Sentiment continues to improve in the gold market among both Wall Street analysts and Main Street investors. However, there is some concern that rising bond yields will cap gold at critical resistance below $1,750 in the near-term.

"Gold has had a nice bounce from its recent lows, but this just could be a short-term correction as prices appear to be contained as inflation still isn't a major story for investors," said Colin Cieszynski, chief market strategist at SIA Wealth Management.

Although Cieszynski is bearish on gold in the near-term, he added that gold has room to move higher in this corrective bounce.

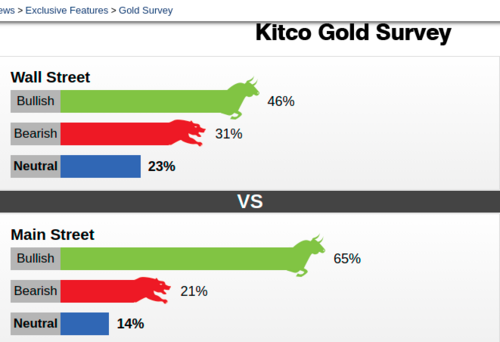

This week, 13 analysts participated in the survey. A total of 6 voters, or 46%, called for gold prices to rise next week. Meanwhile, four voters, or 31%, said they see gold prices falling next week. Three analysts, or 23%, saw prices moving sideways.

Both sentiment and participation in the weekly gold survey are improving among retail investors. This week, 1698 votes were cast in online surveys. Among those, 1,101, or 65%, said they were bullish on gold next week. Another 355 participants, or 21%, said they were bearish, while 242 voters, or 14%, were neutral on the precious metal.

The increase in bullish sentiment comes as the gold market ends the week with modest gains but down from a one-week high. June gold futures last traded at $1,740 an ounce, up 1% from last Friday.

This week the gold market saw a brief push to $1,750 an ounce after the Federal Reserve left its ultra-loose monetary policies unchanged. The central bank also signaled that it doesn't expect to raise interest rates until at least 2024.

While the Federal Reserve is expected to remain extremely patient as the U.S. economy recovers, the gold market still has to deal with rising bond yields. Federal Reserve Chair Jerome Powell indicated that he wasn't concerned with the recent selloff in the bond market that has driven yields to a 13-month high above 1.7%.

For a lot of investors, higher bond yields, which are also supporting the U.S. dollar, are the biggest challenge for the gold market. However, gold's positive moves this week could indicate that the bond market is having less impact on the precious metal.

Adrian Day, president of Adrian Day Asset Management, said that he is bullish on gold as bond yields might be close to peaking.

"The bond vigilantes may not have been defeated by Fed Chair Jerome Powell's assertions that the Fed would remain easy, but eventually, through more words or by action, the Fed will stop the rise in long yields, and that will be positive for gold," he said.

Sean Lusk, co-director of commercial hedging at Walsh Trading, said that he is also looking for bond yields to find a natural ceiling as the U.S. central bank is expecting to keep interest rates at the zero-bound range for the next three years.

However, Lusk added that it is a little too early to get excited about gold as the market remains in a solid downtrend.

"With interest rates at zero, bond yields can only go so high," he said. "But I want to see gold hold at least $1,740 and see some weakness in the U.S. dollar before I start getting excited about gold."

Ole Hansen, head of commodity strategy at Saxo Bank, said that he is also neutral on gold in the near-term, but he wants to see a break above $1,765 an ounce before he starts to become bullish.

He added that gold is "trying to reestablish its reflation credentials, something that has been sorely missing for the past four months."

By Neils Christensen

For Kitco News

Kinesis money system put gold and silver to use no storage fees