Bitcoin [BTC] rose $200 on Sunday as price broke above $9000. The psychological positive move along with green across the entire crypto market raises the sentiments of most traders towards the year-end.

However, it fails to hold the bullish psychological as the price has fallen back to $8950 levels. The price of Bitcoin [BTC] at 4: 30 hours UTC on 11th November 2019 is $8955.

Bitcoin Weekly Close

On a weekly scale, even after the positive move, BTC price closed on a red. According to Tone Vays, the weekly chart looks neutral, however, on a bearish count according to sequential analysis.

Similarly, on a daily scale as well, the 200-Day inability to break above the 200-Day Moving average brings it closer to a death cross with the 128-Day moving average.

He cites that the resistance for a bullish break-out this week out would be around $9600.

BTC/USD Weekly Chart on Bitstamp (TradingView)

Another Gap Fills on CME on the 4-Hour

The change in the price of Bitcoin over the weekend often creates a substantial gap with CME. As CME is one of the largest regulated exchanges for Bitcoin futures, it has a considerable effect on Bitcoin prices.

Moreover, with Bitcoin, it generally has a tendency to fill the price gaps with CME. The difference was about $215, as Bitcoin closed at $8885 on Friday. With the correction on Monday to about $8950 as filled most of the gap.

Moreover, the volume of the break was also not enough to justify a massive bullish breakout.

Bulls Still Scared of the Bears?

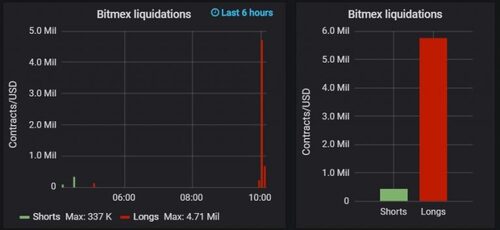

The bullish turn was accepted by the market contently as traders moved further long. Only a small percentage of short liquidations were noticed signaling a bullish inclination.

However, since Bitcoin fails to maintain the levels, about $5 million worth Bitcoin longs liquidates on BitMEX in less than 2 hours.

Bitfinex and BitMEX liquidations (Source)

Technically, Bitcoin is not out of the clutches of the bears. First and foremost, the 200-Day Moving Average continues to act as resistance and is now rising, currently at $9240.

The market sentiments are largely bullish with December futures contracts selling at $9075 and a high long/short ratio on spot exchanges. The funding rate on BitMEX and Bitcoin basis on Okex is also positive with large magnitudes signaling strong bullish inclination. However, there is still a lack of momentum at the moment.

Do you think the strong bullish inclination is justified or bears are still strong? Please share your analysis with us.

Nivesh Rustgi Bitcoin News 1 min ago