To paraphrase Investopedia, the golden cross is a chart pattern. A bullish signal in which a market's moving average moves above a longer-term moving average. The golden cross is a bullish breakout pattern formed from a crossover involving a short-term moving average (such as the 50-day moving average) breaking above a longer-term moving average (such as the 100-day moving average). As long-term indicators carry more weight than a shorter one, the cross indicates a bull market on the horizon and is reinforced by high trading volumes.

This current rally began at the end of March when gold futures traded to approximately $1680. This was a pivotal week that resulted in gold taking out major resistance, which has now become support and resulted in an imminent golden cross between the 50 and 100-day exponential moving averages. In this study, we use exponential rather than simple moving averages. This is because of the lagging nature of long-term moving averages; we can use exponential averages to get a faster, more tradeable signal.

From Friday, May 7, up until Friday, May 14, five of the six trading days resulted in intraday highs at approximately $1840 to $1844.

On Monday, May 17, gold opened at last week's highs ($1844) and broke above that former level of resistance, and closed above its 200-day moving average as well as the 61.8% Fibonacci retracement level. The data set used to create the Fibonacci retracement begins in March 2020, with gold trading at $1454 up until August 2020, when gold reached its all-time high at $2088. With the exception of Wednesday, May 19 when gold traded to an intraday low of $1851, gold prices remained above the 200-day moving average for the entire week.

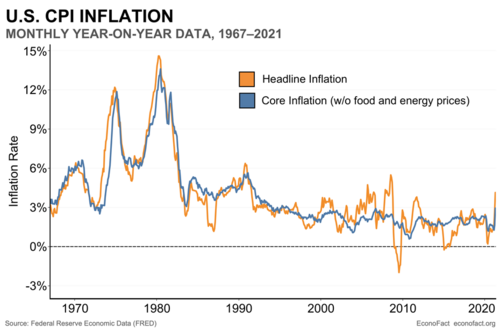

The most recent leg of this rally has been fueled by concerns about rising inflation. According to EconoFact, Inflation was 4.2% in April 2021. Whether it is likely to continue increasing depends on different factors that contribute to a generalized rise in prices."

Econofact's article that was published on May 18 went on to say, “There are concerns about inflation rising, and perhaps even accelerating, fueled by an overheating economy as a consequence of the large fiscal stimulus, the Federal Reserve's commitment to keeping interest rates low for an extended period, and pent-up demand for consumption that was foregone during the pandemic. The last bout of high and rising inflation, in the 1970s, was during a time of economic distress and only ended with a painful recession engineered by the Federal Reserve in the early 1980s."

The Federal Reserve maintains its stance that the current level of inflation is only temporary, and their recent amended mandate is to let inflation run hot in lieu of maximum employment.

As of 5 PM, EST gold is trading at $1882.40 which is a net gain of $0.50 on the day. Two of the trading days this week resulted in an intraday high of $1890, which means that for gold futures, $1890 is the last minor resistance price point until $1900. The fact that a golden cross is forming between the 50-day EMA and the 100-day EMA signals a real potential for $1900 to be achieved relatively soon.

By Gary Wagner

Contributing to kitco.com