complete its tapering process in March and implement its first-rate hike immediately following the completion of the tapering process.

Image Source: Kitco News

The updated monetary policy statement released by the Federal Reserve today announced its updated monetary policy, which was almost exactly what economists had anticipated. The Fed vowed to keep interest rates where they are, near zero for the time being. Although they did not specify an exact liftoff date, Chairman Powell used the word "soon" to describe the timeline for liftoff.

Many analysts interpreted the meaning of "soon" as a signal that they would begin to raise the Fed funds rate which is currently near zero in March. The new piece of information released by the Federal Reserve today was a document regarding its plan for its balance sheet reduction.

When the statement was released, gold was trading off by approximately $24 with the February contract trading around $1830. Gold prices remained steady until Chairman Powell began his press conference. However, as he began to speak the selling pressure reignited and took gold to a low of $1814.10. The same occurrence was seen in what will be the next front month, the April 2022 contract month. Read More

Fed tanks markets with bombshell announcement; Is a recession next? Danielle DiMartino Booth

Stock markets slid sharply after 2:00 pm ET on Wednesday following an announcement from the Federal Reserve.

The Fed kept interest rates unchanged but markets reacted negatively on comments from Fed Chair Jerome Powell, said Danielle DiMartino Booth, CEO of Quill Intelligence.

“What really triggered it was some commentary that [Fed Chair Jerome] Powell made during the press conference where he said that the balance sheet run-off would be ‘in the background.’ Those three words, in the background, he repeated several times and they’re akin to what Janet Yellen originally said the balance sheet running off would be like watching paint dry. It also indicated that the rate hikes were going to be coming as well,” Booth told David Lin, anchor for Kitco News. Read More

Gold and silver both move lower heading into the European open

Gold fell just over -1.50% after the FOMC meeting and press conference last night and this morning the yellow metal moved another -0.33% lower. Silver also struggled and dropped another -1.46% overnight. In the rest of the commodities complex, copper is -0.46% in the red, and spot WTI has fallen -0.39%.

It has been a heavy risk-off session overnight. The Nikkei 225 (-3.11%), ASX (-1.77%), and Shanghai Composite (-1.78%) all took a tumble as the market is pricing in more rate hikes and possibly a bigger hike than once thought in March. Futures in Europe are pointing to a lower cash open.

In FX markets, the dollar index strengthened overnight rising 0.24%. The biggest mover was NZD/USD which fell 0.65%. In the crypto space, BTC/USD is -1.68% lower overnight and trades at $36,277. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.