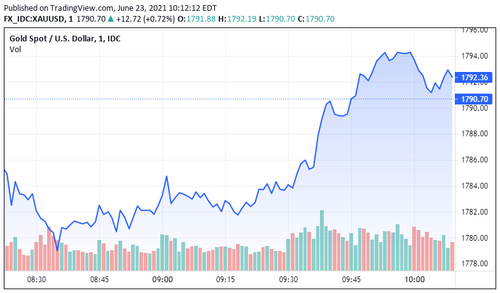

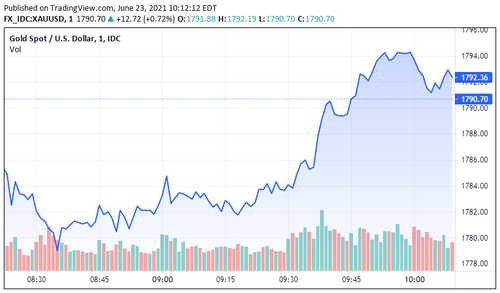

Gold and silver are setting up for a much bigger move. They have been vacillating in a tight range for the last five days. This pattern is known as consolidation, which is always a precursor to a much bigger move. Based on the current trend, which is lower, we expect that move to be lower.

We know that the next move can be in either direction, but the odds favor down. However, we can make a case for a reversal as well. The moving average over the last couple of days has some positive signs that could create a rally. We are short and will stay there knowing that the current direction favors us.

When trading in any market, the most important thing we can do is be flexible and not stubborn. If we remember the market is always right and the price is absolute, we must let the price action determine our trades and direction.

As support in gold and silver hold, two things are occurring: one, the inability to collapse could lead to a reversal; two, the last couple of days have seen higher lows. For now, we are tenuously short but ready to reverse if necessary.

Patience, discipline, and money management always win the day.

By Todd 'Bubba' Horwitz

Contributing to kitco.com