Fundstrat analyst Tom Lee is moving the goalpost yet again. Not only is he slashing his previous Bitcoin price prediction by nearly 40 percent, but he is also pushing the timeline back by a further two years.

Appearing on CNBC’s Street Signs Asia on Friday, Lee offered his insight on where the market is headed and how long it will take to get there.

The prominent Bitcoin proponent maintained that he is still “very bullish” on the digital currency in the long term, noting that the crypto market as a whole is still in its infancy.

“I think this is still the earliest days for digital assets. I think a lot of this is – over time – going to be very institutional and become an asset class,” Lee said.

“I think once we hit that, it’s actually another hockey stick,” he added.

As far as how increased institutional interest will affect Bitcoin prices, Lee predicted that BTC would hit $25,000 by 2022.

While still a rosy outlook for Bitcoin, Lee’s latest price prediction is a far cry from his $40,000 call back in June of this year.

At the time, Lee said that if Bitcoin could reach $10,000, then “it’s very likely going to make a run to $40,000 within five months.”

For the record, the price of Bitcoin hit $10,000 on June 21st, so by Lee’s original prediction, we should be seeing $40,000 BTC any day now.

A timeline of Lee’s changing price predictions

This isn’t the first time Lee has changed his Bitcoin price predictions. Here are just a few of his past highlights:

2019

$25,000 by 2022 – November 15, 2019

$20,000 by the end of 2019 – August 15, 2019

$40,000 within five months if Bitcoin can hit the $10,000 mark – June 6, 2019

2018

$10 million per Bitcoin by 2028 – November 28, 2018

Reduced August prediction to $15,000 – November 16, 2018

$25,000 by the end of 2018 – August 25, 2018

$91,000 by March 2020 – March 17, 2018

2017

$11,500 by mid-2018 – November 22, 2017

Bitcoin will ‘cannibalize’ gold, be worth $20,000 – $55,000 by 2022 – July 7, 2017

Fundstrat analyst Tom Lee's Bitcoin price predictions (CNBC)

More recent Bitcoin price predictions

While Lee isn’t alone in making price predictions in recent weeks, his is definitely one of the more conservative of the bunch.

Tim Draper – $250,000

Appearing by video at the Malta AI & Blockchain Summit (AIBC) last week, venture capitalist and Bitcoin bull Tim Draper reiterated his belief that the digital currency will hit $250,000 by 2022 – 2023.

Calling Bitcoin “one of the most transformative technologies that has ever hit the world,” Draper cited the growing use of the Lightning Network as a key factor that would help propel the price of BTC upward.

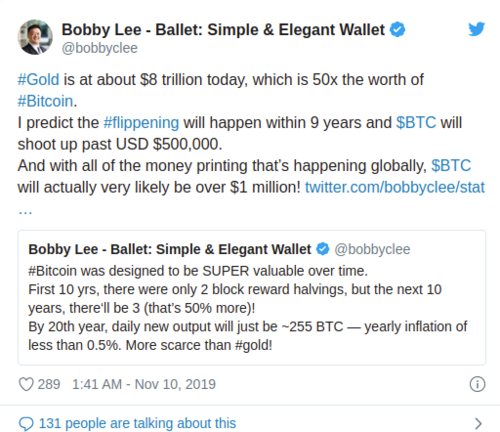

Bobby Lee – $100,000 to $1 million

Also appearing at AIBC, Ballet Crypto founder and CEO Bobby Lee predicted that Bitcoin prices would climb to as high as $200,000 within the next five or ten years.

“Bitcoin’s price goes in waves. Every so-called bubble, every FOMO run, it could go up by ten or twenty times the previous high,” Lee explained.

“So the next one could easily top $100,000 or even $200,000 per bitcoin…So I definitely think it will go up quite a bit in the next five to ten years.”

The next day, Lee took his prediction even further, posting on Twitter that he believed that Bitcoin would surpass $500,000 – and likely over $1 million – within nine years.

Anthony Pompliano – $100,000

Slightly less bullish, in July of this year, Morgan Creek Digital co-founder Anthony Pompliano said that he was 70 – 75 percent confident that the price of Bitcoin would hit $100,000 by 2021.

Speaking with AIBC’s Jennifer Walker in September about whether the drop in the price of Bitcoin had caused him to alter his prediction, Pompliano re-affirmed his $100,000 prediction, explaining:

“I really look at the macro trends so kind of these bear and bull markets. So the short term price movements really have no effect and usually I don’t even look at them, to be honest.”

By Cynthia Turcotte -November 16, 20191158