Image Source: Unsplash

Gold price hits new daily lows as U.S. Q4 GDP beats expectations

The U.S. economy grew more than expected in the fourth quarter, the U.S. Bureau of Economic Analysis reported on Thursday.

The preliminary estimate showed that the U.S. Q4 GDP rose 6.9% versus markets' expectations of a 5.5% increase. In the third quarter, the U.S. GDP came in at 2.3%.

"The acceleration in real GDP in the fourth quarter primarily reflected an upturn in exports, accelerations in private inventory investment and PCE, and smaller decreases in residential fixed investment and federal government spending that were partly offset by a downturn in state and local government spending. Imports accelerated," the report said.

Gold price dropped to new daily lows following the data release, with February Comex gold futures last trading at $1,803.80, down 1.42% on the day. Read More

Image Source: Kitco News

Gold price remains near $1,800 following 3.8% drop in U.S. pending home sales

The gold market remains solidly in negative territory and can’t find any bullish traction even as fewer U.S. consumers start the process of buying a home, according to the latest data from the National Association of Realtors (NAR).

U.S. pending home sales dropped 3.8% in December, following November’s drop of 2.2%, the NAR said on Thursday. The data was much worse than expected as consensus forecasts called for a decline of 0.9%.

For the year pending home sales are down 6.9%.

The gold market is not seeing much movement following the latest U.S. housing sales data. February gold futures last traded at $1,805 an ounce, down 1.35% on the day.

This was the second consecutive month pending home sales declined, the report said. Read More

TDS takes tactical short position in gold after hawkish Fed meeting

Hawkish comments from Federal Reserve Chair Jerome Powell after the U.S. central bank said that it could raise interest rates "soon" have helped push gold prices below $1,800 an ounce.

According to commodity analysts at TD Securities, gold has room to fall further.

Thursday, the Canadian bank announced a tactical short position on gold for the next four to six weeks. In the note, the commodity analysts said that they shorted gold at $1,821 and are looking for prices to fall to $1,740 an ounce.

After Wednesday's Federal Reserve monetary policy meeting, markets started pricing in the potential for five rate hikes. At the same time, markets see the potential for liftoff of the new tightening cycle in March.

In the press conference following the Federal Reserve's decision Powell said there was plenty of room to raise rates without hurting the jobs market. Read More

Gold, silver pounded by inflation fears, strong greenback

Gold and silver futures prices are sharply lower in midday U.S. trading Thursday. The precious metals are getting hammered following a more-hawkish-than-expected Federal Reserve meeting and some upbeat U.S. economic data—both of which have helped push the U.S. dollar index to a 1.5-year high today. February gold futures were last down $36.10 at $1,793.50 and March Comex silver was last down $1.142 at $22.655 an ounce.

I've been involved in the markets full-time for almost 40 years. I've this many times before: Traders are fickle, especially on a short-term markets basis. The gold and silver markets are selling off sharply recently due to a tighter Federal Reserve (and other central banks') monetary policies, after having been boosted by looser monetary policies for several years. Yet, the tighter monetary policies are being implemented mainly due to rising inflation fears. Historically, rising inflation has been bullish for hard assets like precious metals. My bias is that as inflation continues to bite, gold and silver markets will respond, overall, in a longer-term bullish fashion.

Image Source: Kitco News

March silver futures prices hit a three-week low today. The silver bears have gained the overall near-term technical advantage. A six-week-old uptrend on the daily bar chart has been negated. Silver bulls' next upside price objective is closing prices above solid technical resistance at $24.00 an ounce. The next downside price objective for the bears is closing prices below solid support at the December low of $21.41. First resistance is seen at $23.00 and the at $23.50. Next support is seen at $22.50 and then at $22.25. Wyckoff's Market Rating: 4.0. Read More

Expect 'much higher' commodity prices if Russia-Ukraine crisis escalates - ING

If Russia-Ukraine tensions were to escalate further, there would be "far-reaching" consequences for commodities, and Europe could be the worst hit, according to a report by ING.

"If the Russia-Ukraine crisis escalates further, expect much higher commodity prices, and Europe could be the worst hit," said ING head of commodities strategy Warren Patterson. "Reaction to any aggression could have far-reaching consequences for commodities."

The commodity sector will surge if the U.S. introduces sanctions as a response to potential action by Russia against Ukraine.

"Tough sanctions would rattle commodity markets," said Patterson. "It appears that a number of commodity markets are starting to at least price in some geopolitical risk around the growing tension between Russia and Ukraine. There is still plenty of uncertainty over how the situation will evolve." Read More

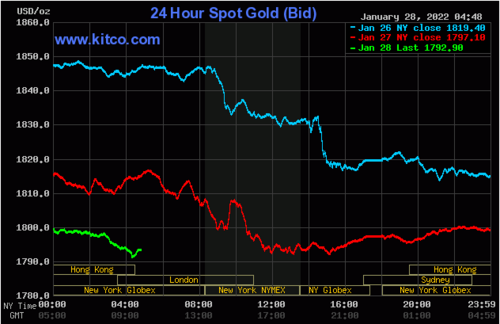

A strong 4th quarter GDP is the driving force that took gold sharply lower today

A report released today by the government indicated tremendous growth in GDP Q4, coupled with the change of market sentiment for gold from yesterday's release of the Fed's updated monetary policy resulted in gold trading sharply lower.

As of 3:43 PM EST gold futures basis the February 2022 Comex contract is trading $36 lower or -1.97% and fixed at $1793.70. The April Comex contract which will soon become the most active contract month lost $36.50 and is currently fixed at $1795.50.

Image Source: Kitco News

Today the Bureau of Economic Analysis part of the US Department of Commerce released its advance estimate of the Gross Domestic Product for the fourth quarter of 2021. It revealed extremely strong growth during the last quarter of 2021.

According to the BEA, "Real gross domestic product (GDP) increased at an annual rate of 6.9 percent in the fourth quarter of 2021, following an increase of 2.3 percent in the third quarter. The acceleration in the fourth quarter was led by an upturn in exports as well as accelerations in inventory investment and consumer spending. In the fourth quarter, COVID-19 cases resulted in continued restrictions and disruptions in the operations of establishments in some parts of the country. Government assistance payments in the form of forgivable loans to businesses, grants to state and local governments, and social benefits to households all decreased as provisions of several federal programs expired or tapered off." Read More

Despite dismal ETF interest, global gold demand grew 10% in 2021

The gold market has once again proven itself that it is a global market that is more robust than just investment demand, according to the latest report from the World Gold Council.

In its quarterly and annual gold trends report, published Thursday, the WGC said that the physical gold market saw broad-based robust growth in 2021 even in the face of lackluster demand for gold-backed exchange-traded products.

The WCG said that global physical gold demand grew 10% to 4,021 tonnes in 2021. The report added that gold demand grew by 50% in the fourth quarter last year, the highest pace in 10 years.

"Demand recouped much of the COVID-related losses sustained during 2020. Demand for gold in the consumer-driven jewelry and technology sectors recovered throughout the year in line with economic growth and sentiment, while central bank buying also far outpaced that of 2020," the analysts said in the report. Read More

Gold and silver are subdued leading into the European open

Gold once again breached $1800/oz during Thursday's session to trade at $1796/oz leading into the European open. Silver is also down half a percent trading at $22.64/oz. Looking at the rest of the commodities complex, both copper (-0.08%) and spot WTI (-0.13%) are down marginally.

Overnight the Nikkei 225 (2.09%) and ASX (2.19%) recouped some losses seen earlier in the week but the Shanghai Composite fell -0.97%. Futures in Europe are pointing towards a mixed open.

In FX markets, the dollar index trades 0.15% overnight. The biggest mover heading into the European open is USD/JPY (0.28%). In the crypto space, BTC/USD is 1% lower trading at $36,824. Read More

Gold imports by India hit decade-high as jewellery demand doubles

According to the World Gold Council (WGC), gold imports by India have reached their highest level in a decade in 2021. Jewelry sales double and it seems the outlook remains bright.

Imports reached 925 tonnes as weddings and festivals came back in full swing after some pent-up demand following pandemic lockdowns. The WGC's chief executive officer for India said that in 2022 demand could get back to more normal levels of 800-850 tonnes. He added that over the next two years demand could be governed by policy reform and technological advances (for sales).

In the stats, it was noted that demand for gold coins and bars rose 79% to 797 tonnes. Read More

Gold & Silver Market Analysis for Friday 28th January

Kinesis Gold Price Analysis: While gold can be considered a commodity, due to its use in a number of industrial applications such as in phones and lateral flow tests - which we have all become so familiar within the last couple of years - its primary role is as a financial asset class.

As such the Federal Reserve’s announcement earlier in the week, that it could well start increasing interest rates as soon as March, sparked a plunge in the price of gold.

Suddenly the support the metal had been finding as investors sought its sanctuary amid declines on equities vanished; gold was heavily punished for its lack of yield with signs that interest rates are likely to rise sooner and faster than had been expected.

The warning signs for gold had already been there. It was positioned for a fall, with the price largely drifting along, despite the supposedly supportive element of gold as a hedge against inflation.

Image Source: Kinesis

Gold’s sharp fall, from challenging $1,850 an ounce a few days ago to now trading below the psychologically important threshold of $1,800, raises questions of how much further it can fall yet.

That said, the price plunge may now attract buying interest, as investors view gold as much better value and push it back above $1,800 once again.

Kinesis Silver Price Analysis: Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.